Answered step by step

Verified Expert Solution

Question

1 Approved Answer

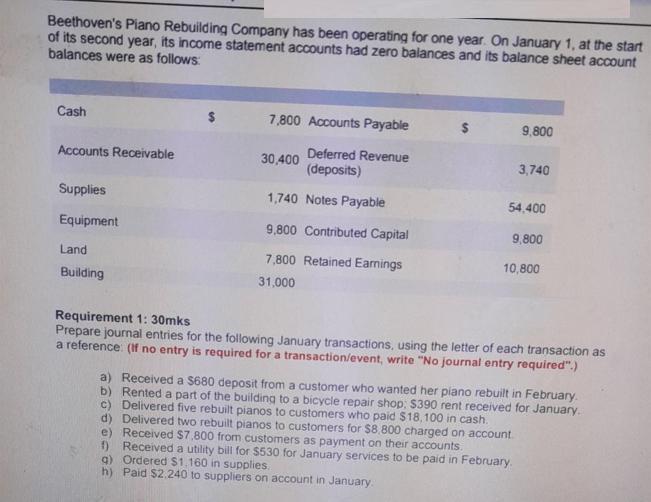

Beethoven's Piano Rebuilding Company has been operating for one year. On January 1, at the start of its second year, its income statement accounts

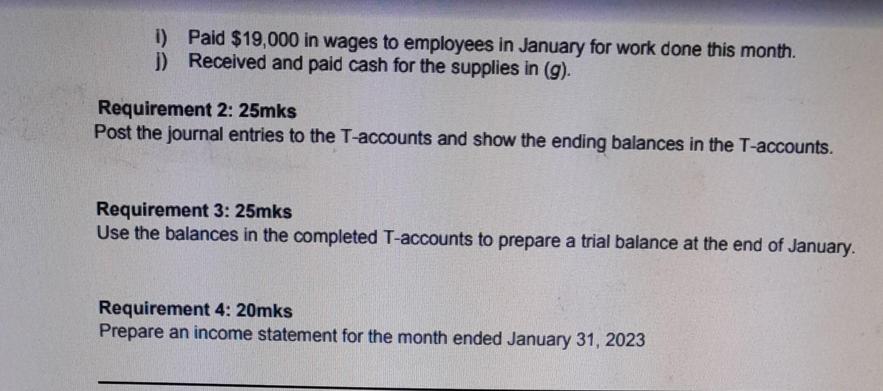

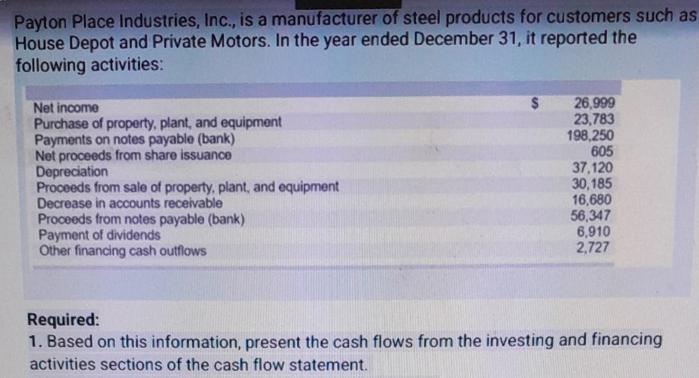

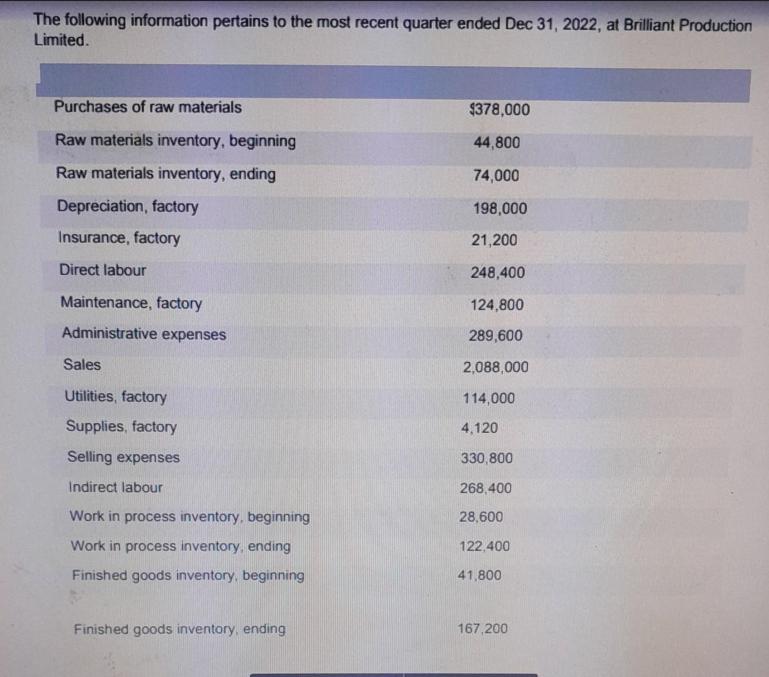

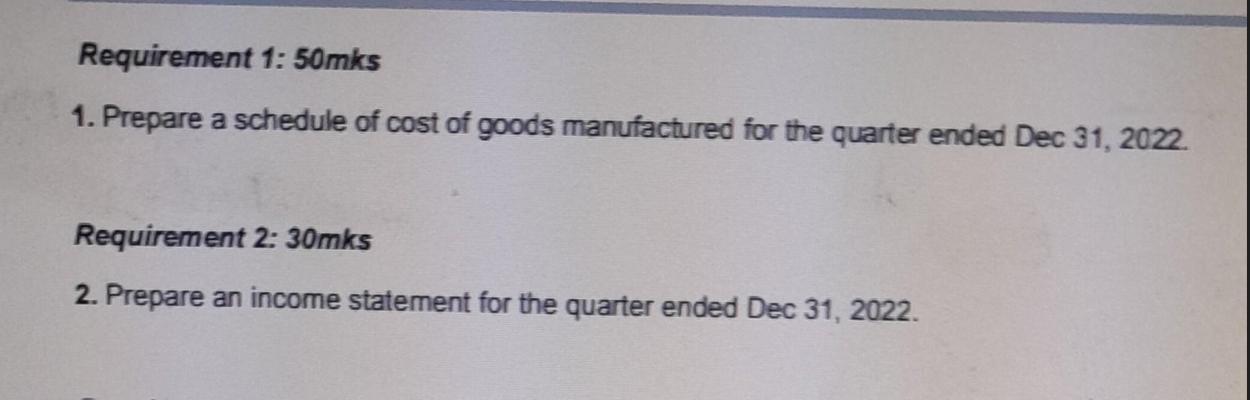

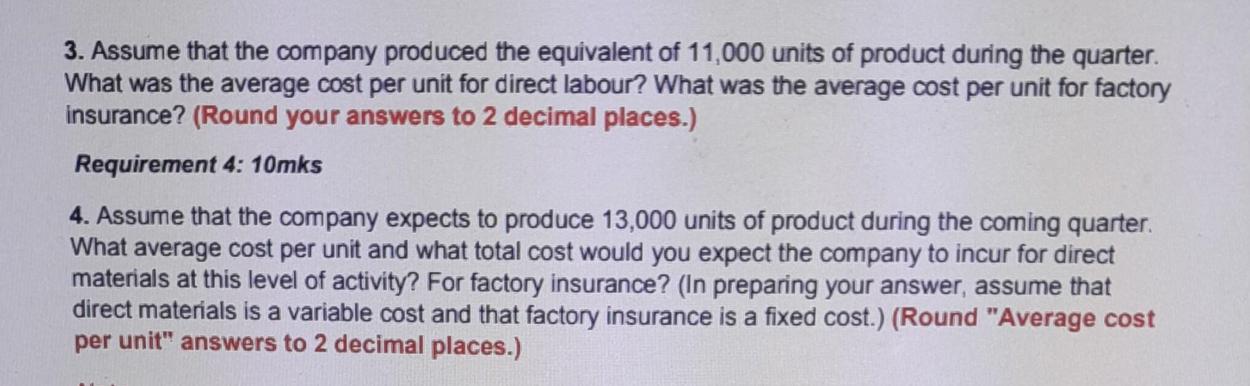

Beethoven's Piano Rebuilding Company has been operating for one year. On January 1, at the start of its second year, its income statement accounts had zero balances and its balance sheet account balances were as follows: Cash Accounts Receivable Supplies Equipment Land Building 7,800 Accounts Payable Deferred Revenue (deposits) 30,400 1,740 Notes Payable 9,800 Contributed Capital 7,800 Retained Earnings 31,000 9,800 3,740 g) Ordered $1.160 in supplies. h) Paid $2.240 to suppliers on account in January. 54,400 9,800 10,800 Requirement 1: 30mks Prepare journal entries for the following January transactions, using the letter of each transaction as a reference: (If no entry is required for a transaction/event, write "No journal entry required".) a) Received a $680 deposit from a customer who wanted her piano rebuilt in February. b) Rented a part of the building to a bicycle repair shop; $390 rent received for January. c) Delivered five rebuilt pianos to customers who paid $18,100 in cash. d) Delivered two rebuilt pianos to customers for $8,800 charged on account. e) Received $7,800 from customers as payment on their accounts. f) Received a utility bill for $530 for January services to be paid in February. i) Paid $19,000 in wages to employees in January for work done this month. 1) Received and paid cash for the supplies in (g). Requirement 2: 25mks Post the journal entries to the T-accounts and show the ending balances in the T-accounts. Requirement 3: 25mks Use the balances in the completed T-accounts to prepare a trial balance at the end of January. Requirement 4: 20mks Prepare an income statement for the month ended January 31, 2023 Payton Place Industries, Inc., is a manufacturer of steel products for customers such as House Depot and Private Motors. In the year ended December 31, it reported the following activities: Net income Purchase of property, plant, and equipment Payments on notes payable (bank) Net proceeds from share issuance Depreciation Proceeds from sale of property, plant, and equipment Decrease in accounts receivable Proceeds from notes payable (bank) Payment of dividends Other financing cash outflows S 26,999 23,783 198,250 605 37,120 30,185 16,680 56,347 6,910 2,727 Required: 1. Based on this information, present the cash flows from the investing and financing activities sections of the cash flow statement. The following information pertains to the most recent quarter ended Dec 31, 2022, at Brilliant Production Limited. Purchases of raw materials Raw materials inventory, beginning Raw materials inventory, ending