Drop down option:

Drop down option:

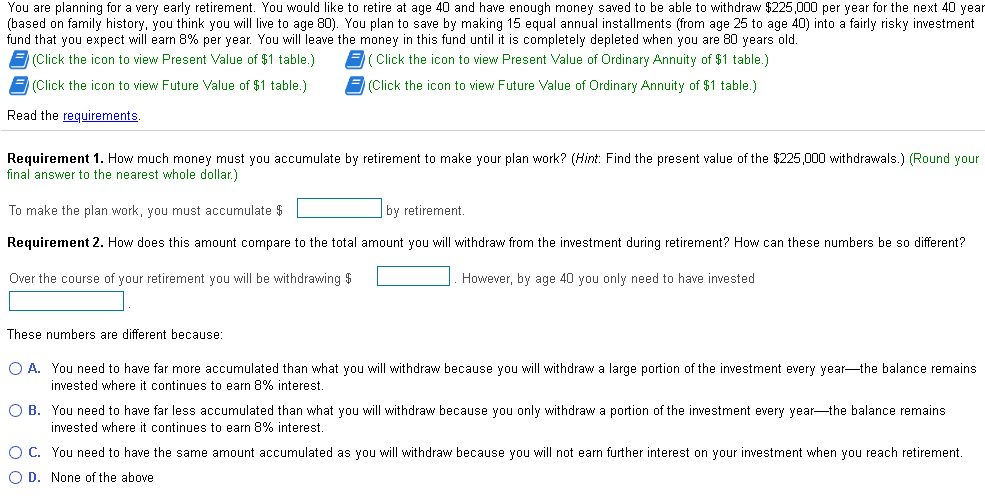

Requirement 2:

However, by age 40 you only need to have invested - $225,000 / the future value / the present value

