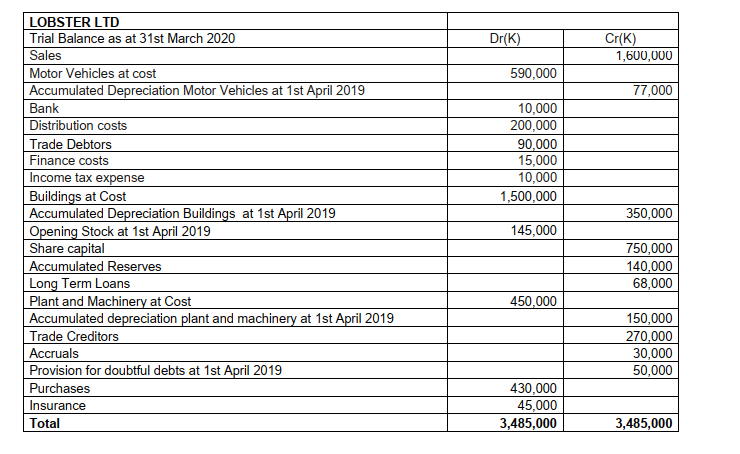

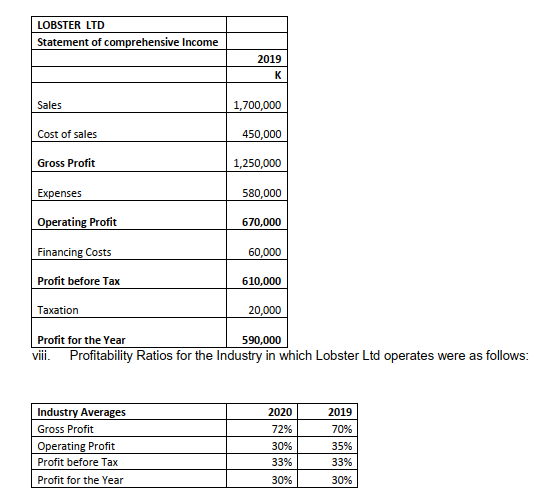

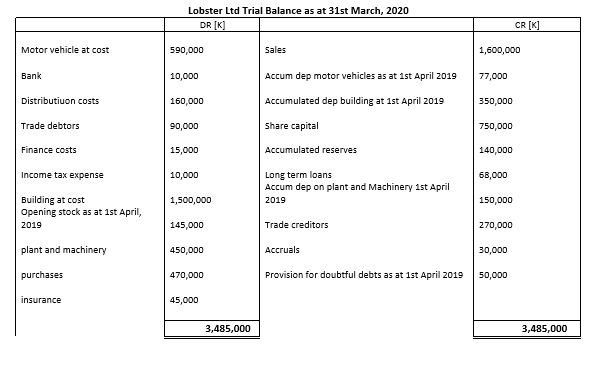

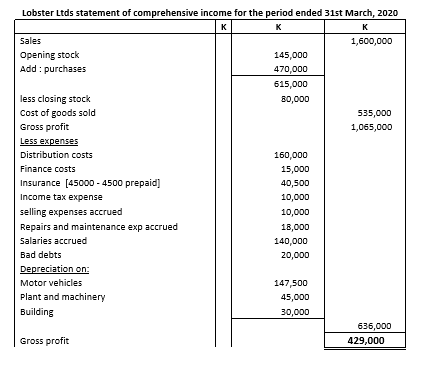

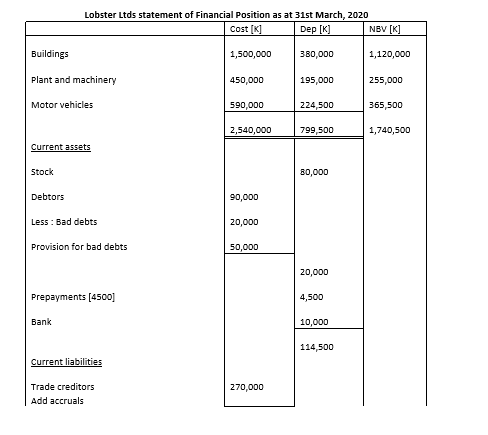

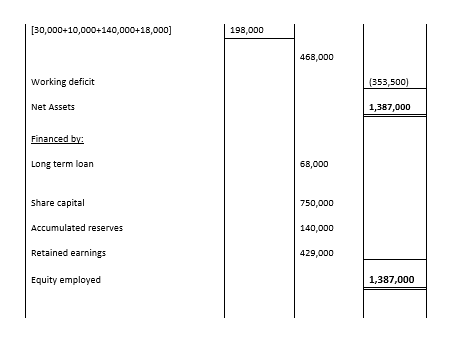

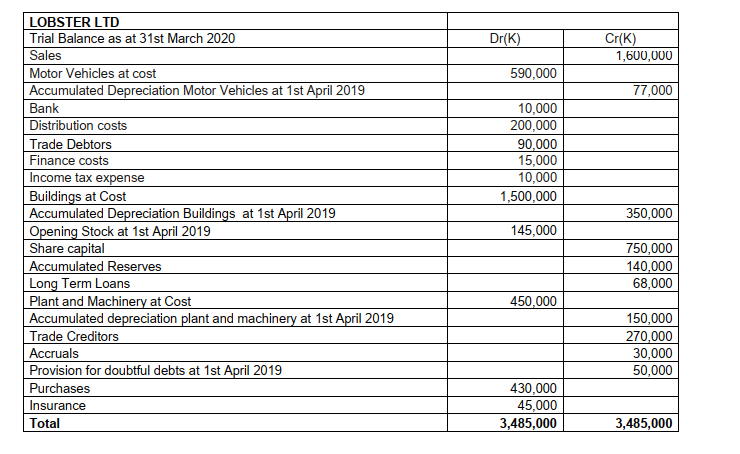

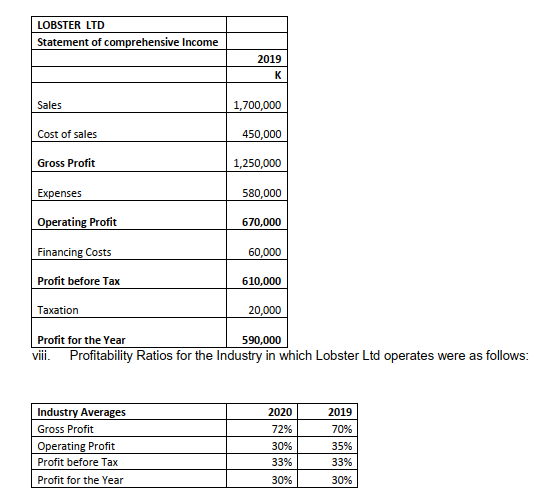

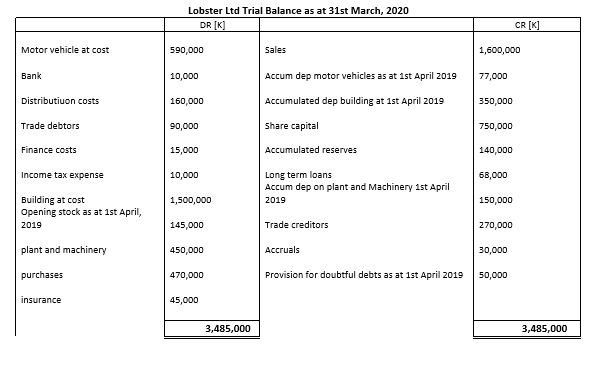

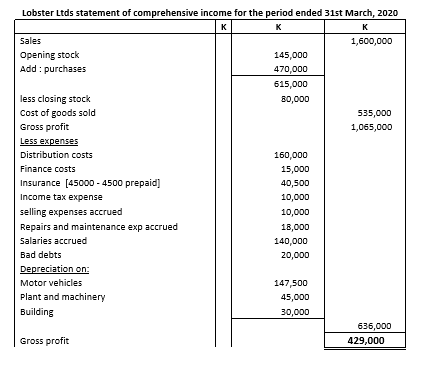

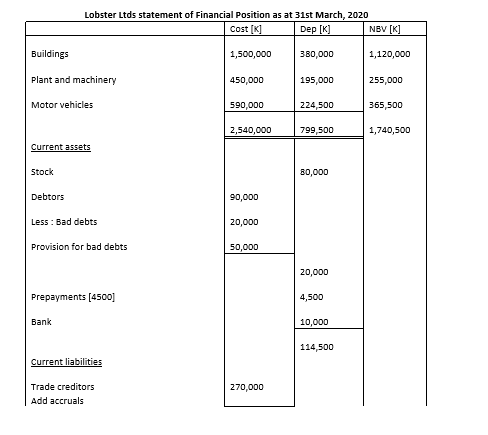

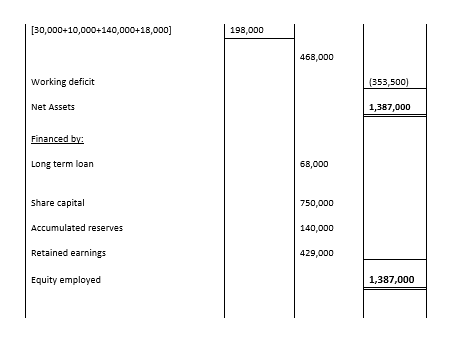

Dr(K) Cr(K) 1,600,000 590,000 77,000 10,000 200,000 90,000 15,000 10,000 1,500,000 350,000 LOBSTER LTD Trial Balance as at 31st March 2020 Sales Motor Vehicles at cost Accumulated Depreciation Motor Vehicles at 1st April 2019 Bank Distribution costs Trade Debtors Finance costs Income tax expense Buildings at Cost Accumulated Depreciation Buildings at 1st April 2019 Opening Stock at 1st April 2019 Share capital Accumulated Reserves Long Term Loans Plant and Machinery at Cost Accumulated depreciation plant and machinery at 1st April 2019 Trade Creditors Accruals Provision for doubtful debts at 1st April 2019 Purchases Insurance Total 145,000 750,000 140,000 68,000 450,000 150,000 270,000 30,000 50,000 430,000 45,000 3,485,000 3,485,000 LOBSTER LTD Statement of comprehensive Income 2019 K Sales 1,700,000 Cost of sales 450,000 Gross Profit 1,250,000 Expenses 580,000 Operating Profit 670,000 Financing Costs 60,000 610,000 Profit before Tax Taxation 20,000 Profit for the Year 590,000 viii. Profitability Ratios for the Industry in which Lobster Ltd operates were as follows: Industry Averages Gross Profit Operating Profit Profit before Tax Profit for the Year 2020 72% 30% 33% 30% 2019 70% 35% 33% 30% Lobster Ltd Trial Balance as at 31st March, 2020 DR [K] CR[K] Motor vehicle at cost 590,000 Sales 1,600,000 Bank 10,000 Accum dep motor vehicles as at 1st April 2019 77,000 