Question

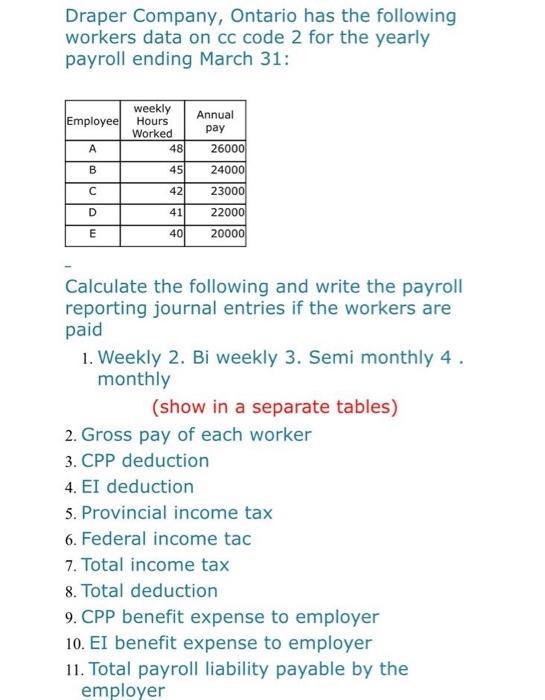

Draper Company, Ontario has the following workers data on cc code 2 for the yearly payroll ending March 31: weekly Employee Hours Worked 48

Draper Company, Ontario has the following workers data on cc code 2 for the yearly payroll ending March 31: weekly Employee Hours Worked 48 Annual pay A 26000 B 45 24000 42 23000 D 41 22000 40 20000 E Calculate the following and write the payroll reporting journal entries if the workers are paid 1. Weekly 2. Bi weekly 3. Semi monthly 4. monthly (show in a separate tables) 2. Gross pay of each worker 3. CPP deduction 4. EI deduction 5. Provincial income tax 6. Federal income tac 7. Total income tax 8. Total deduction 9. CPP benefit expense to employer 10. EI benefit expense to employer 11. Total payroll liability payable by the employer

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Financial Management

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

10th Canadian edition

1259261018, 1259261015, 978-1259024979

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App