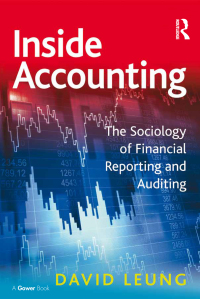

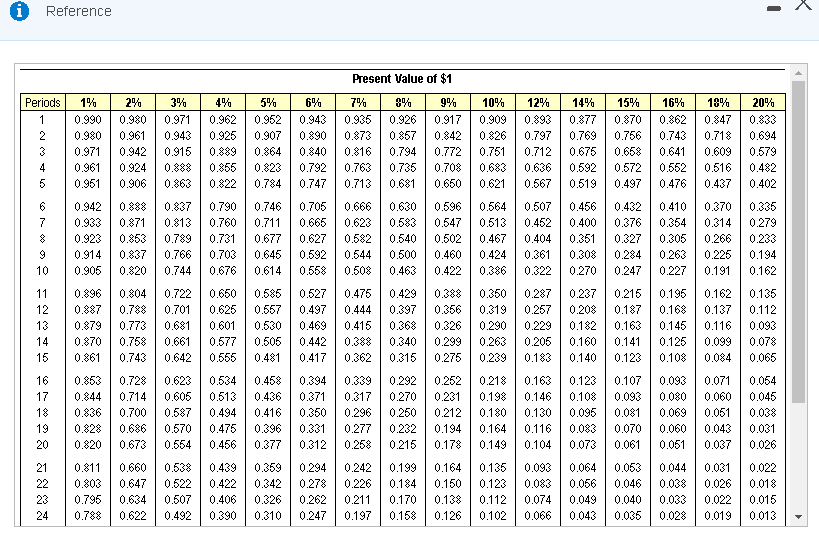

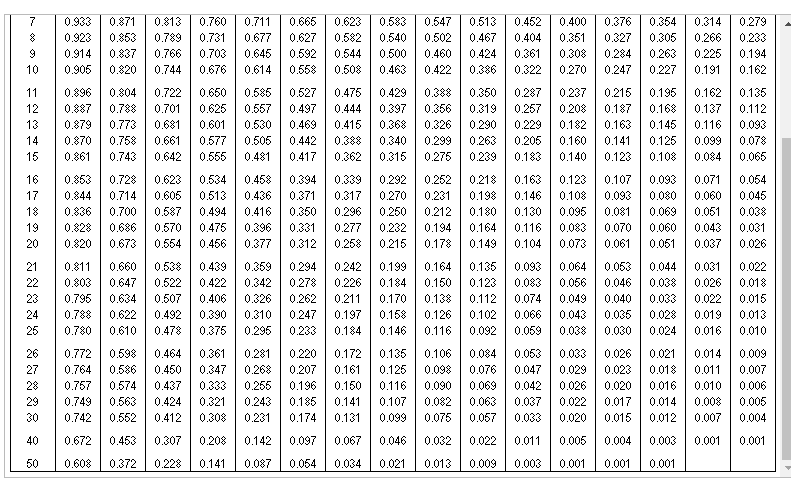

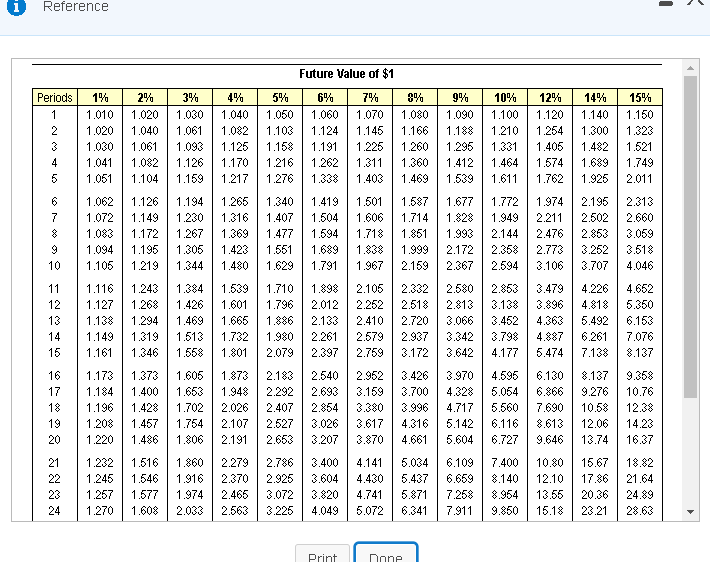

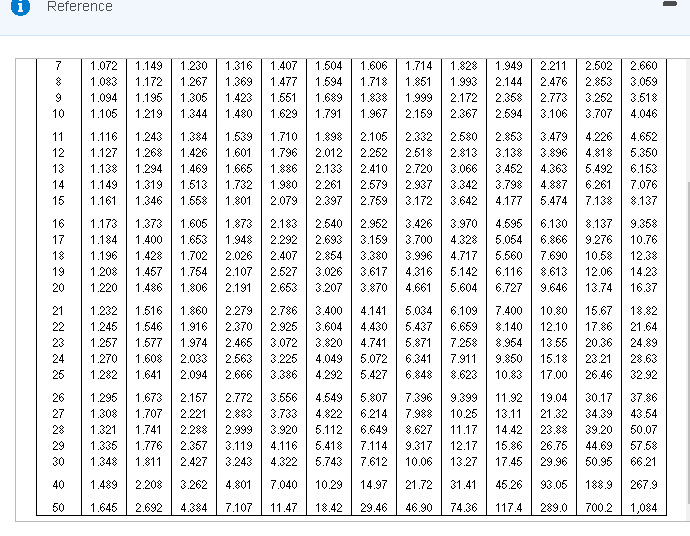

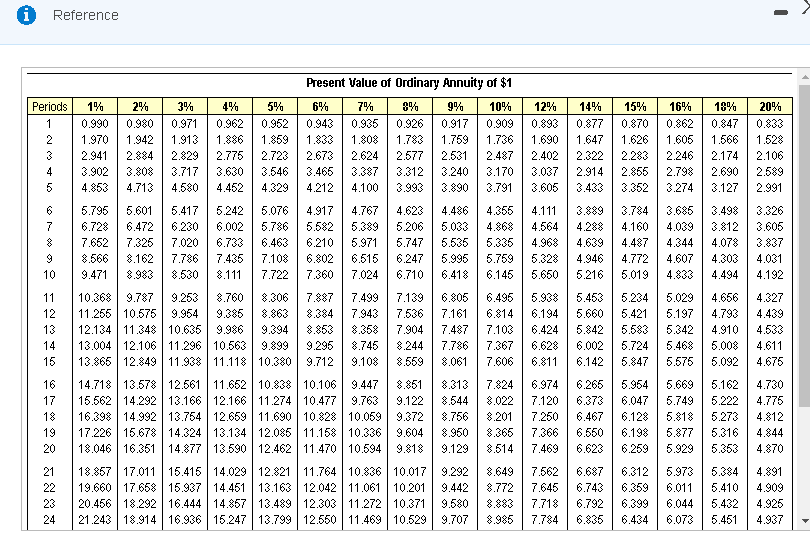

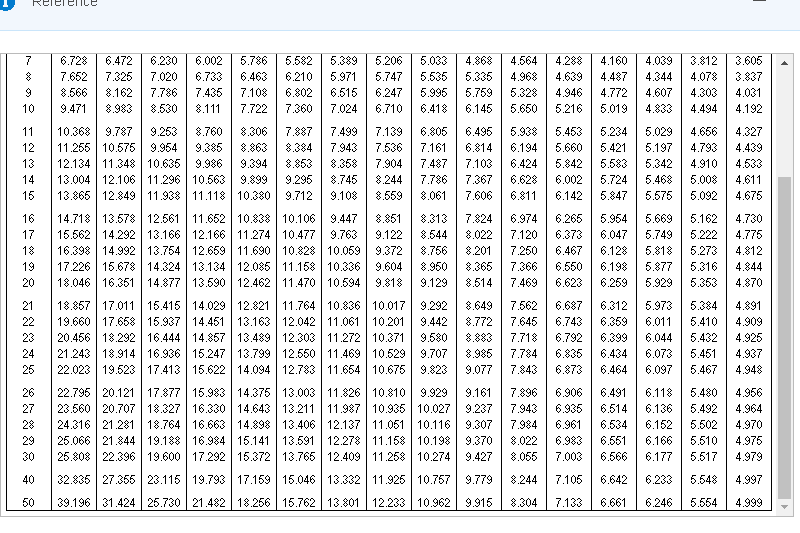

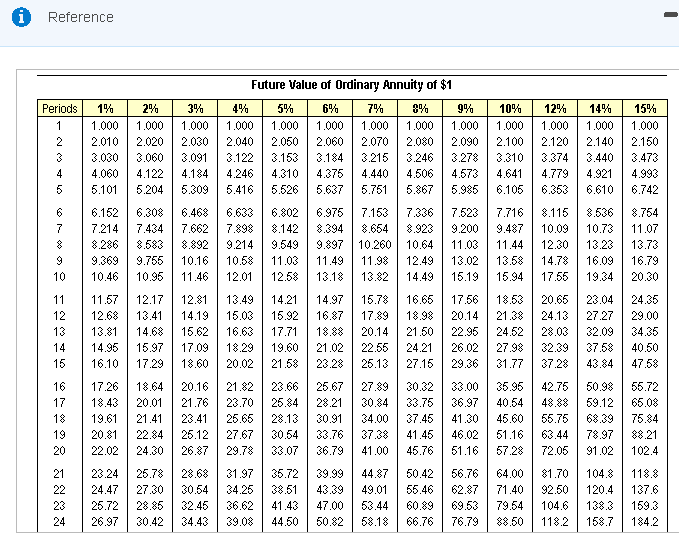

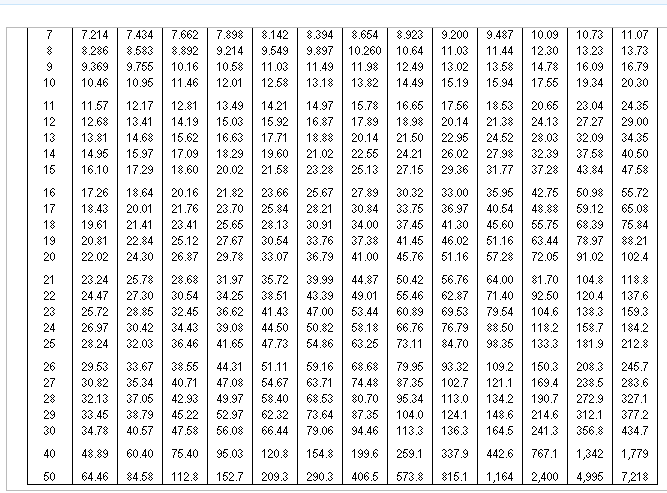

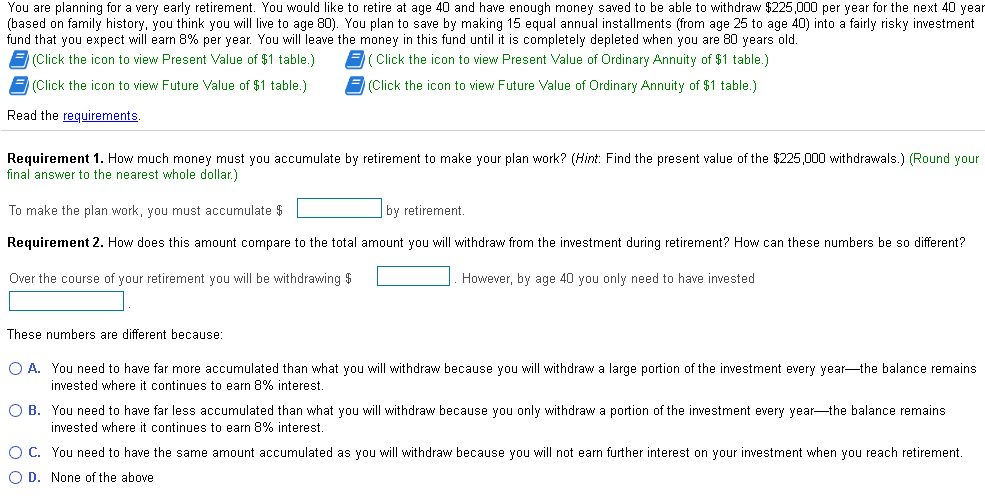

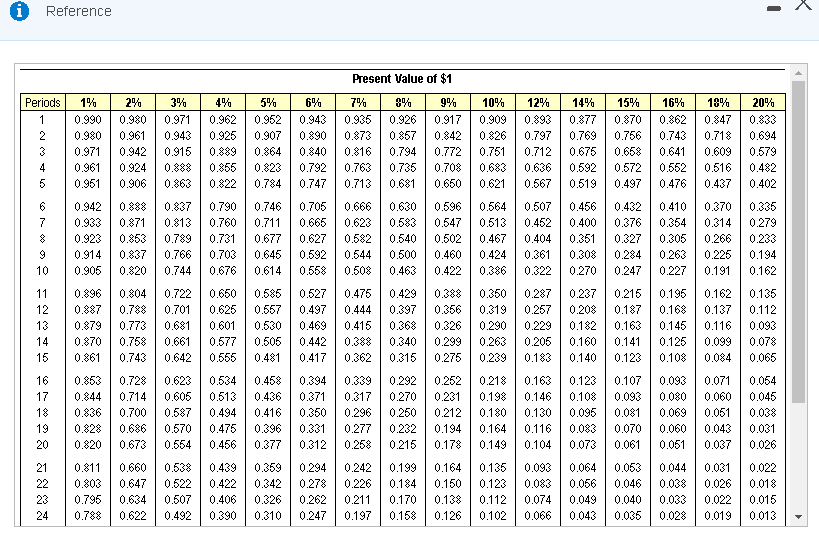

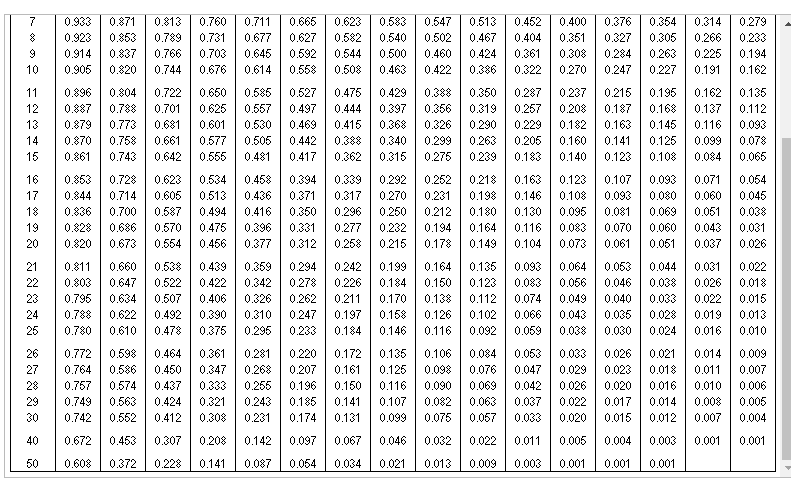

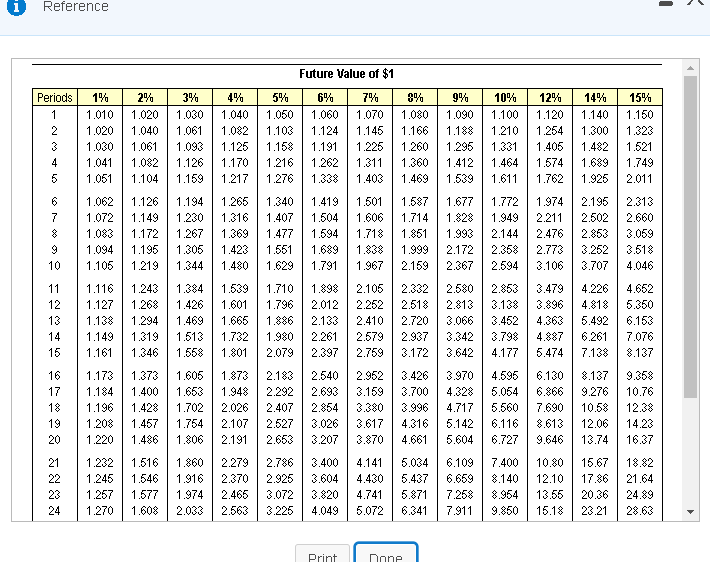

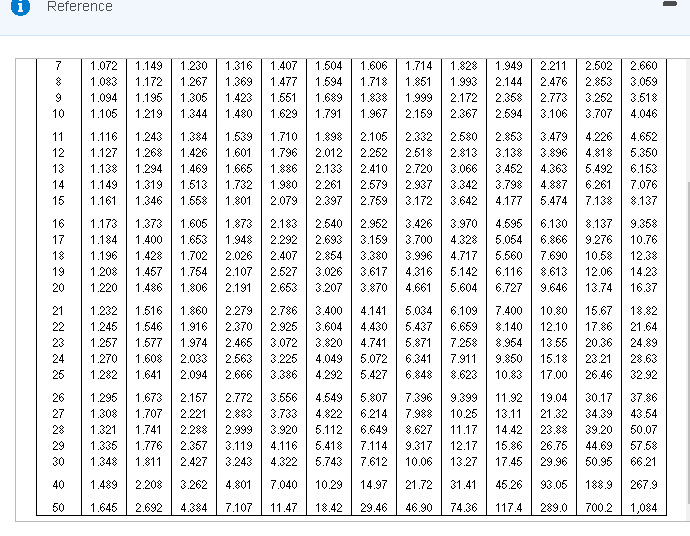

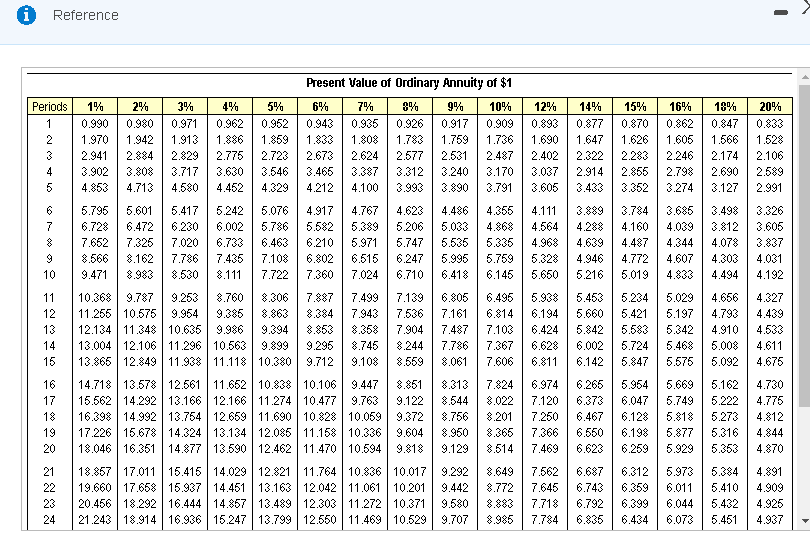

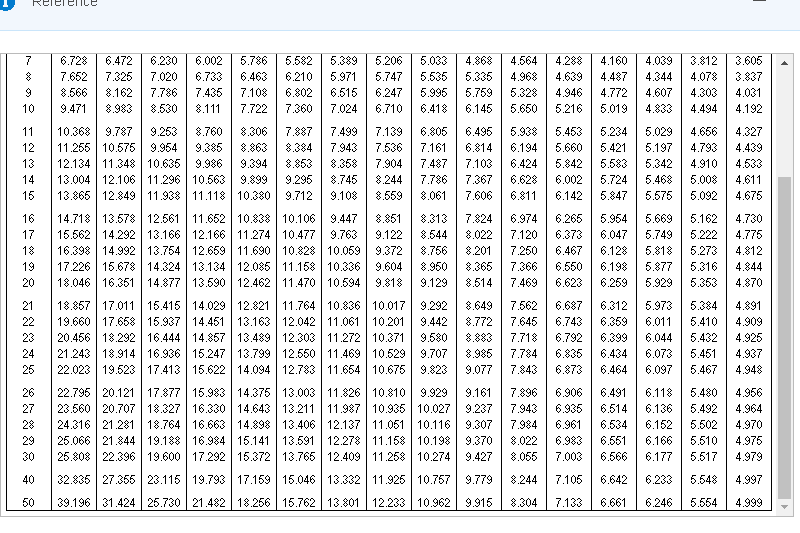

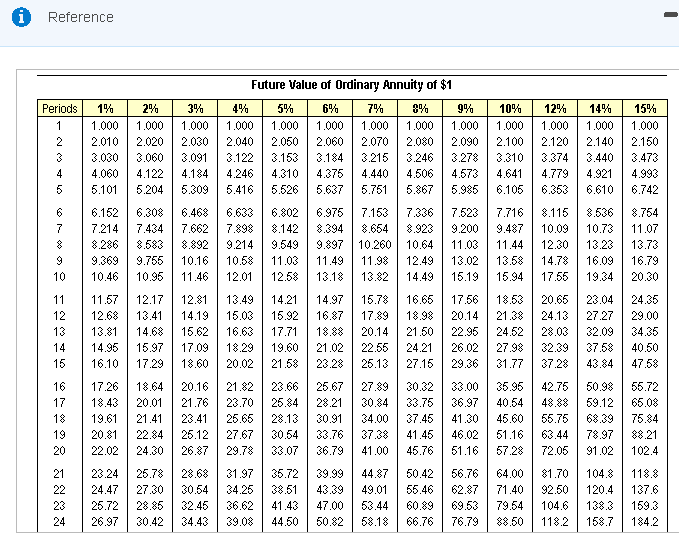

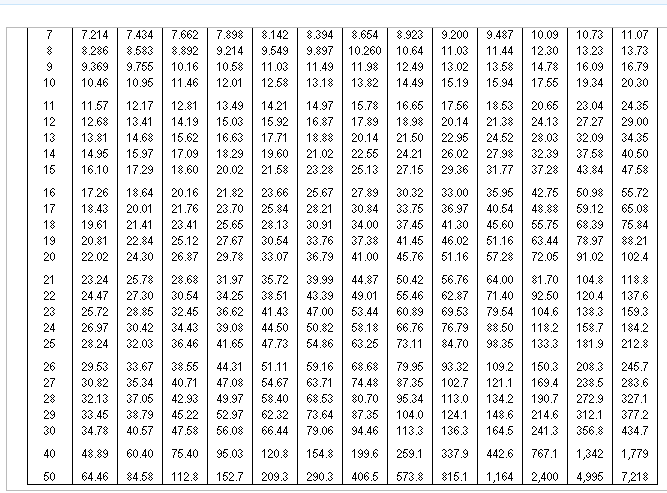

i Reference Present Value of $1 Periods 2% 1 3% 0.971 0.943 0.915 4% 0.962 0.925 1% 0.990 0.980 0.971 0.961 0.951 2 5% 0.952 0.907 0.864 0.823 0.784 0.961 0.942 0.924 0.906 6% 0.943 0.890 0.840 0.792 0.747 7% 0.935 0.873 0.816 0.763 0.713 8% 0.926 0.857 0.794 0.735 0681 9% 0.917 0.842 0.772 0.708 0.650 10% 0.909 0.826 0.751 0683 0.621 12% 0.893 0.797 0.712 0.636 0.567 14% 0.877 0.769 0.675 0.592 0.519 15% 0.870 0.756 0.658 0.572 0.497 16% 0.862 0.743 0.641 0.552 0.476 18% 0.847 0.718 0.609 0.516 0.437 20% 0.833 0.694 0.579 0.482 0.402 M 4 0.855 0.822 0.863 6 7 0.942 0.933 0.923 0.914 0.905 0.871 0.853 0.837 0.820 0.837 0.813 0.789 0.766 0.744 0.790 0.760 0.731 0.703 0.676 0.746 0.711 0.677 0.645 0.614 0.705 0.665 0.627 0.592 0.558 0.666 0.623 0.582 0.544 0.508 0.630 0.583 0.540 0.500 0.463 0.596 0.547 0.502 0.460 0.422 0.564 0.513 0.467 0.424 0.507 0.452 0.404 0.361 0.322 0.456 0.400 0.351 0.308 0.270 0.432 0.376 0.327 0.284 0.247 0.410 0.354 0.305 0.263 0.227 0.370 0.314 0.266 0.225 0.191 0.335 0.279 0.233 0.194 0.162 10 11 12 13 14 15 0.896 0.887 0.879 0.870 0.861 0.804 0.788 0.773 0.758 0.743 0.722 0.701 0.681 0.661 0.642 0.650 0.625 0.601 0.577 0.555 0.585 0.557 0.530 0.505 0.481 0.527 0.497 0.469 0.442 0.417 0.475 0.444 0.415 0.388 0.362 0.429 0.397 0.368 0.340 0.315 0.356 0.326 0.299 0.275 0.350 0.319 0.290 0.263 0.239 0.287 0.257 0.229 0.205 0.183 0.237 0.208 0.182 0.160 0.140 0.215 0.187 0.163 0.141 0.123 0.195 0.168 0.145 0.125 0.108 0.162 0.137 0.116 0.099 0.084 0.135 0.112 0.093 0.078 0.065 16 17 18 19 20 0.853 0.844 0.836 0.828 0.820 0.728 0.714 0.700 0.686 0.673 0.623 0.605 0.587 0.570 0.554 0.534 0.513 0.494 0.475 0.456 0.458 0.436 0.416 0.396 0.377 0.394 0.371 0.350 0.331 