Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Drag the words into the correct boxes EITC s determined by various factors, including income level, filing status, and the number of qualifying children. To

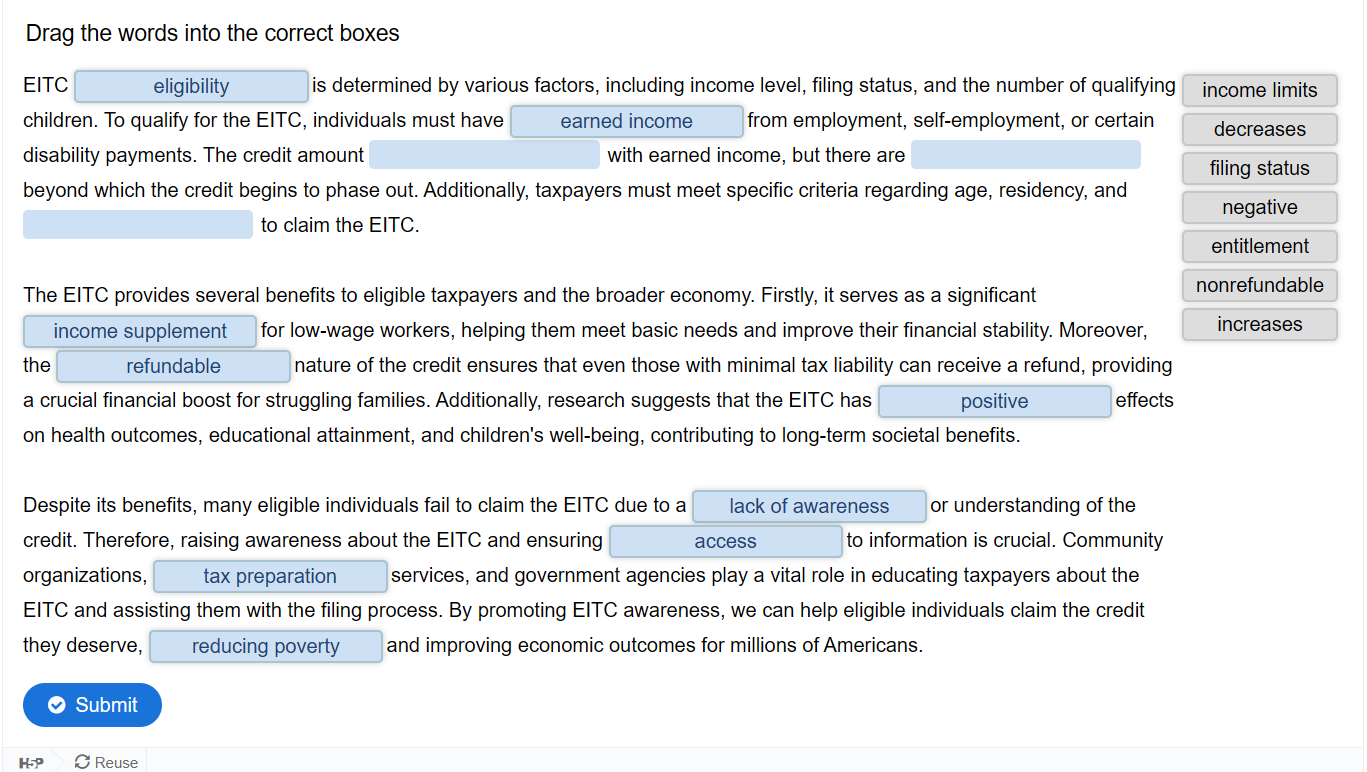

Drag the words into the correct boxes

EITC s determined by various factors, including income level, filing status, and the number of qualifying children. To qualify for the EITC, individuals must have from employment, selfemployment, or certain disability payments. The credit amount earned income with earned income, but there are beyond which the credit begins to phase out. Additionally, taxpayers must meet specific criteria regarding age, residency, and to claim the EITC.

The EITC provides several benefits to eligible taxpayers and the broader economy. Firstly, it serves as a significant income supplement for lowwage workers, helping them meet basic needs and improve their financial stability. Moreover, decreases

negative entitlement

thi nature of the credit ensures that even those with minimal tax liability can receive a refund, providing a crucial financial boost for struggling families. Additionally, research suggests that the EITC has ffects on health outcomes, educational attainment, and children's wellbeing, contributing to longterm societal benefits.

Despite its benefits, many eligible individuals fail to claim the EITC due to a or understanding of the credit. Therefore, raising awareness about the EITC and ensurins to information is crucial. Community organizations, services, and government agencies play a vital role in educating taxpayers about the EITC and assisting them with the filing process. By promoting EITC awareness, we can help eligible individuals claim the credit they deserve, and improving economic outcomes for millions of Americans.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started