Distributiuon costs 160,000 Accumulated dep building at 1st April 2019 350,000 Trade debtors 90,000 Share capital 750,000 Finance costs 15,000 Accumulated reserves 140,000 Income tax expense 10,000 68,000 Long term loans Accum dep on plant and Machinery 1st April 2019 1,500,000 150,000 Building at cost Opening stock as at 1st April, 2019 145,000 Trade creditors 270,000 plant and machinery 450,000 Accruals 30,000 purchases 470,000 Provision for doubtful debts as at 1st April 2019 50,000 insurance 45,000 3,485,000 3,485,000 Lobster Ltds statement of comprehensive income for the period ended 31st March, 2020 K Sales 1,600,000 Opening stock 145,000 Add: purchases 470,000 615,000 less closing stock 80,000 Cost of goods sold 535,000 Gross profit 1,065,000 Less expenses Distribution costs 160,000 Finance costs 15,000 Insurance [45000 - 4500 prepaid] 40,500 Income tax expense 10,000 selling expenses accrued 10,000 Repairs and maintenance exp accrued 18,000 Salaries accrued 140,000 Bad debts 20,000 Depreciation on Motor vehicles 147,500 Plant and machinery 45,000 Building 30,000 636,000 Gross profit 429,000 Lobster Ltds statement of Financial Position as at 31st March, 2020 Cost [K] DEP [E] NBV [K] Buildings 1,500,000 380,000 1,120,000 Plant and machinery 450,000 195,000 255,000 Motor vehicles 590,000 224,500 365,500 2,540,000 799,500 1,740,500 Current assets Stock 80,000 Debtors 90,000 Less : Bad debts 20,000 Provision for bad debts 50,000 20,000 Prepayments (4500] 4,500 Bank 10,000 114,500 Current liabilities 270,000 Trade creditors Add accruals [30,000+10,000+140,000+18,000) 198,000 468,000 Working deficit (353,500) Net Assets 1,387,000 Financed by: Long term loan 68,000 Share capital 750,000 Accumulated reserves 140,000 Retained earnings 429,000 Equity employed 1,387,000 (a) Prepare a horizontal analysis of the Statement of Comprehensive Income for Lobster Ltd for 2020 compared to 2019. (9.5 marks) (b) Prepare a vertical analysis of the Statement of Comprehensive Income for Lobster Ltd for 2020 and 2019.