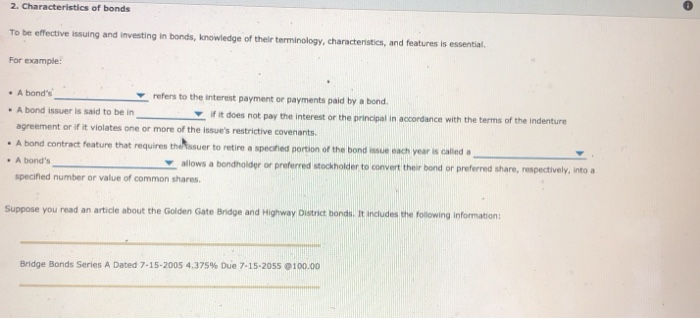

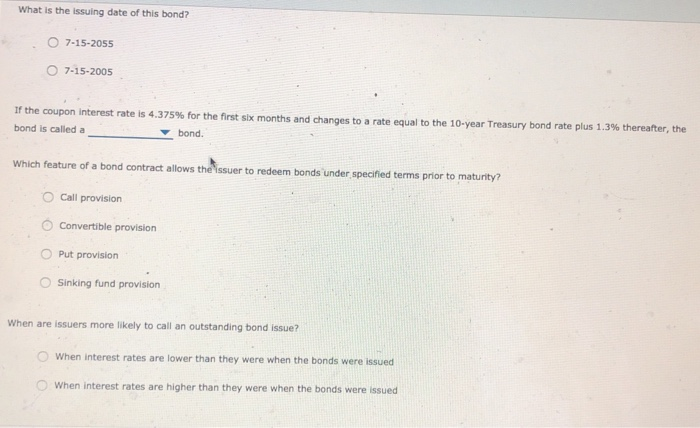

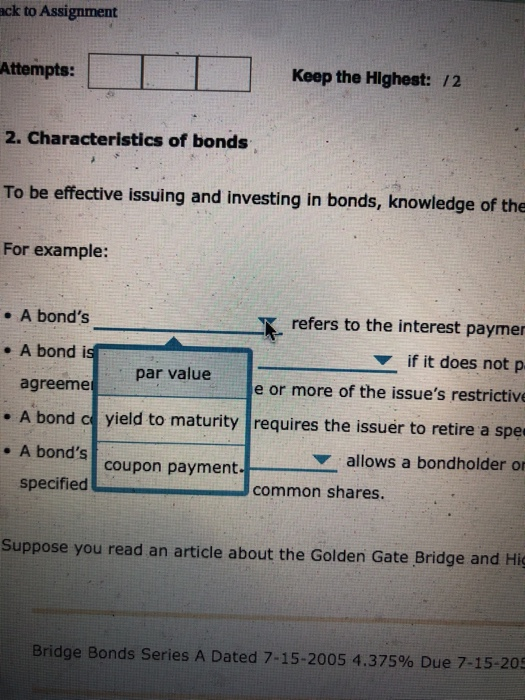

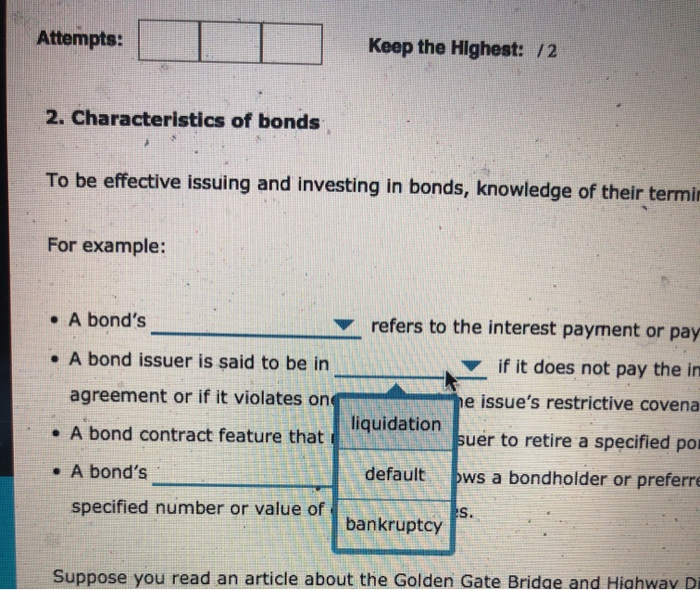

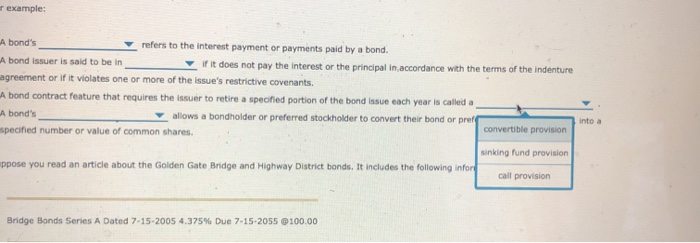

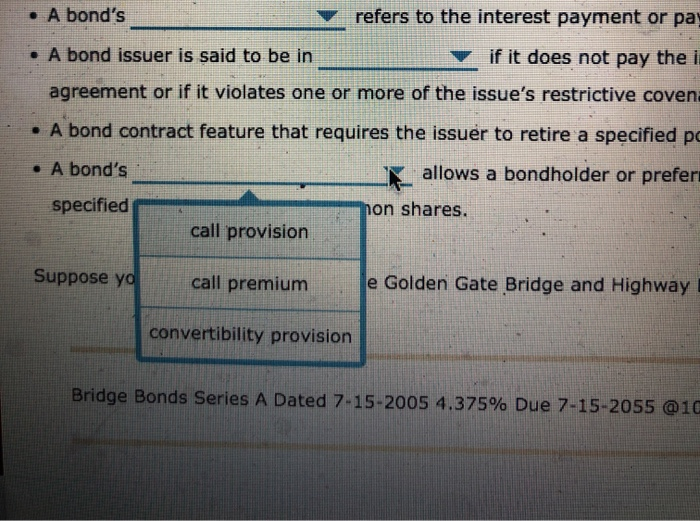

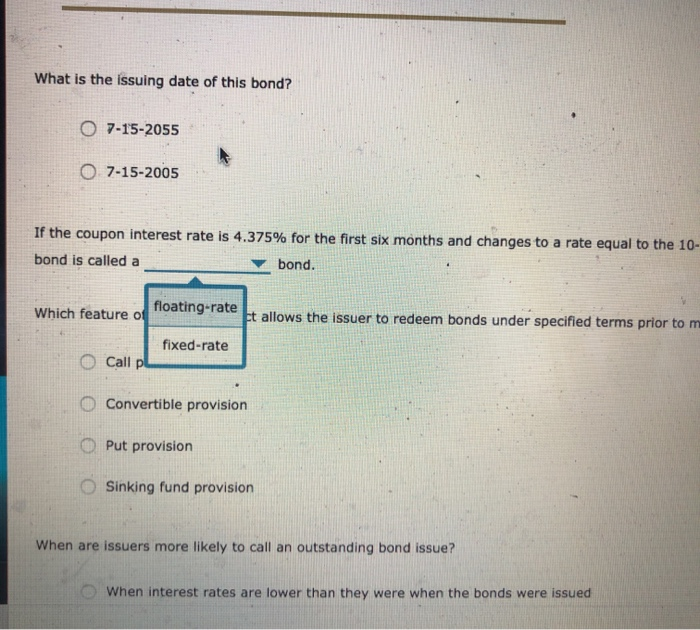

2. Characteristics of bonds To be effective issuing and Investing in bonds, knowledge of their terminology, characteristics, and features is essential For example: A bond's refers to the interest payment or payments paid by a bond. A bond issuer is said to be in if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants A bond contract feature that requires the ser to retire a specified portion of the bond issue each year is called a - A bond's allows a bondholder or preferred stockholder to convert their bond or preferred share, respectively, into a specified number or value of common shares Suppose you read an article about the Golden Gate Bridge and Highway District bondi. It includes the following information: Bridge Bonds Series A Dated 7-15-2005 4.375% Due 7-15-2055 100.00 What is the issuing date of this bond? O 7-15-2055 7-15-2005 If the coupon Interest rate is 4.375% for the first six months and changes to a rate equal to the 10-year Treasury bond rate plus 1.3% thereafter, the bond is called a bond. Which feature of a bond contract allows the issuer to redeem bonds under specified terms prior to maturity? Call provision Convertible provision Put provision Sinking fund provision When are issuers more likely to call an outstanding bond issue? When interest rates are lower than they were when the bonds were issued When Interest rates are higher than they were when the bonds were issued ack to Assignment Lattempts: Attempts: Keep the Highest: 12 Keep the Highest: 12 2. Characteristics of bonds To be effective issuing and investing in bonds, knowledge of the For example: A bond's A bond is agreemet A bond A bonds specified refers to the interest paymer if it does not p par value e or more of the issue's restrictive yield to maturity requires the issuer to retire a spe coupon payment. allows a bondholder or common shares. Suppose you read an article about the Golden Gate