0.312 0.339 0.317 0.296 0.277 0.258 0.292 0.270 0.250 0.232 0.215 0.252 0.231 0.212 0.194 0.178 0.218 0.198 0.180 0.164 0.149 0.163 0.146 0.130 0.116 0.104 0.123 0.108 0.095 0.083 0.073 0.107 0.093 0.081 0.070 0.061 0.093 0.080 0.069 0.060 0.051 0.071 0.060 0.051 0.043 0.037 0.054 0.045 0.038 0.031 0.026 21 22 23 24 0.811 0.803 0.795 0.788 0.660 0.647 0.634 0.622 0.538 0.522 0.507 0.492 0.439 0.422 0.406 0.390 0.359 0.342 0.326 0.310 0.294 0.278 0.262 0.247 0.242 0.226 0.211 0.197 0.199 0.184 0.170 0.158 0.164 0.150 0.138 0.126 0.135 0.123 0.112 0.102 0.093 0.083 0.074 0.066 0.064 0.056 0.049 0.043 0.053 0.046 0.040 0.035 0.044 0.038 0.033 0.028 0.031 0.026 0.022 0.019 0.022 0.018 0.015 0.013 1922 14 6 ! 13 744 ,760 1 . 0.711 Q645 Q814 82 .8 5 .844 0.50 .5 1.540 .50 .4 547 Q502 2.4 .422 Q513 1.457 .424 42 .44 2 .40 1 2.27 .24 2.247 64 .26 .227 14 .28 0.225 1 .2 2 .14 1 1 11 12 13 14 16 4 .75 0748 081 .72 1 1.51 Q1 42 60 85 0.5 155 557 0530 0.56 0.41 0527 1.497 1.48 1.442 1.417 1.476 1.444 415 1.429 097 Q340 15 86 26 0.29 26 80 Q13 .290 Q262 0.28 0.2 0.257 .223 0.25 0.1 0.2 Q1 .1 Q140 0.215 1 0.141 0.1 Q1 .1 145 @126 0.1 Q1 Q17 Q116 0.0 004 01 .112 093 5 382 17 1 13 63 44 38 20 084 14 66 513 .44 .45 64 48 0.45 .4$ .416 4 371 1 Q312 Q2 Q17 Q2 2% 250 .277 .25 215 262 21 212 14 2.17 2.21 1 .1 .14 149 168 2.146 .10 2.118 2.14 Q13 .1 @@ 0.17 Q.09 1 QQ Q.QQ @O Q061 1 QQ71 060 51 04 Q064 045 Q1 028 21 28 24 % 11 60 Q647 4 Q622 Q10 0.53 0.522 Q. .42 47 1.49 0.422 1.46 75 59 Q342 28 1 0.29% 0.294 .27 262 0.247 2.28 Q242 228 Q211 17 2.14 Q1 Q14 Q10 158 0.146 Q14 150 .1% 0.116 0.136 2.128 Q112 2.1 093 20 QQ74 $4 0066 0.049 .043 0.0 Q062 046 Q040 0.0 0.00 .044 0.023 002 Q024 | 0.026 0.022 Q.019 E 2022 2015 Q013 2010 28 27 . 4 Q:749 742 74 .5% 0.52 .44 .450 2.437 2.424 .412 81 1 .21 25 28 243 2.231 220 207 1 Q1 Q174 1 2.11 Q.150 Q141 Q11 1 2.18 Q116 .17 .099 Q106 09 0.05 0024 076 .06 Q06 67 0.05 0.047 42 0.0 @@@ .026 Q.022 Q020 .028 Q.022 .020 0.017 QQ15 21 14 Q11 18 1 0014 Q.00 QQ12 @@@ Q004 47 Q672 .48 20 Q142 0.97 046 .022 QQ11 2006 .04 Q001 50 22 Q141 @ 64 Q4 0.021 2012 0.009 Q.00 Q2001 Q1 1 Reference - Future Value of $1 Periods 1 2 3 4 5 1% 1.010 1.020 1.030 1.041 1.051 2% 1.020 1.040 1.061 1.082 1.104 3% 1.030 1.061 1.093 1.126 1.159 1.040 1.082 1.125 1.170 1.217 5% 1.050 1.103 1.158 1.216 1.276 6% 1.060 1.124 1.191 1.262 1.338 7% 1.070 1.145 1.225 1.311 1.403 8% 1.080 1.166 1.260 1.360 1.469 9% 1.090 1.188 1.295 1.412 1.539 10% 