Answered step by step

Verified Expert Solution

Question

1 Approved Answer

drilling while Throsel's focus had been in surface drilling. Jongsma Equity Partners (Jongsma), a Chicago-based pri- vate equity firm, which owned Teskey-Dean, led the

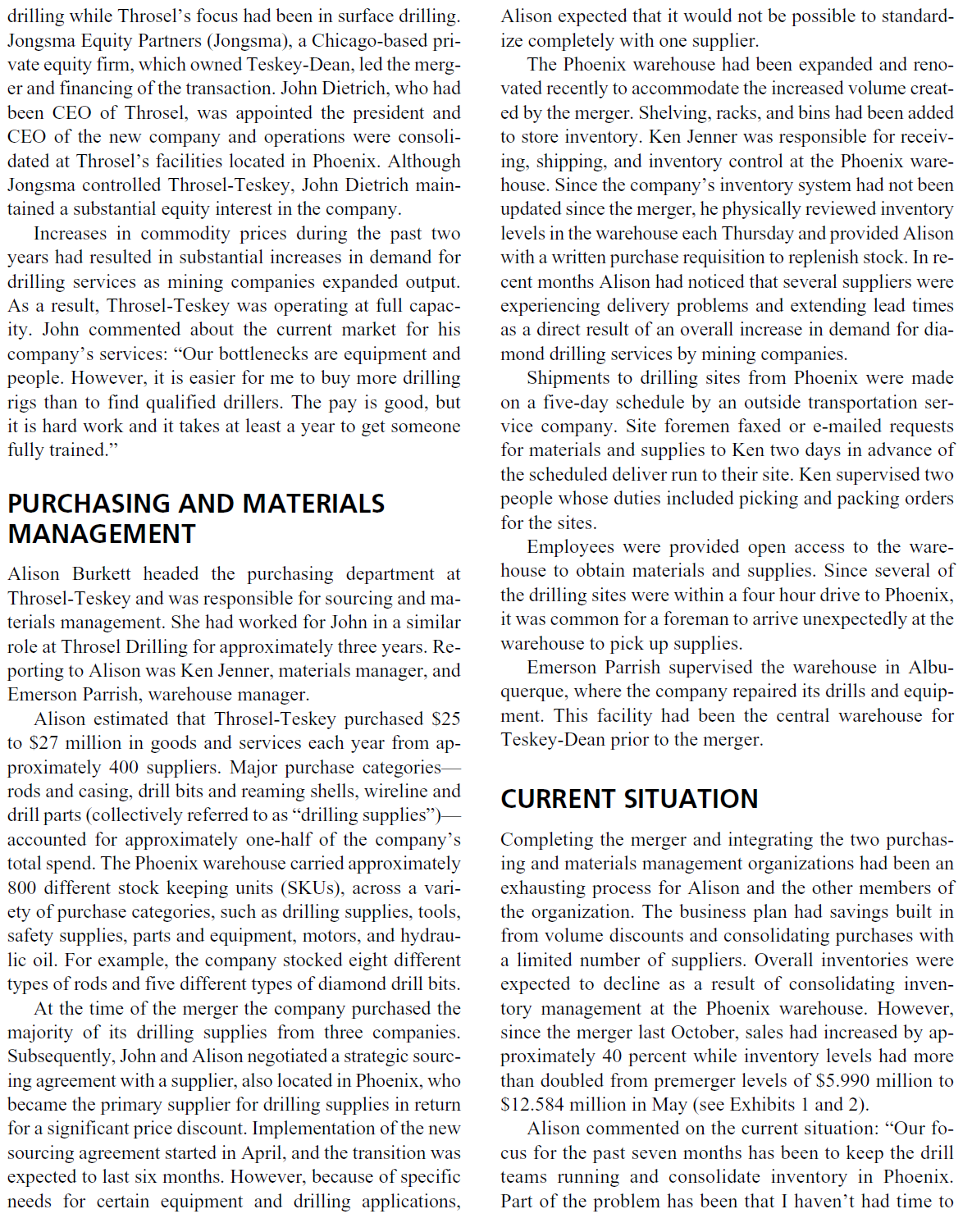

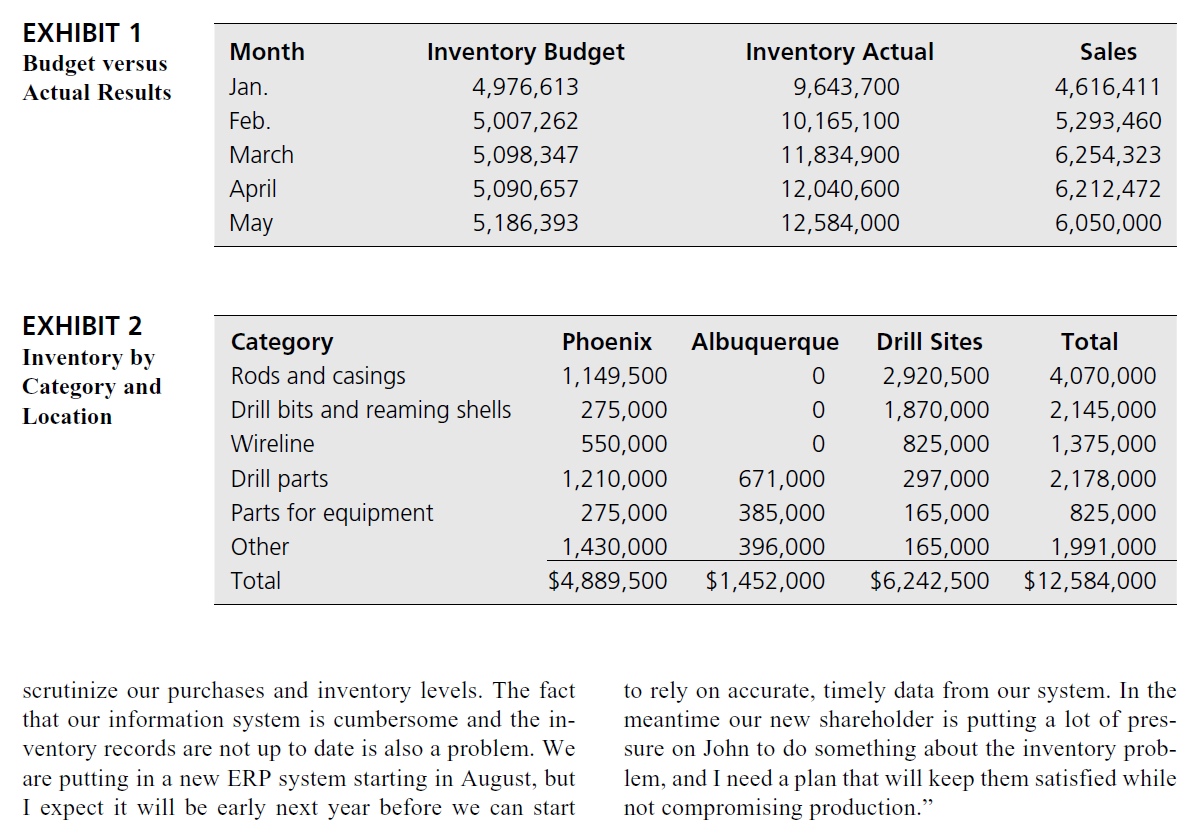

drilling while Throsel's focus had been in surface drilling. Jongsma Equity Partners (Jongsma), a Chicago-based pri- vate equity firm, which owned Teskey-Dean, led the merg- er and financing of the transaction. John Dietrich, who had been CEO of Throsel, was appointed the president and CEO of the new company and operations were consoli- dated at Throsel's facilities located in Phoenix. Although Jongsma controlled Throsel-Teskey, John Dietrich main- tained a substantial equity interest in the company. Increases in commodity prices during the past two years had resulted in substantial increases in demand for drilling services as mining companies expanded output. As a result, Throsel-Teskey was operating at full capac- ity. John commented about the current market for his company's services: "Our bottlenecks are equipment and peop However, it is easier for m to buy more drilling rigs than to find qualified drillers. The pay is good, but it is hard work and it takes at least a year to get someone fully trained." PURCHASING AND MATERIALS MANAGEMENT Alison Burkett headed the purchasing department at Throsel-Teskey and was responsible for sourcing and ma- terials management. She had worked for John in a similar role at Throsel Drilling for approximately three years. Re- porting to Alison was Ken Jenner, materials manager, and Emerson Parrish, warehouse manager. Alison estimated that Throsel-Teskey purchased $25 to $27 million in goods and services each year from ap- proximately 400 suppliers. Major purchase categories- rods and casing, drill bits and reaming shells, wireline and drill parts (collectively referred to as "drilling supplies") accounted for approximately one-half of the company's total spend. The Phoenix warehouse carried approximately 800 different stock keeping units (SKUS), across a vari- ety of purchase categories, such as drilling supplies, tools, safety supplies, parts and equipment, motors, and hydrau- lic oil. For example, the company stocked eight different types of rods and five different types of diamond drill bits. At the time of the merger the company purchased the majority of its drilling supplies from three companies. Subsequently, John