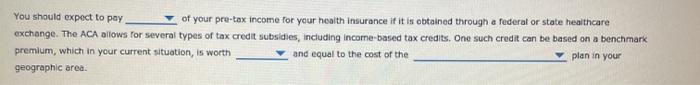

Drop Down:

1) 6%, 7%, 7.5%, 8%

2) $3,000, $4,000, $2,500, $3,500

3) most expensive gold, second lowest cost silver, most expensive bronze, second lowest cost platinum

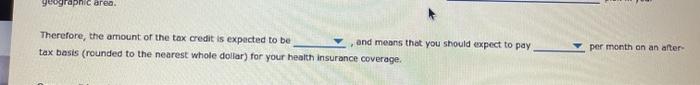

drop down:

1) $590, $534, $1,124, $562

2) $590, $1,124, $47, $534

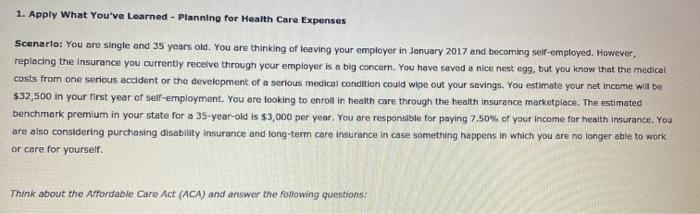

1. Apply What You've learned - Planning for Health Care Expenses Scenario: You are single and 35 years old. You are thinking of leaving your employer in January 2017 and becoming self-employed. However, replacing the insurance you currently receive through your employer is a big concern. You have saved a nice nest egg, but you know that the medical costs from one serious accident or the development of a serious medical condition could wipe out your savings. You estimate your net income will be $32,500 in your first year of self-employment. You are looking to enroll in health care through the health insurance marketplace. The estimated benchmark premium in your state for a 35-year-old is $3,000 per year. You are responsible for paying 7.50% of your income for health insurance. You are also considering purchasing disability insurance and long-term care insurance in case something happens in which you are no longer able to work or care for yourself Think about the Affordable Care Act (ACA) and answer the following questions: You should expect to pay of your pre-tex income for your health insurance if it is obtained through a federal or state healthcare exchange. The ACA allows for several types of tax credit subsidies, including income-based tax credits. One such credit can be based on a benchmark premium, which in your current situation, is worth and equal to the cost of the plan in your geographic area. geographic area. Therefore, the amount of the tax credit is expected to be and means that you should expect to pay tax basis (rounded to the nearest whole dollar) for your health insurance coverage. per month on an alter 1. Apply What You've learned - Planning for Health Care Expenses Scenario: You are single and 35 years old. You are thinking of leaving your employer in January 2017 and becoming self-employed. However, replacing the insurance you currently receive through your employer is a big concern. You have saved a nice nest egg, but you know that the medical costs from one serious accident or the development of a serious medical condition could wipe out your savings. You estimate your net income will be $32,500 in your first year of self-employment. You are looking to enroll in health care through the health insurance marketplace. The estimated benchmark premium in your state for a 35-year-old is $3,000 per year. You are responsible for paying 7.50% of your income for health insurance. You are also considering purchasing disability insurance and long-term care insurance in case something happens in which you are no longer able to work or care for yourself Think about the Affordable Care Act (ACA) and answer the following questions: You should expect to pay of your pre-tex income for your health insurance if it is obtained through a federal or state healthcare exchange. The ACA allows for several types of tax credit subsidies, including income-based tax credits. One such credit can be based on a benchmark premium, which in your current situation, is worth and equal to the cost of the plan in your geographic area. geographic area. Therefore, the amount of the tax credit is expected to be and means that you should expect to pay tax basis (rounded to the nearest whole dollar) for your health insurance coverage. per month on an alter