1.100 1.210 1.331 1.464 1.611 12% 1.120 1.254 1.405 1.574 1.762 14% 1.140 1.300 1.482 1.689 1.925 15% 1.150 1.323 1.521 1.749 2.011 6 7 8 9 1.062 1.072 1.083 1.094 1.105 1.126 1.149 1.172 1.195 1.219 1.194 1.230 1.267 1.305 1.344 1.265 1.316 1.369 1.423 1.480 1.340 1.407 1.477 1.551 1.629 1.419 1.504 1.594 1.689 1.791 1.501 1.606 1.718 1.838 1.967 1.587 1.714 1.851 1.999 2.159 1.677 1.828 1.993 2.172 2.367 1.772 1.949 2.144 2.358 2.594 1.974 2.211 2.476 2.773 3.106 2.195 2.502 2.853 3.252 3.707 2.313 2.660 3.059 3.518 4.046 10 11 12 13 14 15 1.116 1.127 1.138 1.149 1.161 1.243 1.268 1.294 1.319 1.346 1.384 1.426 1.469 1.513 1.558 1.539 1.601 1.665 1.732 1.801 1.710 1.796 1.886 1.980 2.079 1.898 2.012 2.133 2.261 2.397 2.105 2.252 2.410 2.579 2.759 2.332 2.518 2.720 2.937 3.172 2.580 2.813 3.066 3.342 3.642 2.853 3.138 3.452 3.798 4.177 3.479 3.896 4.363 4.887 5.474 4.226 4.818 5.492 6.261 7.138 4.652 5.350 6.153 7.076 8.137 6.130 16 17 18 19 20 1.173 1.184 1.196 1.208 1.220 1.373 1.400 1.428 1.457 1.486 1.605 1.653 1.702 1.754 1.806 1.873 1.948 2.026 2.107 2.191 2.183 2.292 2.407 2.527 2.653 2.540 2.693 2.854 3.026 3.207 2.952 3.159 3.380 3.617 3.870 3.426 3.700 3.996 4.316 4.661 3.970 4.328 4.717 5.142 5.604 4.595 5.054 5.560 6.116 6.727 7.690 8.613 9.646 8.137 9.276 10.58 12.06 13.74 9.358 10.76 12.38 14.23 16.37 21 22 23 24 1.232 1.245 1.267 1.270 1.516 1.546 1.577 1.608 1.860 1.916 1.974 2.033 2.279 2.370 2.465 2.563 2.786 2.925 3.072 3.225 3.400 3.604 3.820 4.049 4.141 4.430 4.741 5.072 5.034 5.437 5.871 6.341 6.109 6.659 7.258 7.911 7.400 8.140 8.954 9.850 10.80 12.10 13.55 15.18 15.67 17.86 20.36 23.21 18.82 21.64 24.89 28.63 Print None Reference 1072 1.0 14 1.1% 1.149 1172 1.1% 1213 1.230 1.87 1. 144 116 1.38 1.422 1.4 1.47 1477 151 16293 1.04 1.584 1.83 11 1.6 1.744 1. 151 1 1999 1 2.18 1. 1 2.1 2. 1949 2.144 26 284 2.211 2.476 2. 3.1 2502 25 3.252 3. 2 360 351 4.046 1 3.4 11 12 14 6 1.116 1.127 1.1 1.19 1.161 1.242 1.2 1.234 11 1346 14 1.428 1.48 151 1.58 1. 1710 11 1.7% 1 1. 17 1. 11 209 1. 2012 2.1 2.251 2. 2.1 2.252 2410 25 2.759 2. 251 2.720 2. 3.1 25 2.13 3.6 342 642 2388 3.1 3.42 4.177 4. 4.28 4.1 5.492 281 138 4.62 5.360 18 .17 5.474 16 17 1.1 1.14 11 12 1.220 1 1.4 1.428 1.457 1.48 106 1. 18 14 1.2 226 1.64 2.107 1. 2.11 2.1 2.22 2.40 2.27 263 2.540 26 4 026 3.207 22 159 3.30 17 3.428 3.70 3 4.18 4.61 37 4.2 4.17 5.142 504 4.5 $10 564 5.6 5.5 890 6.116 613 6.727 648 .17 276 12.58 12 13.74 96 1 12. 14. 