Question

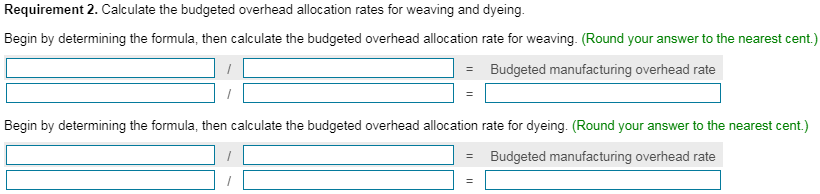

Drop down options: Direct manuf. labor , Direct manuf labor hours , Direct materials , Machine hours, Output units produced , Total budgeted overhead costs

Drop down options: Direct manuf. labor , Direct manuf labor hours , Direct materials , Machine hours, Output units produced , Total budgeted overhead costs

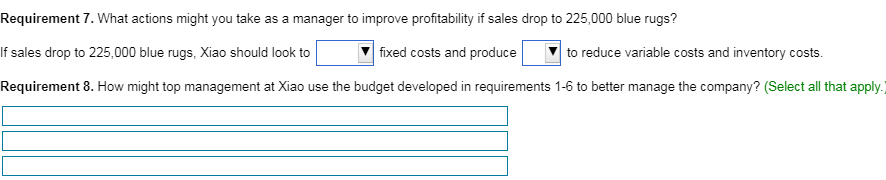

Drop down option Requirement 7: increase or reduce

Drop down option Requirement 7: increase or reduce

Drop down option Requirement 8:

coordinate and communicate across different parts of the organization

create a framework for judging performance

look for ways to increase sales and improve quality, efficiency and input prices.

look for ways to improve quality and efficiency while also increasing input prices

motivate managers and employees to increase inventory and achieve higher costs.

