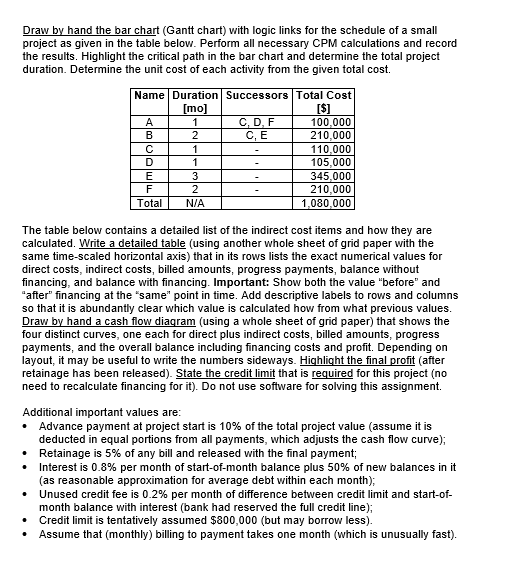

Draw by hand the bar chart (Gantt chart) with logic links for the schedule of a small project as given in the table below. Perform all necessary CPM calculations and record the results. Highlight the critical path in the bar chart and determine the total project duration. Determine the unit cost of each activity from the given total cost.

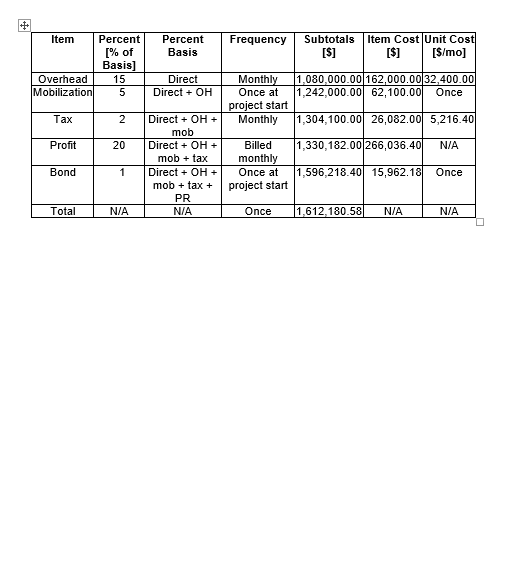

The table below contains a detailed list of the indirect cost items and how they are calculated. Write a detailed table (using another whole sheet of grid paper with the same time-scaled horizontal axis) that in its rows lists the exact numerical values for direct costs, indirect costs, billed amounts, progress payments, balance without financing, and balance with financing. Important: Show both the value before and after financing at the same point in time. Add descriptive labels to rows and columns so that it is abundantly clear which value is calculated how from what previous values.

Draw by hand a cash flow diagram (using a whole sheet of grid paper) that shows the four distinct curves, one each for direct plus indirect costs, billed amounts, progress payments, and the overall balance including financing costs and profit. Depending on layout, it may be useful to write the numbers sideways. Highlight the final profit (after retainage has been released). State the credit limit that is required for this project (no need to recalculate financing for it). Do not use software for solving this assignment.

Additional important values are:

- Advance payment at project start is 10% of the total project value (assume it is deducted in equal portions from all payments, which adjusts the cash flow curve);

- Retainage is 5% of any bill and released with the final payment;

- Interest is 0.8% per month of start-of-month balance plus 50% of new balances in it (as reasonable approximation for average debt within each month);

- Unused credit fee is 0.2% per month of difference between credit limit and start-of-month balance with interest (bank had reserved the full credit line);

- Credit limit is tentatively assumed $800,000 (but may borrow less).

- Assume that (monthly) billing to payment takes one month (which is unusually fast).

