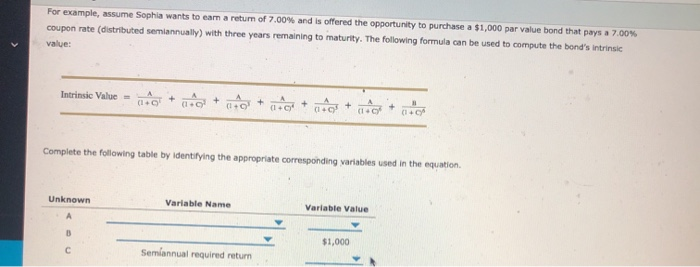

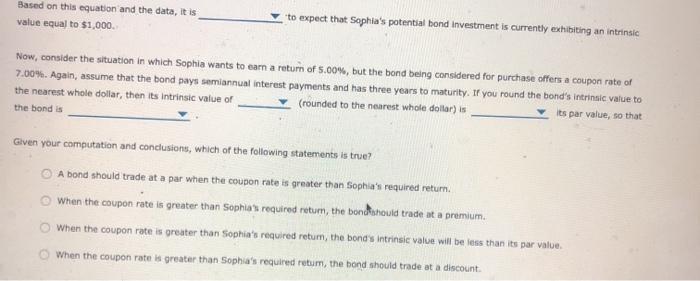

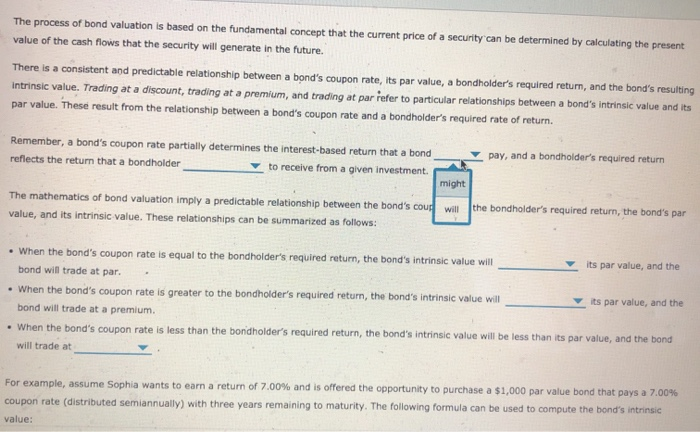

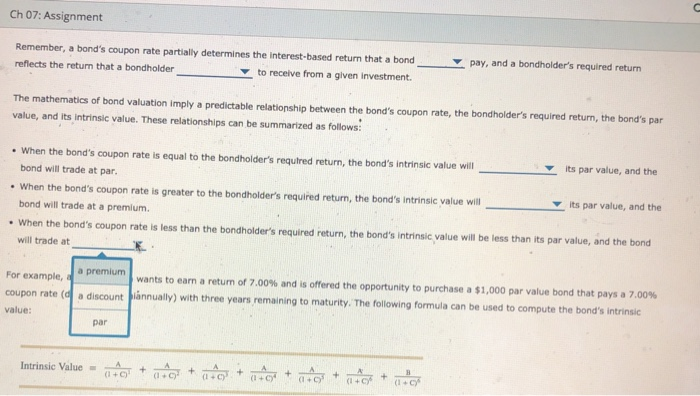

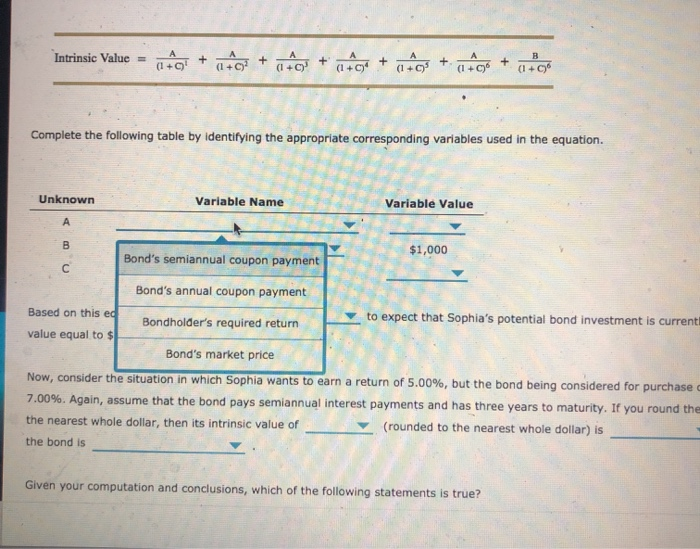

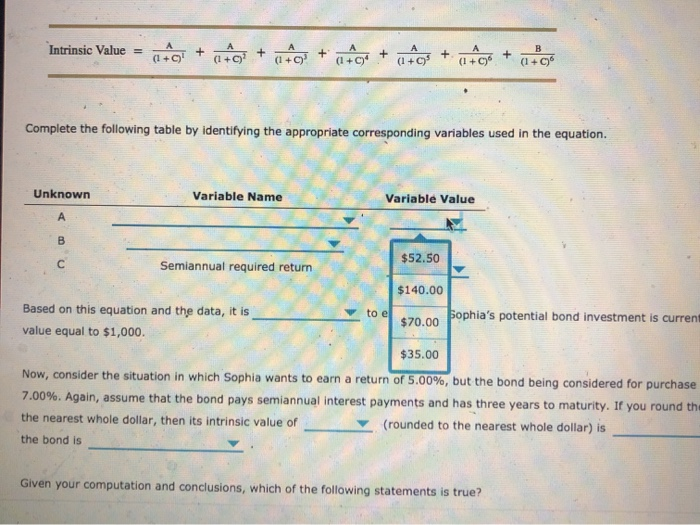

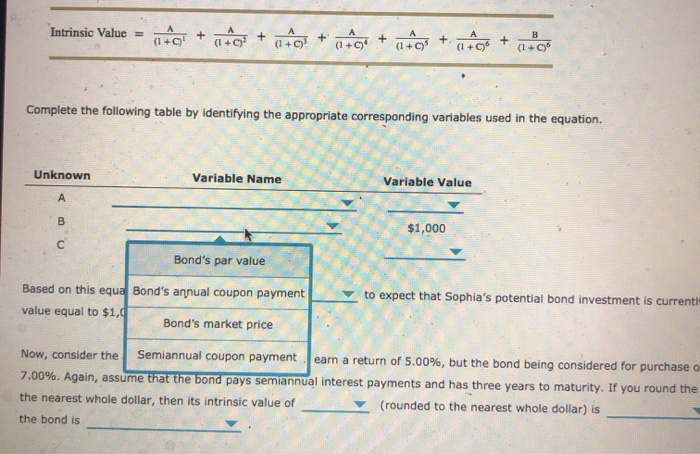

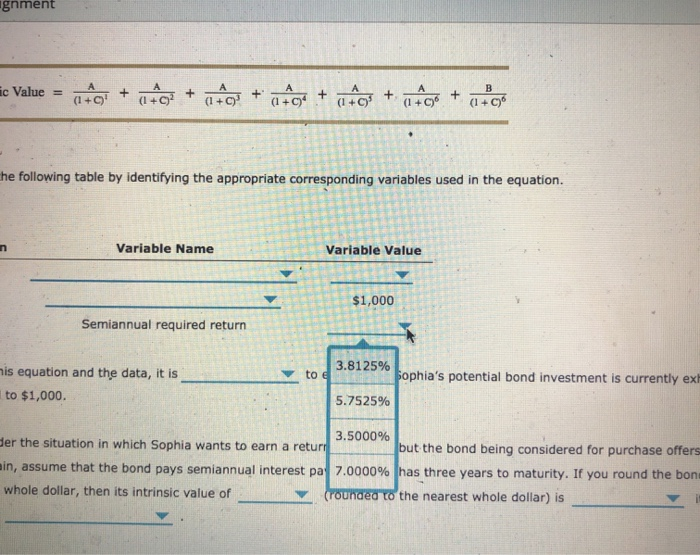

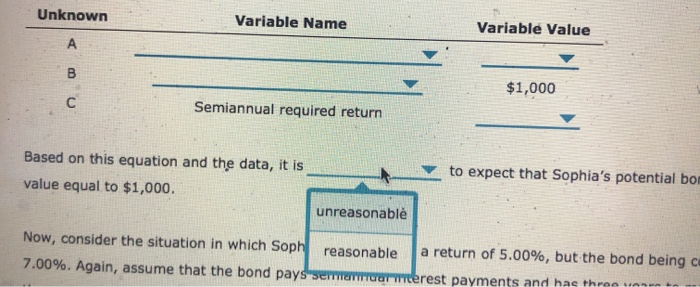

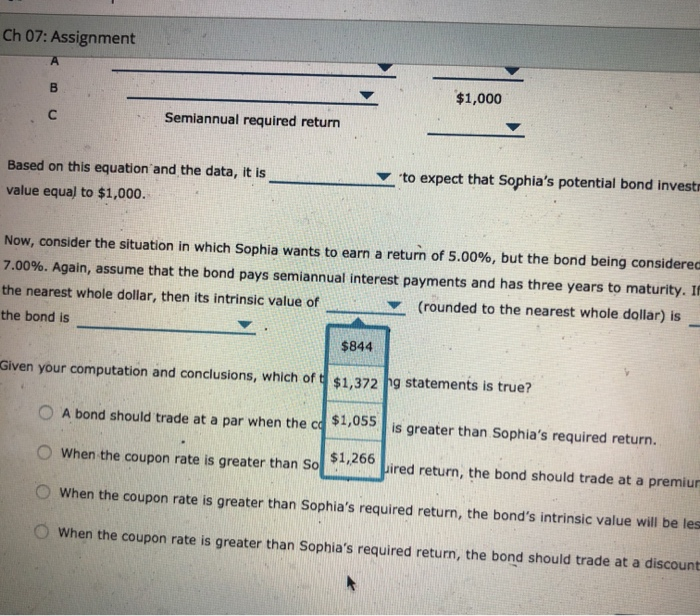

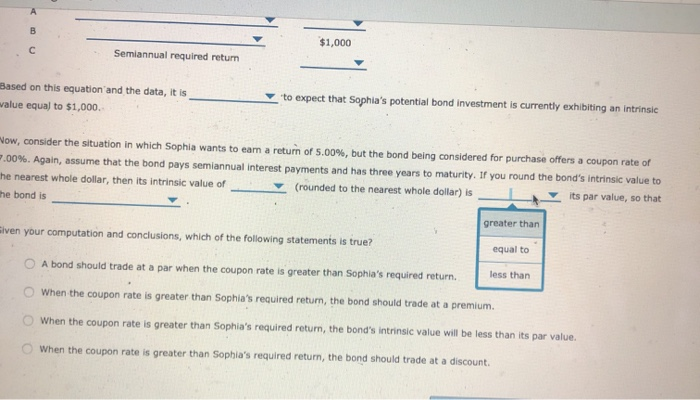

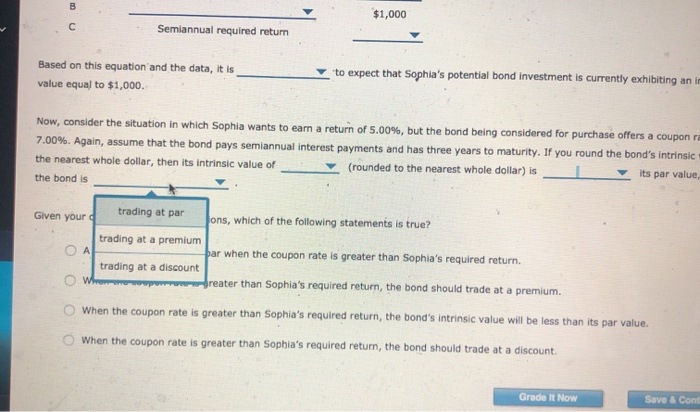

4. Bond valuation The process of bond valuation is based on the fundamental concept that the current price of a security can be determined by calculating the present value of the cash flows that the security will generate in the future. There is a consistent and predictable relationship between a bond's coupon rate, its par value, a bondholder's required return, and the bond's resulting intrinsic value. Trading at a discount, trading at a premium, and trading at par refer to particular relationships between a bond's intrinsic value and its par value. These result from the relationship between a bond's coupon rate and a bondholder's required rate of return. pay, and a bondholder's required return Remember, a bond's coupon rate partially determines the interest-based return that a bond_ reflects the return that a bondholder to receive from a given investment, The mathematics of bond valuation imply a predictable relationship between the bond's coupon rate, the bondholder's required return, the bond's par value, and its intrinsic value. These relationships can be summarized as follows: . When the bond's coupon rate is equal to the bondholder's required return, the band's intrinsic value will its par value, and the bond will trade at par. When the bond's coupon rate is greater to the bondholder's required return, the bond's intrinsic value will its par value, and the bond will trade at a premium. When the bond's coupon rate is less than the bondholder's required return, the bond's intrinsic value will be less than its par value, and the bond will trade at For example, assume Sophia wants to eam a return of 7.00% and is offered the opportunity to purchase a $1,000 par value bond that pays a 7.00% coupon rate (distributed semiannually) with three years remaining to maturity. The following formula can be used to compute the bond's intrinsic value: Intrinsic Value - + + + + + + + + + + + Complete the following table by identifying the appropriate corresponding variables used in the equation Unknown Variable Name Variable Value $1,000 Semiannual required return Based on this equation and the data, it is value equal to $1,000. to expect that Sophia's potential bond investment is currently exhibiting an intrinsic Now, consider the situation in which Sophia wants to earn a return of 5.00%, but the bond being considered for purchase offers a coupon rate of 7.00%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to the nearest whole dollar, then its intrinsic value of (rounded to the nearest