Depreciation, factory Insurance, factory Direct labour Maintenance, factory Administrative expenses Sales Utilities, factory Supplies, factory Selling expenses Indirect labour Work in process inventory, beginning Work in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending $378,000 44,800 74,000 198,000 21,200 248,400 124,800 289,600 2,088,000 114,000 4,120 330,800 268,400 28,600 122,400 41,800 167,200 Requirement 1: 50mks 1. Prepare a schedule of cost of goods manufactured for the quarter ended Dec 31, 2022. Requirement 2: 30mks 2. Prepare an income statement for the quarter ended Dec 31, 2022. 3. Assume that the company produced the equivalent of 11,000 units of product during the quarter. What was the average cost per unit for direct labour? What was the average cost per unit for factory insurance? (Round your answers to 2 decimal places.) Requirement 4: 10mks 4. Assume that the company expects to produce 13,000 units of product during the coming quarter. What average cost per unit and what total cost would you expect the company to incur for direct materials at this level of activity? For factory insurance? (In preparing your answer, assume that direct materials is a variable cost and that factory insurance is a fixed cost.) (Round "Average cost per unit" answers to 2 decimal places.)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

answer Part 1 TAccounts Account Debit Credit Cash 47570 Accounts Receivable 7800 Supplies 1160 Equip...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started