Bridge and his Bridge Bonds Series A Dated 7-15-2005 4.375% Due 7-15-205 Attempts: Attempts: I O Keep the Highest: /2 2. Characteristics of bonds To be effective issuing and investing in bonds, knowledge of their termin A bond's A bond issuer is said to be in agreement or if it violates on A bond contract feature that A bond's specified number or value of refers to the interest payment or pay if it does not pay the in he issue's restrictive covena liquidation suer to retire a specified po default bws a bondholder or preferre bankruptcy Suppose you read an article about the Golden Gate Bridae and Highway Di example: A bond's refers to the interest payment or payments paid by a bond. A bond issuer is said to be in if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants A bond contract feature that requires the issuer to retire a specified portion of the bond issue each year is called a A bond's allows a bondholder or preferred stockholder to convert their bond or pref convertible provision specified number or value of common shares sinking fund provision ppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following inford call provision into a Bridge Bonds Series A Dated 7-15-2005 4.375% Due 7-15-2055 100.00 A bond's refers to the interest payment or pa A bond issuer is said to be in if it does not pay the i agreement or if it violates one or more of the issue's restrictive coven A bond contract feature that requires the issuer to retire a specified pe A bond's allows a bondholder or prefer specified non shares. call provision Suppose yo call premium le Golden Gate Bridge and Highway convertibility provision Bridge Bonds Series A Dated 7-15-2005 4.375% Due 7-15-2055 @10 What is the issuing date of this bond? O 7-15-2055 O 7-15-2005 If the coupon interest rate is 4.375% for the first six months and changes to a rate equal to the 10- bond is called a bond. Which feature of a gree t allows the issuer to redeem bonds under specified terms prior to m fixed-rate Call p O Convertible provision O Put provision Sinking fund provision When are issuers more likely to call an outstanding bond issue? When interest rates are lower than they were when the bonds were issued