187 19 4 2 24 5 1.222 1.246 1.257 1.270 1.2 1.18 1. 22 1.546 18 23 1.57 174 245 1. 2. 2.5 1541 24 2.66 2. 2.25 3 3.225 3 3.400 4 20 4.043 4.2 4.141 4.4 4.741 5.072 5.427 54 5.47 51 $341 4 1 6 7.25 11 7.40 .140 4 0 1 1 12.10 138 16.1 17 167 12 17 14 24. 21 5.4$ 27 1.25 1.67 1. 17 11 1741 1.35 1.77E 1.4 111 2.157 2.221 2.2 267 2.427 2.72 2. 2999 3.119 3.248 3.566 3 3920 4.11 4.222 4.84 4.22 5.112 5.41 5.43 8 6.214 $849 7114 12 . 27 3317 1 105 11.17 12.17 1 27 11.2 13.11 14.42 16 17.45 1904 21 85 17 , 20 44 42.54 Q7 7 21 40 1.4 3.22 4.01 7040 1 14.7 21.72 1.41 46. $79 1645 2.62 4.34 7.127 11.47 1.42 48 46 4.8 117.4 20 2 1.084 i Reference Periods 1 2 3 4 5 1% 0.990 1.970 2.941 3.902 4.853 2% 0.980 1.942 2.884 3.808 4.713 3% 0.971 1.913 2.829 3.717 4.580 4% 0.962 1.886 2.775 3.630 4.452 5% 0.952 1.859 2.723 3.546 4.329 Present Value of Ordinary Annuity of $1 6% 7% 8% 9% 10% 0.943 0.935 0.926 0.917 0.909 1.833 1.808 1.783 1.759 1.736 2.673 2.624 2.577 2.531 2.487 3.465 3.312 3.240 3.170 4.212 4.100 3.890 3.791 12% 0.893 1.690 2.402 3.037 3.605 14% 0.877 1.647 2.322 2.914 3.433 15% 0.870 1.626 2.283 2.855 3.352 16% 0.862 1.605 2.246 2.798 3.274 18% 0.847 1.566 2.174 2.690 3.127 20% 0.833 1.528 2.106 2.589 2.991 6 7 5.796 6.728 7.652 8.566 9.471 5.601 6.472 7.325 8.162 5.417 6.230 7.020 7.786 8.530 5.242 6.002 6.733 7.435 8.111 5.076 5.786 6.463 7.108 7.722 4.917 5.582 6.210 6.802 7.360 4.767 5.389 5.971 6.515 7.024 4.623 5.206 5.747 6.247 6.710 4.486 5.033 5.535 5.995 6.418 4.355 4.868 5.335 5.759 6.145 4.111 4.564 4.968 5.328 5.650 4.288 4.639 4.946 5.216 3.784 4.160 4.487 4.772 5.019 3.685 4.039 4.344 4.607 3.498 3.812 4.078 4.303 4.494 3.326 3.605 3.837 4.031 4.192 10 11 12 13 14 15 6.495 6.814 7.103 7.367 7.606 5.938 6.194 6.424 6.628 6.811 5.453 5.660 5.842 6.002 6.142 5.234 5.421 5.583 5.724 5.847 5.029 5.197 5.342 5.468 5.575 4.656 4.793 4.910 5.008 5.092 4.327 4.439 4.533 4.611 4.675 16 17 18 19 20 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 11.255 10.575 9.954 9.385 8.384 7.943 7.536 7.161 12.134 | 11.348 10.635 | 9.986 9.394 8.853 8.358 7.904 7.487 13.004 | 12.106 11.296 | 10.563 9.899 9.295 8.745 8.244 7.786 13.865 12.849 11.938 | 11.118 10.380 9.712 9.108 8.559 8.061 14.718 | 13.578 12.561 11.652 10.838 10.106 9.447 8.861 8.313 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 16.398 | 14.992 | 13.754 12.659 | 11.690 10.828 10.059 9.372 8.756 17.226 15.678 14.324 | 13.134 | 12.085 | 11.158 10.336 9.604 8.950 18.046 