and Alison negotiated a strategic sourc- ing agreement with a supplier, also located in Phoenix, who became the primary supplier for drilling supplies in return for a significant price discount. Implementation of the new sourcing agreement started in April, and the transition was expected to last six months. However, because of specific needs for certain equipment and drilling applications, Alison expected that it would not be possible to standard- ize completely with one supplier. The Phoenix warehouse had been expanded and reno- vated recently to accommodate the increased volume creat- ed by the merger. Shelving, racks, and bins had been added to store inventory. Ken Jenner was responsible for receiv- ing, shipping, and inventory control at the Phoenix ware- house. Since the company's inventory system had not been updated since the merger, he physically reviewed inventory levels in the warehouse each Thursday and provided Alison with a written purchase requisition to replenish stock. In re- cent months Alison had noticed that several suppliers were experiencing delivery problems and extending lead times as a direct result of an overall increase in demand for dia- mond drilling services by mining companies. Shipments to drilling sites from Phoenix were made on a five-day schedule by an outside transportation ser- vice company. Site foremen faxed or e-mailed requests for materials and supplies to Ken two days in advance of the scheduled deliver run to their site. Ken supervised two people whose duties included picking and packing orders for the sites. Employees were provided open access to the ware- house to obtain materials and supplies. Since several of the drilling sites were within a four hour drive to Phoenix, it was common for a foreman to arrive unexpectedly at the warehouse to pick up supplies. Emerson Parrish supervised the warehouse in Albu- querque, where the company repaired its drills and equip- ment. This facility had been the central warehouse for Teskey-Dean prior to the merger. CURRENT SITUATION Completing the merger and integrating the two purchas- ing and materials management organizations had been an exhausting process for Alison and the other members of the organization. The business plan had savings built in from volume discounts and consolidating purchases with a limited number of suppliers. Overall inventories were expected to decline as a result of consolidating inven- tory management at the Phoenix warehouse. However, since the