whole dollar) is its par value, so that the bond is Given your computation and conclusions, which of the following statements is true? A bond should trade at a par when the coupon rate is greater than Sophia's required return. When the coupon rate is greater than Sophia's required return, the bond should trade at a premium When the coupon rate is greater than Sophia's required return, the bond's intrinsic value will be less than its par value When the coupon rate is greater than Sophia's required retum, the bond should trade at a discount The process of bond valuation is based on the fundamental concept that the current price of a security can be determined by calculating the present value of the cash flows that the security will generate in the future. There is a consistent and predictable relationship between a bond's coupon rate, its par value, a bondholder's required retum, and the band's resulting intrinsic value. Trading at a discount, trading at a premium, and trading at par refer to particular relationships between a bond's intrinsic value and its par value. These result from the relationship between a bond's coupon rate and a bondholder's required rate of return. pay, and a bondholder's required return Remember, a bond's coupon rate partially determines the interest-based return that a bond reflects the return that a bondholder to receive from a given investment. might The mathematics of bond valuation imply a predictable relationship between the bond's coud will the bondholder's required return, the bond's par value, and its intrinsic value. These relationships can be summarized as follows: When the bond's coupon rate is equal to the bondholder's required return, the bond's intrinsic value will its par value, and the bond will trade at par. When the bond's coupon rate is greater to the bondholder's required return, the bond's intrinsic value will its par value, and the bond will trade at a premium. When the bond's coupon rate is less than the bondholder's required return, the bond's intrinsic value will be less than its par value, and the bond will trade at For example, assume Sophia wants to earn a return of 7.00% and is offered the opportunity to purchase a $1,000 par value bond that pays a 7.00% coupon rate (distributed semiannually) with three years remaining to maturity. The following formula can be used to compute the bond's intrinsic value: The process of bond valuation is based on the fundamental concept that the current price of a security can be determined by calculating the value of the cash flows that the security will generate in the future. There is a consistent and predictable relationship between a bond's coupon rate, its par value, a bondholder's required retur, and the bonds intrinsic value. Trading at a discount, trading at a premium, and trading at par refer to particular relationships between a bond's intrinsic vals par value. These result from the relationship between a bond's coupon rate and a bondholder's required rate of return. pay, and