16.351 14.877 | 13.590 12.462 11.470 10.594 9.818 9.129 18.857 17.01115.415 14.029 12.821 11.764 10.836 10.017 9.292 19.660 | 17.658 15.937 | 14.451 13.163 | 12.042 | 11.061 10.201 9.442 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 21.243 18.914 16.936 15.247 13.799 12.550 | 11.469 10.529 9.707 7.824 8.022 8.201 8.365 8.514 6.974 7.120 7.250 7.366 7.469 6.265 6.373 6.467 6.550 6.623 5.954 6.047 6.128 6.198 6.259 5.669 5.749 5.818 5.877 5.929 5.162 5.222 5.273 5.316 5.353 4.730 4.775 4.812 4.844 4.870 8.649 8.772 21 22 23 24 7.562 7.645 7.718 7.784 6.687 6.743 6.792 6.835 6.312 6.359 6.399 6.434 5.973 6.011 6.044 6.073 5.384 5.410 5.432 5.451 4.891 4.909 4.925 4.937 8.985 _|_|_| 36 $72 .5 9471 $472 .1 2 20 602 8. .45 111 5. .48 7.1 7.72 552 6.210 02 53 5971 515 24 5.26 5.747 247 710 5. 556 5995 $41 4. 4.84 56 4. 5.8 5.2 $145 50 4.2 4.Q 4.348 5.218 4.1 4.4 4.72 513 4. 4.344 4.607 2 4. 4.0 4.494 4.1 4.12 10 4 7.499 7943 11 12 13 14 16 1 7 9.253 11.2 10575 4 12.14] 11.4 10 4 134 |12.1|11.2|10.56 ]12 | 11.] 11.11|10 71 06 7.11 74 .4 244 77 1 .4% 14 100 06 593 6.14 $424 11 5.4 5 5.42 6.02 8.142 5.224 5.421 55 5.724 5.47 5 51 5342 5.4 5576 4.66 4. 4.4g 5. 5092 4. 4.4 4. 4.41 4.875 3.2% 12 ,745 3.1 $25 16 17 1 13 14.71 | 13.57] 12.561 11.82 |10|1016 447 1 15.5 14.13.1|12.1|11.274|10.477 12 16 14.13.74] 12 11 10 17.228 | 15.7| 14.24 | 13.14| 12.0 | 11.15|10 04 1.046|161 | 14.7] 13.| 12.42] 11.4 10.594 13 544 0 2.129 4 022 .514 74 7.120 250 7.4 $487 $580 6.54 6.047 $1 6.1 28 5. 5.749 51 5. 52 5.1 6.222 5.27 518 5.52 4.7 4.76 4. 12 4.244 4. 21 17]1711 | 15.415| 14.029 | 121 | 11.74| 10 | 10.17 .649 19]17 14.45111.112042111.1|10.20 9.442 .41.2| 16.444 | 14.7] 13.4| 12. | 11.272 | 1031 9.5 21.24 | 114 | 16 | 15.247] 13. | 12.80 | 11.4 | 10.89 2022 | 19.52 | 17.41G] 15.22 | 14.04 | 12.| 11.64 | 1085 28 307 7562 12 45 $74 669 6. 5.39 74 8.44 43 5.464 5 11 044 60 54 4.1 5.412 4. 5.4 4.35 5.451 4. 5.457 4.4 24 5 27 227 | 2.121 | 17] 16. | 14.3 | 13 | 11.6 | 11 2.5 0.7 | 1|16| 14.84 | 13.211 | 11.|10. | 10.27 24.18 | 21.21|1.784 | 16 | 14.| 13.4| 12.17]11.1 | 10.116 25. | 21.44 | 19.1| 16.4 | 15.141 | 131 | 12.27 | 11.18 | 10.1 25. | 2.3 | 19 | 17.22 | 15.372 | 13765 | 12.4 | 11.253 | 10.274 | 27.35 | .115 | 19. | 17.19| 15.046 | 13 | 11.25 | 10.757 161 9.237 43 4 93 9.427 .06 60 6 1 98 6.4 6514 84 651 6.5 6.11 6.1 168 6.1 $1 5.4 5.4 5.82 5510 5517 4.6 4.4 4.7 495 4 47 244 7.1 $42 2 5.54 4. 11.424 | 8| 21.4|1.256 | 15.7 | 13. 