Draw by hand the bar chart (Gantt chart) with logic links for the schedule of a small project as given in the table below. Perform all necessary CPM calculations and record the results. Highlight the critical path in the bar chart and determine the total project duration. Determine the unit cost of each activity from the given total cost Name Duration Successors Total Cost [$] 100,000 210,000 110,000 105,000 345,000 210,000 1,080,000 [mo] C, D, F C, E A 1 2 C 1 D 1 3 2 Total N/A The table below contains a detailed list of the indirect cost items and how they are calculated. Write a detailed table (using another whole sheet of grid paper with the same time-scaled horizontal axis) that in its rows lists the exact numerical values for direct costs, indirect costs, billed amounts, progress payments, balance without financing, and balance with financing. Important: Show both the value "before" and "after" financing at the "same" point in time. Add descriptive labels to rows and columns so that it is abundantly clear which value is calculated how from what previous values. Draw by hand a cash flow diaqram (using a whole sheet of grid paper) that shows the four distinct curves, one each for direct plus indirect costs, billed amounts, progress payments, and the overall balance including financing costs and profit. Depending on layout, it may be useful to write the numbers sideways. Highlight the final profit (after retainage has been released). State the credit limit that is required for this project (no need to recalculate financing for it). Do not use software for solving this assignment Additional important values are Advance payment at project start is 10% of the total project value (assume it is deducted in equal portions from all payments, which adjusts the cash flow curve) Retainage is 5 % of any bill and released with the final payment; Interest is 0.8% per month of start-of-month balance plus 50% of new balances in it (as reasonable approximation for average debt within each month); Unused credit fee is 0.2 % per month of difference between credit limit and start-of month balance with interest (bank had reserved the full credit line) Credit limit is tentatively assumed $800,000 (but may borrow less) Assume that (monthly) billing to payment takes one month (which is unusually fast) Item Cost Unit Cost [S/mo] Item Percent Percent Frequency Subtotals [% of Basis] [S] Basis Monthly 1,080,000.00 162,000.00 32,400.00 1,242,000.00 62,100.00 Overhead 15 Direct Mobilization 5 Direct OH Once at Once project start Monthly 1,304,100.00 26,082.00 5,216.40 DirectOH + x 2 mob Direct OH 1,330,182.00266,036.40 Profit 20 Billed N/A mob tax monthly Once at Once 1,596,218.40 15,962.18 Direct OH mobtax Bond 1 project start PR 1,612,180.58 Total N/A N/A Once N/A N/A Draw by hand the bar chart (Gantt chart) with logic links for the schedule of a small project as given in the table below. Perform all necessary CPM calculations and record the results. Highlight the critical path in the bar chart and determine the total project duration. Determine the unit cost of each activity from the given total cost Name Duration Successors Total Cost [$] 100,000 210,000 110,000 105,000 345,000 210,000 1,080,000 [mo] C, D, F C, E A 1 2 C 1 D 1 3 2 Total N/A The table below contains a detailed list of the indirect cost items and how they are calculated. Write a detailed table (using another whole sheet of grid paper with the same time-scaled horizontal axis) that in its rows lists the exact numerical values for direct costs, indirect costs, billed amounts, progress payments, balance without financing, and balance with financing. Important: Show both the value "before" and "after" financing at the "same" point in time. Add descriptive labels to rows and columns so that it is abundantly clear which value is calculated how from what previous values. Draw by hand a cash flow diaqram (using a whole sheet of grid paper) that shows the four distinct curves, one each for direct plus indirect costs, billed amounts, progress payments, and the overall balance including financing costs and profit. Depending on layout, it may be useful to write the numbers sideways. Highlight the final profit (after retainage has been released). State the credit limit that is required for this project (no need to recalculate financing for it). Do not use software for solving this assignment Additional important values are Advance payment at project start is 10% of the total project value (assume it is deducted in equal portions from all payments, which adjusts the cash flow curve) Retainage is 5 % of any bill and released with the final payment; Interest is 0.8% per month of start-of-month balance plus 50% of new balances in it (as reasonable approximation for average debt within each month); Unused credit fee is 0.2 % per month of difference between credit limit and start-of month balance with interest (bank had reserved the full credit line) Credit limit is tentatively assumed $800,000 (but may borrow less) Assume that (monthly) billing to payment takes one month (which is unusually fast) Item Cost Unit Cost [S/mo] Item Percent Percent Frequency Subtotals [% of Basis] [S] Basis Monthly 1,080,000.00 162,000.00 32,400.00 1,242,000.00 62,100.00 Overhead 15 Direct Mobilization 5 Direct OH Once at Once project start Monthly 1,304,100.00 26,082.00 5,216.40 DirectOH + x 2 mob Direct OH 1,330,182.00266,036.40 Profit 20 Billed N/A mob tax monthly Once at Once 1,596,218.40 15,962.18 Direct OH mobtax Bond 1 project start PR 1,612,180.58 Total N/A N/A Once N/A N/A