a bondholder's required ret Remember, a bond's coupon rate partially determines the interest-based return that a bond reflects the return that a bondholder to receive from a given investment. The mathematics of bond valuation in value, and its intrinsic value. These is obligated bble relationship between the bond's coupon rate, the bondholder's required return, the bo would like in be summarized as follows: When the bond's coupon rate is equal to the bondholder's required return, the bond's intrinsic value will its par value, bond will trade at par. When the bond's coupon rate is greater to the bondholder's required return, the bond's intrinsic value will its par value bond will trade at a premium. When the bond's coupon rate is less than the bondholder's required return, the bond's intrinsic value will be less than its par value, and the will trade at For example, assume Sophia wants to earn a return of 7.00% and is offered the opportunity to purchase a $1,000 par value bond that pays le process of bond Valuation is based on the fundamental concept that the current price of a security can be determined by calculating the present value of the cash flows that the security will generate in the future. There is a consistent and predictable relationship between a bond's coupon rate, its par value, a bondholder's required return, and the bond's resulting intrinsic value. Trading at a discount, trading at a premium, and trading at par refer to particular relationships between a bond's intrinsic value and its par value. These result from the relationship between a bond's coupon rate and a bondholder's required rate of return pay, and a bondholder's required return Remember, a bond's coupon rate partially determines the interest-based return that a bond reflects the return that a bondholder to receive from a given investment. The mathematics of bond valuation imply a predictable relationship between the band's coupon rate, the bondholder's required return, the bond's par value, and its intrinsic value. These relationships can be summarized as follows: its par value, and the equal its par value and the When the bond's coupon rate is equal to the bondholder's required return, the bond's intrinsic value will bond will trade at par. When the bond's coupon rate is greater to the bondholder's required return, the bond's intrinsic value wil bond will trade at a premium When the bond's coupon rate is less than the bondholder's required return, the bond's intrinsic value will will trade at be less than par value and the bond exceed For example, assume Sophia wants to earn a return of 7.00% and is offered the opportunity to purchase a $1,000 par value bond that pays a 7.00% coupon rate (distributed semiannually) with three years remaining to maturity. The following formula can be used to compute the band's internal The process of bond valuation is based on the fundamental concept that the current price of a security can be determined by calculating the present value of the cash flows