12.2 |1082 9915 ,304 7.1 661 6248 5.864 4. Reference Periods 1 1% 1.000 2.010 3.030 4.060 5.101 2 3 4 5 2% 1.000 2.020 3.060 4.122 5.204 3% 1.000 2.030 3.091 4.184 5.309 Future Value of Ordinary Annuity of $1 4% 5% 6% 7% 8% 9% 1.000 1.000 1.000 1.000 1.000 1.000 2.040 2.050 2.060 2.070 2.080 2.090 3.122 3.153 3.184 3.215 3.246 3.278 4.246 4.310 4.375 4.440 4.506 4.573 5.416 5.526 5.637 5.751 5.867 5.985 10% 1.000 2.100 3.310 4.641 6.105 12% 1.000 2.120 3.374 4.779 6.363 14% 1.000 2.140 3.440 4.921 6.610 15% 1.000 2.150 3.473 4.993 6.742 6.308 7.434 7 8 9 10 6.152 7.214 8.286 9.369 10.46 6.468 7.662 8.892 10.16 11.46 7.898 9.214 10.58 12.01 6.802 8.142 9.549 11.03 12.58 6.975 8.394 9.897 11.49 13.18 7.153 8.654 10.260 11.98 13.82 7.336 8.923 10.64 12.49 14.49 7.523 9.200 11.03 13.02 15.19 7.716 9.487 11.44 13.58 15.94 8.115 10.09 12.30 14.78 17.55 8.536 10.73 13.23 16.09 19.34 8.754 11.07 13.73 16.79 20.30 9.755 10.95 11 12 13 14 15 11.57 12.68 13.81 14.95 16.10 12.17 13.41 14.68 15.97 17.29 12.81 14.19 15.62 17.09 18.60 13.49 15.03 16.63 18.29 20.02 14.21 15.92 17.71 19.60 21.58 14.97 16.87 18.88 21.02 23.28 15.78 17.89 20.14 22.55 25.13 16.65 18.98 21.50 24.21 27.15 17.56 20.14 22.95 26.02 29.36 18.53 21.38 24.52 27.98 31.77 20.65 24.13 28.03 32.39 37.28 23.04 27.27 32.09 37.58 43.84 24.35 29.00 34.35 40.50 47.58 16 17 18 19 20 17.26 18.43 19.61 20.81 22.02 18.64 20.01 21.41 22.84 24.30 20.16 21.76 23.41 25.12 26.87 21.82 23.70 25.65 27.67 29.78 23.66 25.84 28.13 30.54 33.07 25.67 28.21 30.91 33.76 36.79 27.89 30.84 34.00 37.38 41.00 30.32 33.75 37.45 41.45 45.76 33,00 36.97 41.30 46.02 51.16 35.95 40.54 45.60 51.16 57.28 42.75 48.88 55.75 63.44 72.05 50.98 59.12 68.39 78.97 91.02 55.72 65.08 75.84 88.21 102.4 21 22 23 24 23.24 24.47 25.72 26.97 25.78 27.30 28.85 30.42 28.68 30.54 32.45 34.43 31.97 34.25 36.62 39.08 35.72 38.51 41.43 44.50 39.99 43.39 47.00 50.82 44.87 49.01 53.44 58.18 50.42 55.46 60.89 66.76 56.76 62.87 69.53 76.79 64.00 71.40 79.54 81.70 92.50 104.6 118.2 104.8 120.4 138.3 158.7 118.8 137.6 159.3 184.2 4 7.214 2 7.434 ,583 756 1 .142 54 11. 12.58 9214 10.5 121 4 10.28 11 13 12.64 12.4 14.4 3.200 11. 13.02 6.13 9.4 11.44 158 4 10 12 14.7 178 10 13.8 16Q 1 1.18 11.4$ 11.7 13 16. 20 1. 121 10.4$ 14.7 16 11 12 13 14 117 12 131 14 18.19 12.17 13.41 14. 15.7 179 121 14.13 16. 17 1 1.49 16.03 1 1.29 14 21 15.2 17.1 1 1. 15. 17 .14 256 13 166 1 21.50 24.21 2715 178 14 2% 802 36 18 21. 24.52 27 24.13 7. 24. 