Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Drop down options: $128,400, $107,000, $297,000, or $454,500 A long hedge is a risk management strategy in which a company can lock in the price

Drop down options: $128,400, $107,000, $297,000, or $454,500

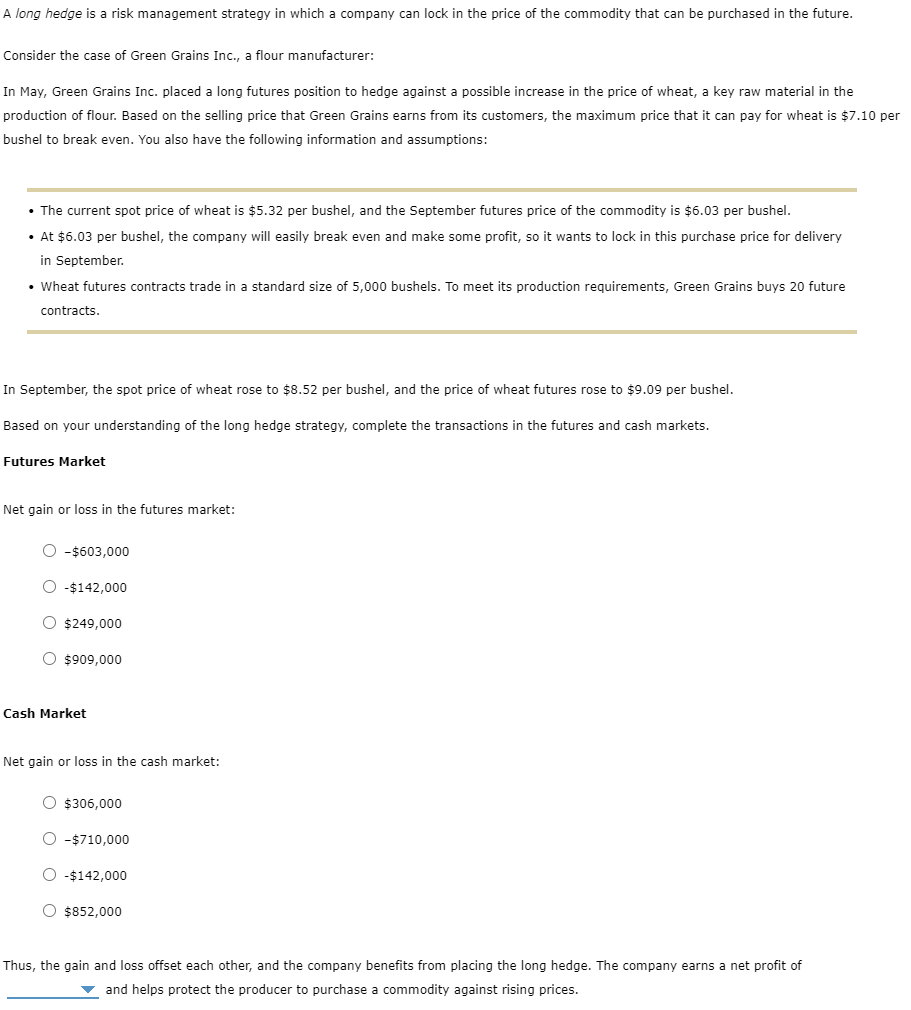

A long hedge is a risk management strategy in which a company can lock in the price of the commodity that can be purchased in the future. Consider the case of Green Grains Inc., a flour manufacturer: In May, Green Grains Inc. placed a long futures position to hedge against a possible increase in the price of wheat, a key raw material in the production of flour. Based on the selling price that Green Grains earns from its customers, the maximum price that it can pay for wheat is $7.10 per bushel to break even. You also have the following information and assumptions: The current spot price of wheat is $5.32 per bushel, and the September futures price of the commodity is $6.03 per bushel. At $6.03 per bushel, the company will easily break even and make some profit, so it wants to lock in this purchase price for delivery in September Wheat futures contracts trade in a standard size of 5,000 bushels. To meet its production requirements, Green Grains buys 20 future contracts. In September, the spot price of wheat rose to $8.52 per bushel, and the price of wheat futures rose to $9.09 per bushel. Based on your understanding of the long hedge strategy, complete the transactions in the futures and cash markets. Futures Market Net gain or loss in the futures market: 0 - $603,000 O -$ 142,000 O $249,000 O $909,000 Cash Market Net gain or loss in the cash market: O $306,000 0 - $710,000 0-$142,000 O $852,000 Thus, the gain and loss offset each other, and the company benefits from placing the long hedge. The company earns a net profit of and helps protect the producer to purchase a commodity against rising pricesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started