that the security will generate in the future. There is a consistent and predictable relationship between a bond's coupon rate, its par value, a bondholder's required return, and the bond's resulting intrinsic value. Trading at a discount, trading at a premiurn, and trading at par refer to particular relationships between a bond's intrinsic value and its par value. These result from the relationship between a bond's coupon rate and a bondholder's required rate of return. pay, and a bondholder's required return Remember, a bond's coupon rate partially determines the interest-based return that a bond reflects the return that a bondholder to receive from a given investment The mathematics of bond valuation imply a predictable relationship between the bond's coupon rate, the bondholder's required return, the bond's par value, and its intrinsic value. These relationships can be summarized as follows: its par value, and the When the bond's coupon rate is equal to the bondholder's required return, the bond's intrinsic value will bond will trade at par. When the bond's coupon rate is greater to the bondholder's required return, the bond's intrinsic value will its par value, and the bond will trade at a premium be less than ar value, and the bond . When the bond's coupon rate is less than the bondholder's required return, the band's intrinsic value will be will trade at equal exceed For example, assume Sophia wants to earn a return of 7.00% and is offered the opportunity to purchase as J bond that pays a 7.00% coupon rate (distributed semiannually) with three years remaining to maturity. The following formula can be used to compute the bond's intrinsic Ch 07: Assignment pay, and a bondholder's required return Remember, a bond's coupon rate partially determines the interest-based return that a bond reflects the return that a bondholder to receive from a given investment. The mathematics of bond valuation imply a predictable relationship between the bond's coupon rate, the bondholder's required return, the bond's par value, and its intrinsic value. These relationships can be summarized as follows: When the bond's coupon rate is equal to the bondholder's required return, the bond's intrinsic value will its par value, and the bond will trade at par. When the bond's coupon rate is greater to the bondholder's required return, the bond's intrinsic value will its par value, and the bond will trade at a premium. When the bond's coupon rate is less than the bondholder's required return, the bond's intrinsic value will be less than its par value, and the bond will trade at a premium For example, coupon rate (da discount wants to earn a return of 7.00% and is offered the opportunity to purchase a $1,000 par value bond that pays a 7.00% annually) with three years remaining to maturity. The following formula can be used to compute the bond's intrinsic value: par Intrinsic Value = ato + a + 40 + 0 + 0 + 0 + 0 + at Intrinsic Value = omo + ato + a + amo + tots + af ca + utora Complete the following