27.27 48 4.50 44 47 21 12 16 17 1 13 178 1.48 191 14 | 201 21.41 24 24. 218 1. .41 5.12 21. 22 2566 277 5. 4 54 07 5 .21 1 27 4 4. 41.00 45 41.45 456 8.7 41. 462 116 4.54 45 51.16 42.6 4 6 .44 6. 6.4 21 12.4 37 12 21 24 24.47 25.72 2.24 27 42 24 5 4 .46 4.43 .4$ 17 4.5 416 .72 51 41.43 44.5 47 48 47 44. 491 8.44 58.1 25 0.42 8.46 , .11 4. 1.40 54 &7 4. 14. 11 14 176 14.5 1 193 112 1, 14.2 1 113 12.8 4. 16 8 27 98 .1 .46 4. 54 41 42 46.22 4 47 44.1 47 497 837 1.11 54.7 .40 .44 4.4 35 4.46 4 1040 1133 4 12 1503 2033 246 1. 1211 14 5 2838 1130 14.2 17 23 271 124.1 148 2148 12.1 2 183 14.5 2413 6. 434.7 4428 1 1.242 1,779 15.1 11.164 | 2.400 4.996 7.218 40 4, ,40 6.40 03 120 14. 16 259.1 50 4.46 4.58 112 1. 203 2903 45 5.8 You are planning for a very early retirement. You would like to retire at age 40 and have enough money saved to be able to withdraw $225,000 per year for the next 40 year (based on family history. you think you will live to age 80). You plan to save by making 15 equal annual installments (from age 25 to age 40) into a fairly risky investment fund that you expect will earn 8% per year. You will leave the money in this fund until it is completely depleted when you are 80 years old. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Read the requirements Requirement 1. How much money must you accumulate by retirement to make your plan work? (Hint: Find the present value of the $225,000 withdrawals.) (Round your final answer to the nearest whole dollar.) To make the plan work, you must accumulate $ by retirement Requirement 2. How does this amount compare to the total amount you will withdraw from the investment during retirement? How can these numbers be so different? Over the course of your retirement you will be withdrawing $ However, by age 40 you only need to have invested These numbers are different because: O A. You need to have far more accumulated than what you will withdraw because you will withdraw a large portion of the investment every yearthe balance remains invested where it continues to earn 8% interest. OB. You need to have far less accumulated than what you will withdraw because you only withdraw a portion of the investment every yearthe balance remains invested where it continues to earn 8% interest. O C. You need to have the same amount accumulated as you will withdraw because you will not earn further interest on your investment when you reach retirement. OD. None of the above

Drop down option:

Drop down option: