Answered step by step

Verified Expert Solution

Question

1 Approved Answer

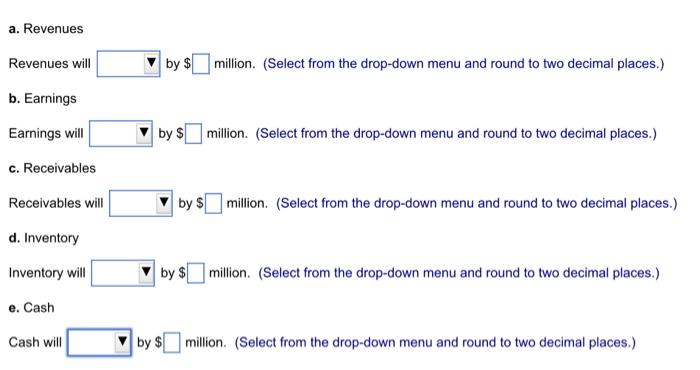

drop down options are increase/ decrease Suppose your firm receives a $4.87 million order on the last day of the year. You fill the order

drop down options are increase/ decrease

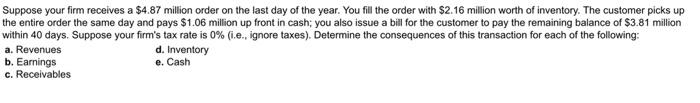

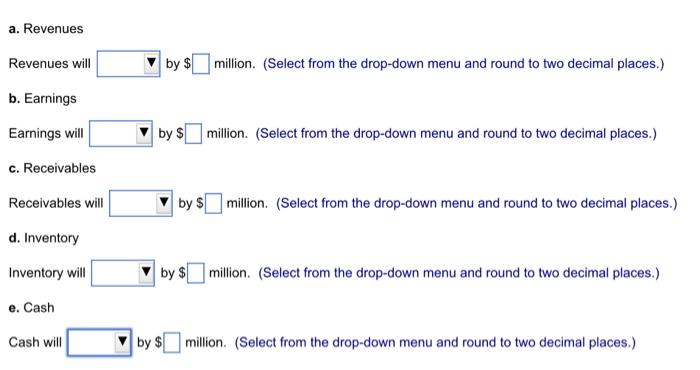

Suppose your firm receives a $4.87 million order on the last day of the year. You fill the order with $2.16 million worth of inventory. The customer picks up he entire order the same day and pays $1.06 million up front in cash; you also issue a bill for the customer to pay the remaining balance of $3.81 million within 40 days. Suppose your firm's tax rate is 0% (i.e., ignore taxes). Determine the consequences of this transaction for each of the following: a. Revenues d. Inventory b. Earnings e. Cash c. Receivables a. Revenues Revenues will by $ million. (Select from the drop-down menu and round to two decimal places.) b. Earnings Earnings will by $ million. (Select from the drop-down menu and round to two decimal places.) c. Receivables Receivables will by $ million. (Select from the drop-down menu and round to two decimal places.) d. Inventory Inventory will by $ million. (Select from the drop-down menu and round to two decimal places.) e. Cash Cash will by $ million. (Select from the drop-down menu and round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started