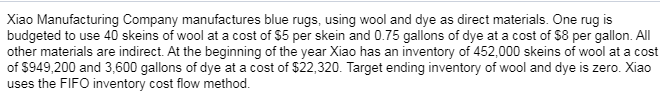

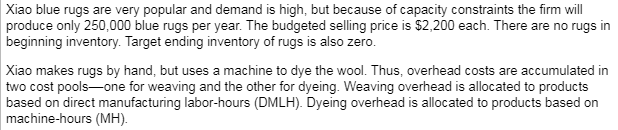

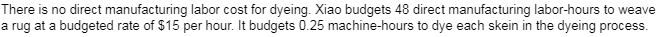

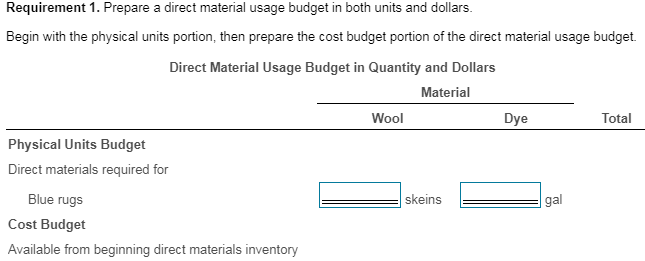

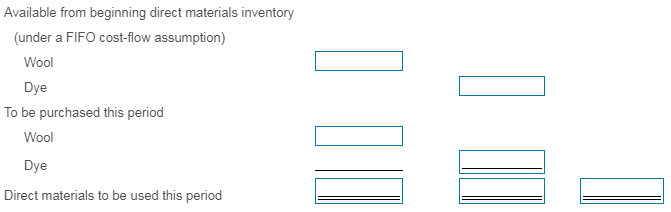

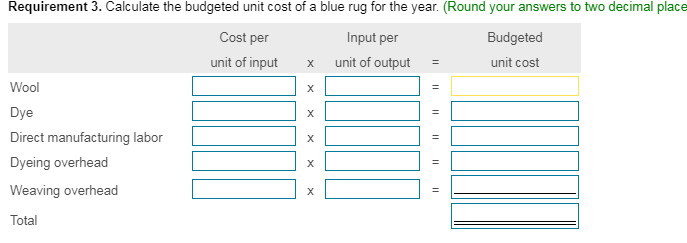

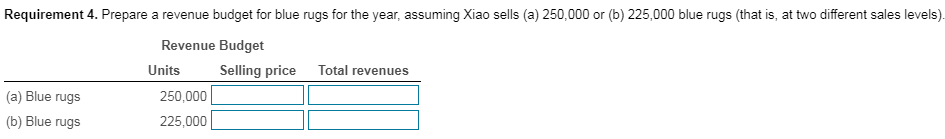

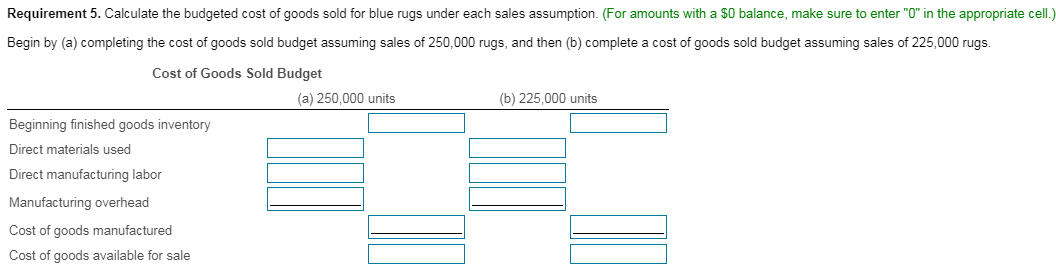

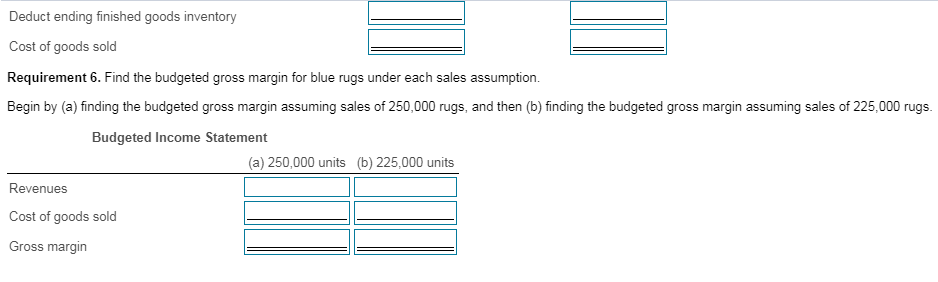

Xiao Manufacturing Company manufactures blue rugs, using wool and dye as direct materials. One rug is budgeted to use 40 skeins of wool at a cost of $5 per skein and 0.75 gallons of dye at a cost of $8 per gallon. All other materials are indirect. At the beginning of the year Xiao has an inventory of 452,000 skeins of wool at a cost of $949,200 and 3,600 gallons of dye at a cost of $22,320. Target ending inventory of wool and dye is zero. Xiao uses the FIFO inventory cost flow method. Xiao blue rugs are very popular and demand is high, but because of capacity constraints the firm will produce only 250,000 blue rugs per year. The budgeted selling price is $2,200 each. There are no rugs in beginning inventory. Target ending inventory of rugs is also zero. Xiao makes rugs by hand, but uses a machine to dye the wool. Thus, overhead costs are accumulated in two cost poolsone for weaving and the other for dyeing. Weaving overhead is allocated to products based on direct manufacturing labor-hours (DMLH). Dyeing overhead is allocated to products based on machine-hours (MH). There is no direct manufacturing labor cost for dyeing. Xiao budgets 48 direct manufacturing labor-hours to weave a rug at a budgeted rate of $15 per hour. It budgets 0.25 machine-hours to dye each skein in the dyeing process. Dyeing (based on 2,500,000 MH) Weaving (based on 12,000,000 DMLH) 0 $ Variable costs Indirect materials Maintenance Utilities Fixed costs Indirect labor Depreciation 6,570,000 7,575,000 15,450,000 5,530,000 2,365,000 372,000 2,245,000 738,000 17,500,000 $ 1,740,000 275,000 5,840,000 Other 31,200,000 Total budgeted costs Requirement 1. Prepare a direct material usage budget in both units and dollars. Begin with the physical units portion, then prepare the cost budget portion of the direct material usage budget. Direct Material Usage Budget in Quantity and Dollars Material Wool Physical Units Budget Direct materials required for Dye Total E skeins gal Blue rugs Cost Budget Available from beginning direct materials inventory Available from beginning direct materials inventory (under a FIFO cost-flow assumption) Wool Dye To be purchased this period Wool Dye Direct materials to be used this period Requirement 2. Calculate the budgeted overhead allocation rates for weaving and dyeing. Begin by determining the formula, then calculate the budgeted overhead allocation rate for weaving. (Round your answer to the nearest cent.) = Budgeted manufacturing overhead rate Begin by determining the formula, then calculate the budgeted overhead allocation rate for dyeing. (Round your answer to the nearest cent.) = Budgeted manufacturing overhead rate Requirement 3. Calculate the budgeted unit cost of a blue rug for the year. (Round your answers to two decimal place Cost per Input per Budgeted unit of input X unit of output = unit cost Wool Dye Direct manufacturing labor Dyeing overhead Weaving overhead Total Requirement 4. Prepare a revenue budget for blue rugs for the year, assuming Xiao sells (a) 250,000 or (b) 225,000 blue rugs (that is, at two different sales levels). Total revenues Revenue Budget Units Selling price 250,000 225,000 (a) Blue rugs (b) Blue rugs Requirement 5. Calculate the budgeted cost of goods sold for blue rugs under each sales assumption. (For amounts with a $0 balance, make sure to enter "0" in the appropriate cell.) Begin by (a) completing the cost of goods sold budget assuming sales of 250,000 rugs, and then (b) complete a cost of goods sold budget assuming sales of 225,000 rugs. Cost of Goods Sold Budget (a) 250,000 units (b) 225,000 units Beginning finished goods inventory Direct materials used Direct manufacturing labor Manufacturing overhead Cost of goods manufactured Cost of goods available for sale Deduct ending finished goods inventory Cost of goods sold Requirement 6. Find the budgeted gross margin for blue rugs under each sales assumption. Begin by (a) finding the budgeted gross margin assuming sales of 250,000 rugs, and then (b) finding the budgeted gross margin assuming sales of 225,000 rugs. Budgeted Income Statement (a) 250,000 units (b) 225,000 units Revenues Cost of goods sold Gross margin Requirement 7. What actions might you take as a manager to improve profitability if sales drop to 225,000 blue rugs? If sales drop to 225,000 blue rugs, Xiao should look to fixed costs and produce to reduce variable costs and inventory costs. Requirement 8. How might top management at Xiao use the budget developed in requirements 1-6 to better manage the company? (Select all that apply

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started