(9.5 marks) (c) Prepare a Report on the profitability of Lobster Ltd in 2020 compared to 2019 and industry. (25 marks) Dr(K) Cr(K) 1,600,000 590,000 77,000 10,000 200,000 90,000 15,000 10,000 1,500,000 350,000 LOBSTER LTD Trial Balance as at 31st March 2020 Sales Motor Vehicles at cost Accumulated Depreciation Motor Vehicles at 1st April 2019 Bank Distribution costs Trade Debtors Finance costs Income tax expense Buildings at Cost Accumulated Depreciation Buildings at 1st April 2019 Opening Stock at 1st April 2019 Share capital Accumulated Reserves Long Term Loans Plant and Machinery at Cost Accumulated depreciation plant and machinery at 1st April 2019 Trade Creditors Accruals Provision for doubtful debts at 1st April 2019 Purchases Insurance Total 145,000 750,000 140,000 68,000 450,000 150,000 270,000 30,000 50,000 430,000 45,000 3,485,000 3,485,000 LOBSTER LTD Statement of comprehensive Income 2019 K Sales 1,700,000 Cost of sales 450,000 Gross Profit 1,250,000 Expenses 580,000 Operating Profit 670,000 Financing Costs 60,000 610,000 Profit before Tax Taxation 20,000 Profit for the Year 590,000 viii. Profitability Ratios for the Industry in which Lobster Ltd operates were as follows: Industry Averages Gross Profit Operating Profit Profit before Tax Profit for the Year 2020 72% 30% 33% 30% 2019 70% 35% 33% 30% Lobster Ltd Trial Balance as at 31st March, 2020 DR [K] CR[K] Motor vehicle at cost 590,000 Sales 1,600,000 Bank 10,000 Accum dep motor vehicles as at 1st April 2019 77,000 Distributiuon costs 160,000 Accumulated dep building at 1st April 2019 350,000 Trade debtors 90,000 Share capital 750,000 Finance costs 15,000 Accumulated reserves 140,000 Income tax expense 10,000 68,000 Long term loans Accum dep on plant and Machinery 1st