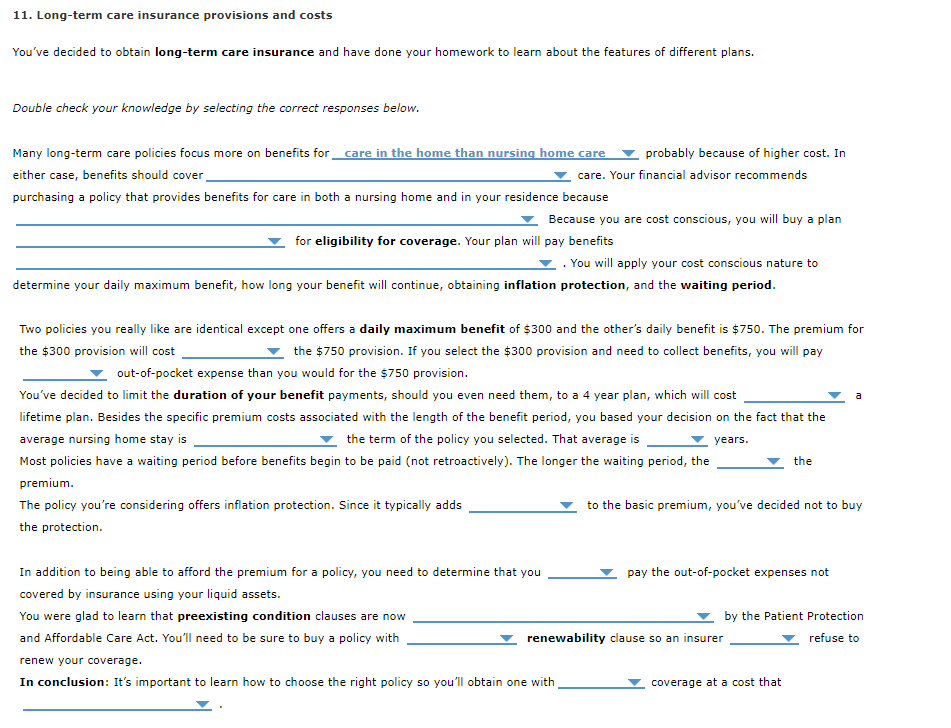

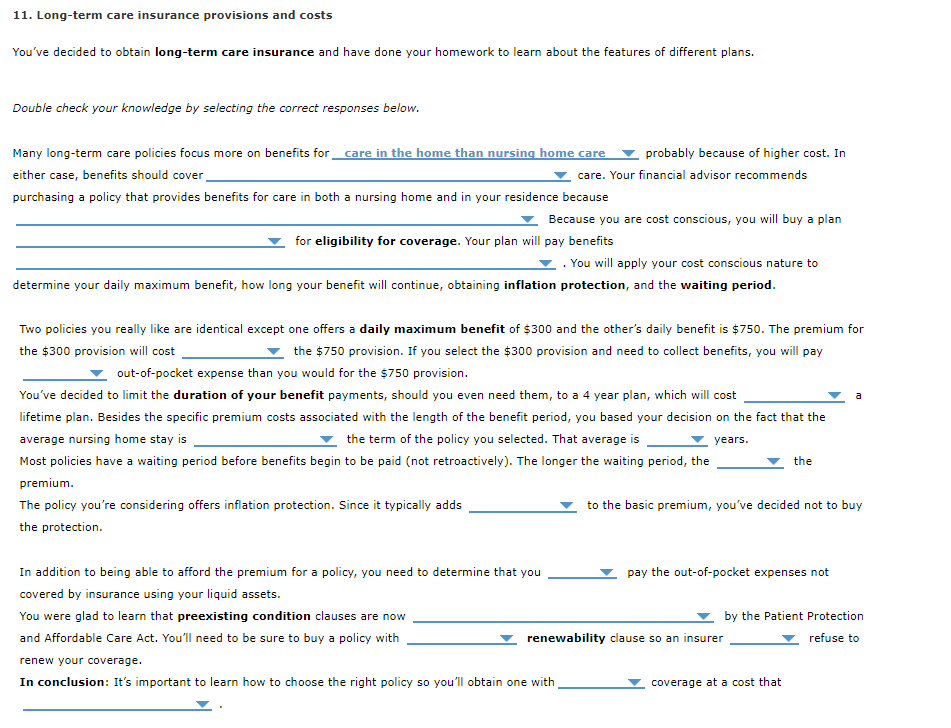

Drop down options:

1. nursing home care rather than at home care, care in the home than nursing home care

2. services for skilled intermediate and custodial, just one service for skilled intermediate or custodial

3. it is very difficult to predict the extent of care you may need as time goes by, she wants to help you spend down your money in order to qualify for Medicaid

4. that is very liberal with limited testing, with gatekeeper provisions to test

5. based only on your doctor's orders that you need the care, only after you have failed to perform a number of defined activities of daily living

6. more than, less than, the same as

7. same as #6

8. same as #6

9. same as #6

10. 2.5, 4.5, 5.0

11. lower, higher

12. 25% to 40%, 40% to 50%

13. can, cannot

14. allowed but within very narrow parameters, outlawed

15. a guaranteed, an optional

16. can, cannot

17. adequate, excessive

18. really strains your budget, you can afford

11. Long-term care insurance provisions and costs You've decided to obtain long-term care insurance and have done your homework to learn about the features of different plans. Double check your knowledge by selecting the correct responses below. Many long-term care policies focus more on benefits for care in the home than nursing home care probably because of higher cost. In either case, benefits should cover care. Your financial advisor recommends purchasing a policy that provides benefits for care in both a nursing home and in your residence because Because you are cost conscious, you will buy a plan for eligibility for coverage. Your plan will pay benefits . You will apply your cost conscious nature to determine your daily maximum benefit, how long your benefit will continue, obtaining inflation protection, and the waiting period. Two policies you really like are identical except one offers a daily maximum benefit of $300 and the other's daily benefit is $750. The premium for the $300 provision will cost the $750 provision. If you select the $300 provision and need to collect benefits, you will pay out-of-pocket expense than you would for the $750 provision. You've decided to limit the duration of your benefit payments, should you even need them, to a 4 year plan, which will cost lifetime plan. Besides the specific premium costs associated with the length of the benefit period, you based your decision on the fact that the average nursing home stay is the term of the policy you selected. That average is years. Most policies have a waiting period before benefits begin to be paid (not retroactively). The longer the waiting period, the the premium. The policy you're considering offers inflation protection. Since it typically adds_ to the basic premium, you've decided not to buy the protection. In addition to being able to afford the premium for a policy, you need to determine that you pay the out-of-pocket expenses not covered by insurance using your liquid assets. You were glad to learn that preexisting condition clauses are now by the Patient Protection and Affordable Care Act. You'll need to be sure to buy a policy with renewability clause so an insurer refuse to renew your coverage. In conclusion: It's important to learn how to choose the right policy so you'll obtain one with coverage at a cost that 11. Long-term care insurance provisions and costs You've decided to obtain long-term care insurance and have done your homework to learn about the features of different plans. Double check your knowledge by selecting the correct responses below. Many long-term care policies focus more on benefits for care in the home than nursing home care probably because of higher cost. In either case, benefits should cover care. Your financial advisor recommends purchasing a policy that provides benefits for care in both a nursing home and in your residence because Because you are cost conscious, you will buy a plan for eligibility for coverage. Your plan will pay benefits . You will apply your cost conscious nature to determine your daily maximum benefit, how long your benefit will continue, obtaining inflation protection, and the waiting period. Two policies you really like are identical except one offers a daily maximum benefit of $300 and the other's daily benefit is $750. The premium for the $300 provision will cost the $750 provision. If you select the $300 provision and need to collect benefits, you will pay out-of-pocket expense than you would for the $750 provision. You've decided to limit the duration of your benefit payments, should you even need them, to a 4 year plan, which will cost lifetime plan. Besides the specific premium costs associated with the length of the benefit period, you based your decision on the fact that the average nursing home stay is the term of the policy you selected. That average is years. Most policies have a waiting period before benefits begin to be paid (not retroactively). The longer the waiting period, the the premium. The policy you're considering offers inflation protection. Since it typically adds_ to the basic premium, you've decided not to buy the protection. In addition to being able to afford the premium for a policy, you need to determine that you pay the out-of-pocket expenses not covered by insurance using your liquid assets. You were glad to learn that preexisting condition clauses are now by the Patient Protection and Affordable Care Act. You'll need to be sure to buy a policy with renewability clause so an insurer refuse to renew your coverage. In conclusion: It's important to learn how to choose the right policy so you'll obtain one with coverage at a cost that