Question

Draw Alfonsos budget line in a contingent consumption (CC) diagram. (b) Suppose Alfonso is risk averse with utility-of-money function v (c) = ln (c). Suppose

Draw Alfonsoís budget line in a contingent consumption (CC)

diagram.

(b) Suppose Alfonso is risk averse with utility-of-money function

v (c) = ln (c). Suppose further that Alfonso has probability 1

4 of

being audited irrespective of how much income he declares.

(i) Find Alfonsoís optimal contingent consumption bundle (i.e.,

the point on his budget line where the budget line is tangent

to an indi§erence curve).

(ii) What value of z achieves this optimal contingent consump-

tion?

(iii) Illustrate your results from (i) and (ii) in a CC diagram. (You

may add the information to your diagram from (a) or draw a

fresh diagram.)

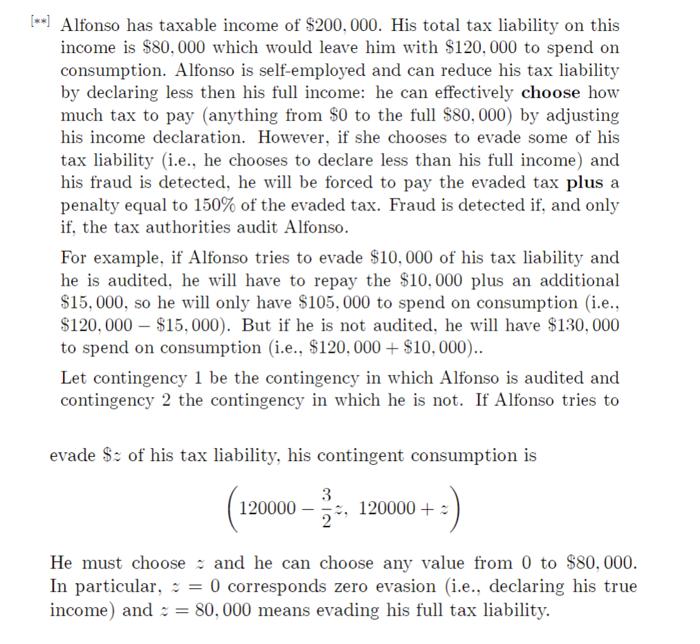

[**] Alfonso has taxable income of $200,000. His total tax liability on this income is $80,000 which would leave him with $120,000 to spend on consumption. Alfonso is self-employed and can reduce his tax liability by declaring less then his full income: he can effectively choose how much tax to pay (anything from $0 to the full $80,000) by adjusting his income declaration. However, if she chooses to evade some of his tax liability (i.e., he chooses to declare less than his full income) and his fraud is detected, he will be forced to pay the evaded tax plus a penalty equal to 150% of the evaded tax. Fraud is detected if, and only if, the tax authorities audit Alfonso. For example, if Alfonso tries to evade $10,000 of his tax liability and he is audited, he will have to repay the $10,000 plus an additional $15,000, so he will only have $105,000 to spend on consumption (i.e.. $120,000 $15,000). But if he is not audited, he will have $130,000 to spend on consumption (i.e., $120,000 + $10,000).. Let contingency 1 be the contingency in which Alfonso is audited and contingency 2 the contingency in which he is not. If Alfonso tries to evade $ of his tax liability, his contingent consumption is 3 120000 120000+ He must choose In particular, and he can choose any value from 0 to $80,000. = 0 corresponds zero evasion (i.e., declaring his true income) and = 80,000 means evading his full tax liability.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started