merger last October, sales had increased by ap- proximately 40 percent while inventory levels had more than doubled from premerger levels of $5.990 million to $12.584 million in May (see Exhibits 1 and 2). Alison commented on the current situation: "Our fo- cus for the past seven months has been to keep the drill teams running and consolidate inventory in Phoenix. Part of the problem has been that I haven't had time to EXHIBIT 1 Budget versus Actual Results EXHIBIT 2 Inventory by Category and Location Month Jan. Feb. March April May Inventory Budget 4,976,613 5,007,262 5,098,347 5,090,657 5,186,393 Category Rods and casings Drill bits and reaming shells Wireline Drill parts Parts for equipment Other Total Inventory Actual 9,643,700 10,165,100 11,834,900 12,040,600 12,584,000 Phoenix 1,149,500 275,000 550,000 1,210,000 275,000 1,430,000 $4,889,500 $1,452,000 scrutinize our purchases and inventory levels. The fact that our information system is cumbersome and the in- ventory records are not up to date is also a problem. We are putting in a new ERP system starting in August, but I expect it will be early next year before we can start Albuquerque 0 0 0 671,000 385,000 396,000 Sales 4,616,411 5,293,460 6,254,323 6,212,472 6,050,000 Drill Sites Total 2,920,500 4,070,000 1,870,000 2,145,000 825,000 1,375,000 297,000 2,178,000 165,000 825,000 165,000 1,991,000 $6,242,500 $12,584,000 to rely on accurate, timely data from our system. In the meantime our new shareholder is putting a lot of pres- sure on John to do something about the inventory prob- lem, and I need a plan that will keep them satisfied while not compromising production." Throsel-Teskey Drilling On Wednesday, June 12, Alison Burkett, purchasing man- ager at Throsel-Teskey Drilling Inc. (Throsel-Teskey) in Phoenix, Arizona, met with John Dietrich, the company's president. He said: I am getting pressure from the board to address our inventory variance. It has been more than seven months since the merger, and we are not getting the synergies that we expected from purchasing. I know our sales are slightly higher than we expected, but inven- tory levels are more than twice what we had forecasted in our budget. Our new shareholder is irate they expect a 25 percent return on their capital. I need you to come up with a plan that I can share with our board at the meet- ing here in Phoenix next Thursday." Alison got up from her chair and responded to John, "I will get you a report with my recommendations on Monday, so we