Answered step by step

Verified Expert Solution

Question

1 Approved Answer

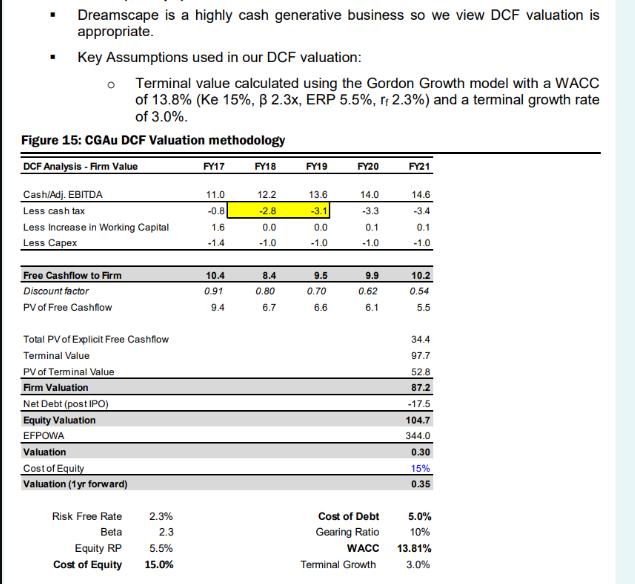

. Dreamscape is a highly cash generative business so we view DCF valuation is appropriate. Key Assumptions used in our DCF valuation: o Terminal

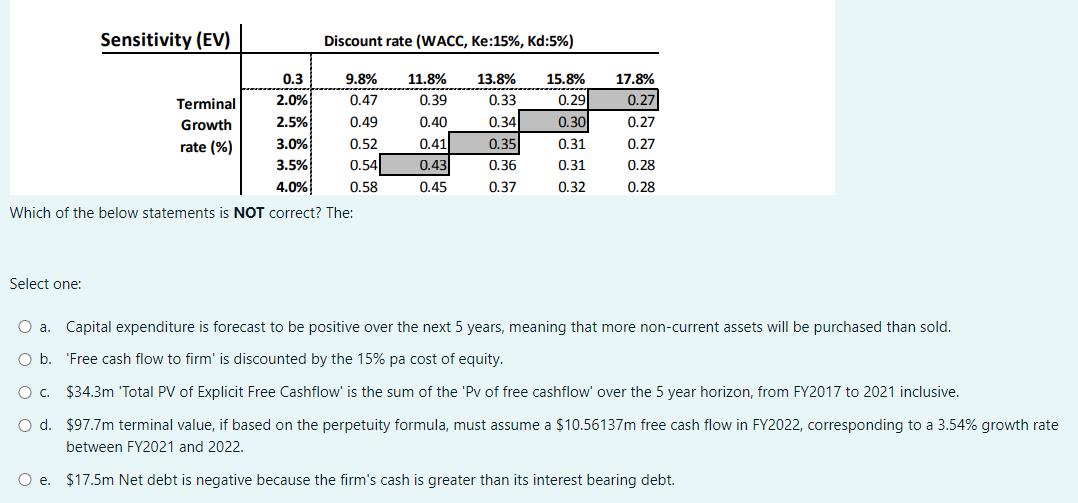

. Dreamscape is a highly cash generative business so we view DCF valuation is appropriate. Key Assumptions used in our DCF valuation: o Terminal value calculated using the Gordon Growth model with a WACC of 13.8% (Ke 15%, 2.3x, ERP 5.5%, rt 2.3%) and a terminal growth rate of 3.0%. Figure 15: CGAU DCF Valuation methodology DCF Analysis - Firm Value Cash/Adj. EBITDA Less cash tax Less increase in Working Capital Less Capex Free Cashflow to Firm Discount factor PV of Free Cashflow Total PV of Explicit Free Cashflow Terminal Value PV of Terminal Value Firm Valuation Net Debt (post IPO) Equity Valuation EFPOWA Valuation Cost of Equity Valuation (1yr forward) Risk Free Rate Beta Equity RP Cost of Equity 2.3% 2.3 5.5% 15.0% FY17 11.0 -0.8 1.6 -1.4 10.4 0.91 9.4 FY18 12.2 -2.8 0.0 -1.0 8.4 0.80 8 10 6.7 FY19 13.6 -3.1 0.0 -1.0 9.5 0.70 6.6 FY20 14.0 -3.3 0.1 -1.0 9.9 0.62 25 6.1 Cost of Debt Gearing Ratio WACC Terminal Growth FY21 14.6 -3.4 0.1 -1.0 10.2 0.54 5.5 34.4 97.7 52.8 87.2 -17.5 104.7 344.0 0.30 15% 0.35 5.0% 10% 13.81% 3.0% Sensitivity (EV) Select one: 0.3 2.0% 2.5% 3.0% 3.5% 4.0% Which of the below statements is NOT correct? The: Discount rate (WACC, Ke:15%, Kd:5%) Terminal Growth rate (%) 9.8% 0.47 0.49 0.52 0.54 0.58 11.8% 13.8% 15.8% 0.39 0.33 0.29 0.40 0.34 0.30 0.41 0.35 0.31 0.43 0.36 0.31 0.45 0.37 0.32 17.8% 0.27 0.27 0.27 0.28 0.28 O a. Capital expenditure is forecast to be positive over the next 5 years, meaning that more non-current assets will be purchased than sold. O b. 'Free cash flow to firm' is discounted by the 15% pa cost of equity. O C. $34.3m 'Total PV of Explicit Free Cashflow' is the sum of the 'Pv of free cashflow' over the 5 year horizon, from FY2017 to 2021 inclusive. O d. $97.7m terminal value, if based on the perpetuity formula, must assume a $10.56137m free cash flow in FY2022, corresponding to a 3.54% growth rate between FY2021 and 2022. O e. $17.5m Net debt is negative because the firm's cash is greater than its interest bearing debt.

Step by Step Solution

★★★★★

3.39 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

The statement that is NOT correct is Ob Free cash flow to firm is discounted by the 15 pa cost of eq...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started