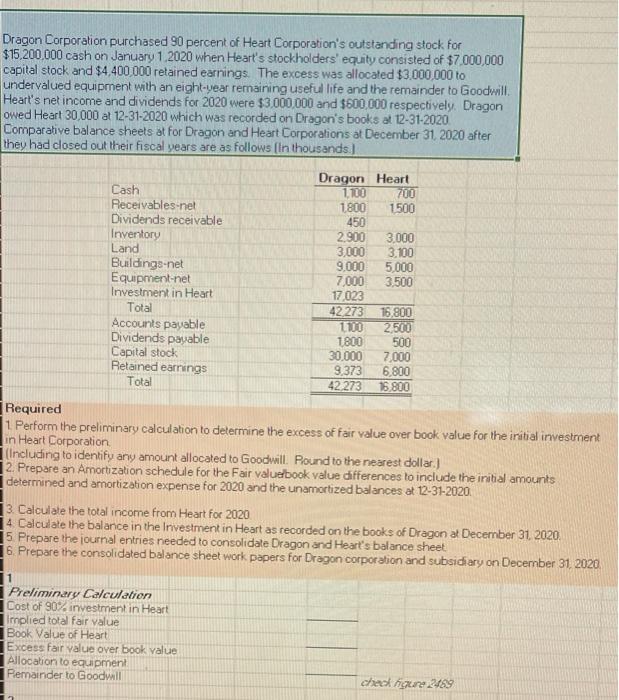

Dragon Corporation purchased 90 percent of Heart Corporation's outstanding stock for $15.200.000 cash on January 1.2020 when Heart's stockholders' equity consisted of $7.000.000 capital stock and $4,400 000 retained earnings. The excess was allocated $3.000.000 to undervalued equipment with an eight-year remaining useful life and the remainder to Goodwill. Heart's net income and dividends for 2020 were $3,000,000 and $600,000 respectively. Dragon owed Heart 30.000 at 12-31-2020 which was recorded on Dragon's books at 12-31-2020 Comparative balance sheets at For Dragon and Heart Corporations at December 31, 2020 after they had closed out their fiscal years are as follows (in thousands. Cash Receivables.net Dividends receivable Inventory Land Buildings-net Equipment.net Investment in Heart Total Accounts payable Dividends payable Capital stock Retained earrings Total Dragon Heart 1.100 700 1800 1500 450 2.900 3.000 3.000 3.100 9,000 5,000 7,000 3,500 17.023 42.273 16.800 1100 2500 1800 30.000 7,000 9.373 6.800 42 273 16.800 500 Required 1. Perform the preliminary calculation to determine the excess of fair value over book value for the initial investment in Heart Corporation Including to identify any amount allocated to Goodwill. Round to the nearest dollar.) 12. Prepare an Amortization schedule for the Fair valuabook value differences to include the initial amounts determined and amortization expense for 2020 and the unamortized balances at 12-31-2020 13. Calculate the total income from Heart for 2020 14 Calculate the balance in the Investment in Heart as recorded on the books of Dragon at December 31, 2020 5. Prepare the journal entries needed to consolidate Dragon and Heart's balance sheet 6. Prepare the consolidated balance sheet work papers for Dragon corporation and subsidiary on December 31, 2020 11 Preliminary Calculation Cost of 90% investment in Heart Implied total fair value Book Value of Heart Excess fair value over book value Allocation to equipment Pemainder to Goodwill check for 2489 Dragon Corporation purchased 90 percent of Heart Corporation's outstanding stock for $15.200.000 cash on January 1.2020 when Heart's stockholders' equity consisted of $7.000.000 capital stock and $4,400 000 retained earnings. The excess was allocated $3.000.000 to undervalued equipment with an eight-year remaining useful life and the remainder to Goodwill. Heart's net income and dividends for 2020 were $3,000,000 and $600,000 respectively. Dragon owed Heart 30.000 at 12-31-2020 which was recorded on Dragon's books at 12-31-2020 Comparative balance sheets at For Dragon and Heart Corporations at December 31, 2020 after they had closed out their fiscal years are as follows (in thousands. Cash Receivables.net Dividends receivable Inventory Land Buildings-net Equipment.net Investment in Heart Total Accounts payable Dividends payable Capital stock Retained earrings Total Dragon Heart 1.100 700 1800 1500 450 2.900 3.000 3.000 3.100 9,000 5,000 7,000 3,500 17.023 42.273 16.800 1100 2500 1800 30.000 7,000 9.373 6.800 42 273 16.800 500 Required 1. Perform the preliminary calculation to determine the excess of fair value over book value for the initial investment in Heart Corporation Including to identify any amount allocated to Goodwill. Round to the nearest dollar.) 12. Prepare an Amortization schedule for the Fair valuabook value differences to include the initial amounts determined and amortization expense for 2020 and the unamortized balances at 12-31-2020 13. Calculate the total income from Heart for 2020 14 Calculate the balance in the Investment in Heart as recorded on the books of Dragon at December 31, 2020 5. Prepare the journal entries needed to consolidate Dragon and Heart's balance sheet 6. Prepare the consolidated balance sheet work papers for Dragon corporation and subsidiary on December 31, 2020 11 Preliminary Calculation Cost of 90% investment in Heart Implied total fair value Book Value of Heart Excess fair value over book value Allocation to equipment Pemainder to Goodwill check for 2489