can review it before the meeting." THROSEL-TESKEY DRILLING Throsel-Teskey was a mining services company that per- formed diamond drilling for underground and surface ex- ploration. Based in Phoenix, Arizona, the company had more than 600 employees and approximately 145 surface and underground drilling rigs operating at sites in the Unit- ed States, Canada, Mexico, and South America. The com- pany's customers were top-tier multinational and junior mining companies involved in the exploration and produc- tion of copper, zinc, and gold. Approximately 75 percent of the company's drilling rigs operated at sites in the south- western United States. Diamond drilling was required at each stage of min- ing operations: exploration, development, and production. Diamond core drilling utilized an annular drill bit with an industrial-grade diamond crown to cut a cylindrical core from solid rock. Core samples were extracted and ana- lyzed to provide the mine operator with information about the mineral deposit. Throsel-Teskey paid its drill teams a base rate and an incentive bonus for achieving produc- tion targets. Production levels averaged 825 feet per week for each drill team, but varied substantially depending on conditions. In the previous October, Throsel Drilling Inc. merged with Teskey-Dean Drilling Inc. (Teskey-Dean), which had its head office in Albuquerque, New Mexico. Both compa- nies were approximately the same size with respect to total sales; however, Teskey-Dean specialized in underground Makeup Assignment MGSC 5123 Procurement and Supply Management Read the following case carefully and answer the questions. 1. As a purchasing manager, what is your analysis of the inventory problem at Throsel- Teskey? What recommendations would you make to the company's president? 2. Do you think that the budget is reasonable? 3. Why did John Dietrich expect total inventories to decline following the merger? 4. What controls do you want to put in place at the Phoenix warehouse? 5. How will you get the drilling foremen to buy into your plan? 6. What policies do you want to put in place at the drilling sites? 7. What target would you give to John Dietrich for his meeting next week?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Analysis of the Inventory Problem and Recommendations The inventory problem at ThroselTeskey appears to stem from a lack of effective inventory management processes and systems compounded by increas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started