Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Drop down answers: 2. lower, higher 3. an increase, a decrease 5. True, false 9. Financial reporting for mergers Aa Aa In June 2001, the

Drop down answers:

2. lower, higher

3. an increase, a decrease

5. True, false

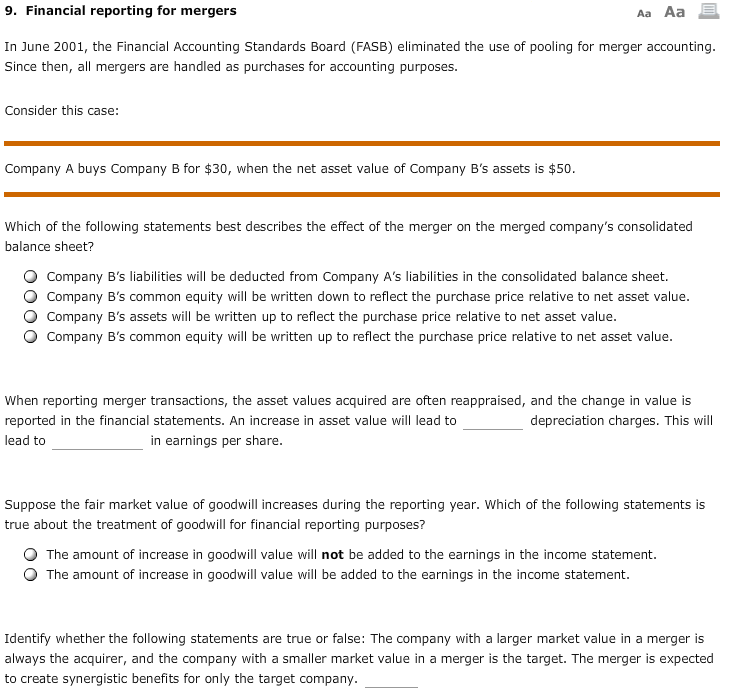

9. Financial reporting for mergers Aa Aa In June 2001, the Financial Accounting Standards Board (FASB) eliminated the use of pooling for merger accounting. Since then, all mergers are handled as purchases for accounting purposes. Consider this case Company A buys Company B for $30, when the net asset value of Company B's assets is $50 Which of the following statements best describes the effect of the merger on the merged company's consolidated balance sheet? Company B's liabilities will be deducted from Company A's liabilities in the consolidated balance sheet. Company B's common equity will be written down to reflect the purchase price relative to net asset value. Company B's assets will be written up to reflect the purchase price relative to net asset value. Company B's common equity will be written up to reflect the purchase price relative to net asset value. When reporting merger transactions, the asset values acquired are often reappraised, and the change in value is reported in the financial statements. An increase in asset value will lead to depreciation charges. This will lead to in earnings per share. Suppose the fair market value of goodwill increases during the reporting year. Which of the following statements is true about the treatment of goodwill for financial reporting purposes? The amount of increase in goodwill value will not be added to the earnings in the income statement. The amount of increase in goodwill value will be added to the earnings in the income statement. Identify whether the following statements are true or false: The company with a larger market value in a merger is always the acquirer, and the company with a smaller market value in a merger is the target. The merger is expected to create synergistic benefits for only the target companyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started