April 2019 1,500,000 150,000 Building at cost Opening stock as at 1st April, 2019 145,000 Trade creditors 270,000 plant and machinery 450,000 Accruals 30,000 purchases 470,000 Provision for doubtful debts as at 1st April 2019 50,000 insurance 45,000 3,485,000 3,485,000 Lobster Ltds statement of comprehensive income for the period ended 31st March, 2020 K Sales 1,600,000 Opening stock 145,000 Add: purchases 470,000 615,000 less closing stock 80,000 Cost of goods sold 535,000 Gross profit 1,065,000 Less expenses Distribution costs 160,000 Finance costs 15,000 Insurance [45000 - 4500 prepaid] 40,500 Income tax expense 10,000 selling expenses accrued 10,000 Repairs and maintenance exp accrued 18,000 Salaries accrued 140,000 Bad debts 20,000 Depreciation on Motor vehicles 147,500 Plant and machinery 45,000 Building 30,000 636,000 Gross profit 429,000 Lobster Ltds statement of Financial Position as at 31st March, 2020 Cost [K] DEP [E] NBV [K] Buildings 1,500,000 380,000 1,120,000 Plant and machinery 450,000 195,000 255,000 Motor vehicles 590,000 224,500 365,500 2,540,000 799,500 1,740,500 Current assets Stock 80,000 Debtors 90,000 Less : Bad debts 20,000 Provision for bad debts 50,000 20,000 Prepayments (4500] 4,500 Bank 10,000 114,500 Current liabilities 270,000 Trade creditors Add accruals [30,000+10,000+140,000+18,000) 198,000 468,000 Working deficit (353,500) Net Assets 1,387,000 Financed by: Long term loan 68,000 Share capital 750,000 Accumulated reserves 140,000 Retained earnings 429,000 Equity employed 1,387,000 (a) Prepare a horizontal analysis of the Statement of Comprehensive Income for Lobster Ltd for 2020 compared to 2019. (9.5 marks) (b) Prepare a vertical analysis of the Statement of Comprehensive Income for Lobster Ltd for 2020 and 2019.(9.5 marks) (c) Prepare a Report on the profitability of Lobster Ltd in 2020 compared to 2019 and industry. (25 marks)