table by identifying the appropriate corresponding variables used in the equation. Unknown Variable Name Variable Value $1,000 Bond's semiannual coupon payment Bond's annual coupon payment Based on this ed Bondholder's required return to expect that Sophia's potential bond investment is current value equal to $ Bond's market price Now, consider the situation in which Sophia wants to earn a return of 5.00%, but the bond being considered for purchase 7.00%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the the nearest whole dollar, then its intrinsic value of (rounded to the nearest whole dollar) is the bond is Given your computation and conclusions, which of the following statements is true? Intrinsic Value = ato + ato + 0.0 + 0 + otros + chcza + 1 + 5* Complete the following table by identifying the appropriate corresponding variables used in the equation. Unknown Variable Name Variable Value to e $52.50 Semiannual required return $140.00 Based on this equation and the data, it is $70.00 Sophia's potential bond investment is current value equal to $1,000. $35.00 Now, consider the situation in which Sophia wants to earn a return of 5.00%, but the bond being considered for purchase 7.00%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round th the nearest whole dollar, then its intrinsic value of (rounded to the nearest whole dollar) is the bond is Given your computation and conclusions, which of the following statements is true? Intrinsic Value = a + auto + + otrogen + ato + dock + 100 Complete the following table by identifying the appropriate corresponding variables used in the equation. Unknown Variable Name Variable Value $1,000 Bond's par value to expect that Sophia's potential bond investment is current Based on this equa Bond's annual coupon payment value equal to $1,1 Bond's market price Now, consider the Semiannual coupon payment earn a return of 5.00%, but the bond being considered for purchase 7.00%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the the nearest whole dollar, then its intrinsic value of (rounded to the nearest whole dollar) is the bond is gnment ac Value = ato + do + oto + dtg + Tt + f + cut the following table by identifying the appropriate corresponding variables used in the equation. Variable Name 1,000 Semiannual required return 3.8125% Sophia's potential bond investment is currently exi is equation and the data, it is to $1,000. 5.7525% 3.5000% Jer the situation in which Sophia wants to earn a return but the bond being considered for purchase offers lin, assume that the bond pays semiannual interest pa 7.0000% has three years to maturity. If you round the bon whole dollar, then its intrinsic value of (rounded to the nearest whole dollar) is Unknown Variable Name Variable Value A $1,000 Semiannual required return to expect that Sophia's potential bo Based on this equation and the data, it is value equal to $1,000 unreasonable Now, consider the situation in which Soph reasonable Ja return of 5.00%, but the bond being 7.00%. Again, assume that the bond pays serv erarmerest payments and has three Ch 07: Assignment $1,000 Semiannual required return Based on this equation and the data, it is value equal to $1,000. to expect that Sophia's potential bond invest Now, consider the situation in which Sophia wants to earn a return of 5.00%, but the bond being considered 7.00%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If the nearest whole dollar, then its intrinsic value of (rounded to the nearest whole dollar) is the bond is $844 Given your computation and conclusions, which of $1,372 hg statements is true? O A bond should trade at a par when the ca $1,055 is greater than Sophia's required return. When the coupon rate is greater than Sol pired return, the bond should trade at a premium When the coupon rate is greater than Sophia's required return, the bond's intrinsic value will be les When the coupon rate is greater than Sophia's required return, the bond should trade at a discount $1,000 Semiannual required return Based on this equation and the data, it is value equal to $1,000 to expect that Sophia's potential bond investment is currently exhibiting an intrinsic Wow, consider the situation in which Sophia wants to earn a return of 5.00%, but the bond being considered for purchase offers a coupon rate of ".00%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to he nearest whole dollar, then its intrinsic value of (rounded to the nearest whole dollar) is its par value, so that he bond is greater than iven your computation and conclusions, which of the following statements is true? equal to A bond should trade at a par when the coupon rate is greater than Sophia's required return less than When the coupon rate is greater than Sophia's required return, the bond should trade at a premium. When the coupon rate is greater than Sophia's required return, the bond's intrinsic value will be less than its par value. When the coupon rate is greater than Sophia's required return, the bond should trade at a discount. $1,000 Semiannual required return to expect that Sophia's potential bond investment is currently exhibiting an il Based on this equation and the data, it is value equal to $1,000. Now, consider the situation in which Sophia wants to earn a return of 5.00%, but the bond being considered for purchase offers a coupon 7.00%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic the nearest whole dollar, then its intrinsic value of (rounded to the nearest whole dollar) is its par value, the bond is Given your trading at par lons, which of the following statements is true? trading at a premium bar when the coupon rate is greater than Sophia's required return trading at a discount WW reater than Sophia's required return, the bond should trade at a premium. When the coupon rate is greater than Sophia's required return, the bond's intrinsic value will be less than its par value. When the coupon rate is greater than Sophia's required return, the bond should trade at a discount. Grade It Now Save & Con