Answered step by step

Verified Expert Solution

Question

1 Approved Answer

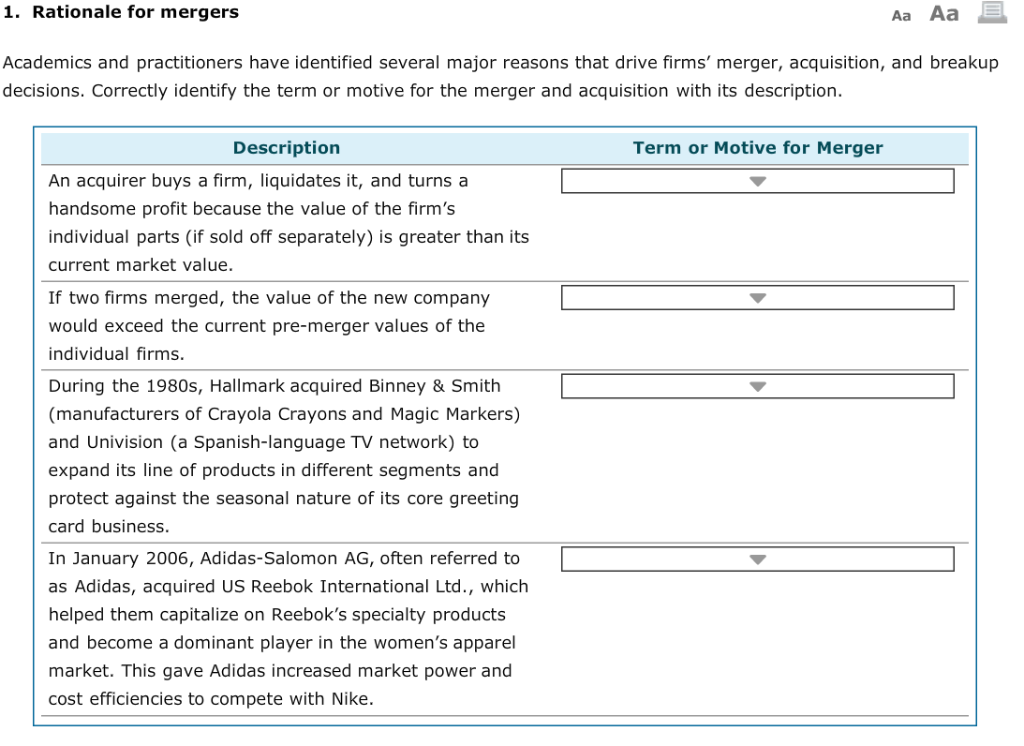

Drop down answers: 1. Diversification, Breakup value, Tax consideration, Manager's personal incentives 2. Diversification, Synergy, Tax consideration, Manager's personal incentives 3. Diversification, Breakup value, Tax

Drop down answers:

1. Diversification, Breakup value, Tax consideration, Manager's personal incentives

2. Diversification, Synergy, Tax consideration, Manager's personal incentives

3. Diversification, Breakup value, Tax consideration, Manager's personal incentives

4. Synergy, Breakup value, Tax consideration, Manager's personal incentives

1. Rationale for mergers Aa Aa Academics and practitioners have identified several major reasons that drive firms' merger, acquisition, and breakup decisions. Correctly identify the term or motive for the merger and acquisition with its description. Description Term or Motive for Merger An acquirer buys a firm, liquidates it, and turns a handsome profit because the value of the firm's individual parts (if sold off separately) is greater than its current market value. If two firms merged, the value of the new company would exceed the current pre-merger values of the individual firms. During the 1980s, Hallmark acquired Binney & Smith (manufacturers of Crayola Crayons and Magic Markers) and Univision (a Spanish-language TV network) to expand its line of products in different segments and protect against the seasonal nature of its core greeting card business. In January 2006, Adidas-Salomon AG, often referred to as Adidas, acquired US Reebok International Ltd., which helped them capitalize on Reebok's specialty products and become a dominant player in the women's apparel market. This gave Adidas increased market power and cost efficiencies to compete with NikeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started