Answered step by step

Verified Expert Solution

Question

1 Approved Answer

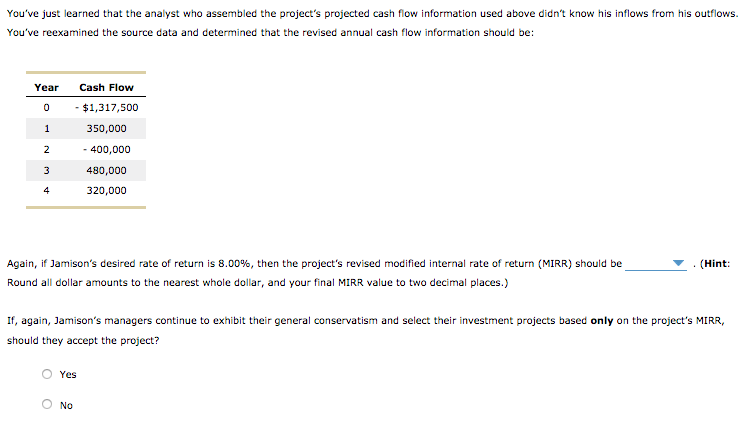

Drop downs: 1) Conventional or unconventional 2) -8.52 -6.31 -5.99 -5.36 10. Cashflow patterns and the modified rate of return calculation Jamison Manufacturing Inc. is

Drop downs:

1) Conventional or unconventional

2)

-8.52

-6.31

-5.99

-5.36

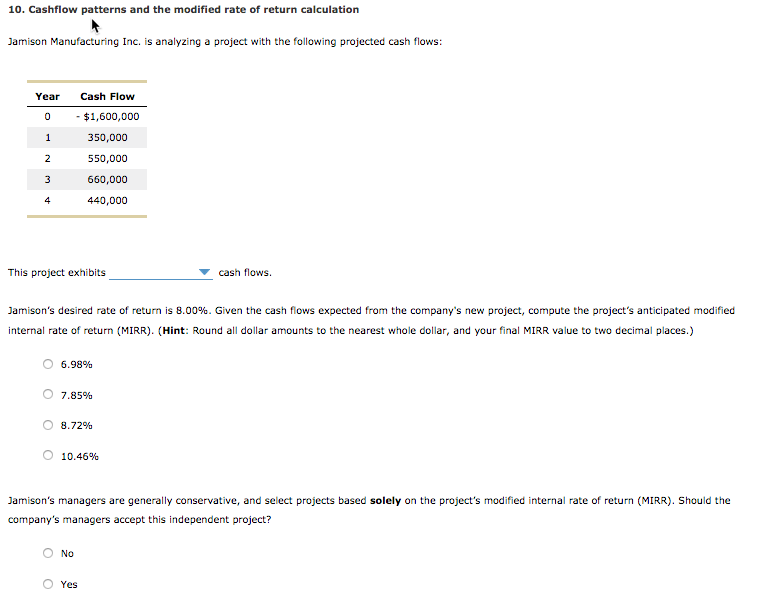

10. Cashflow patterns and the modified rate of return calculation Jamison Manufacturing Inc. is analyzing a project with the following projected cash flows: Year Cash Flow 0 $1,600,000 350,000 550,000 660,000 4 440,000 This project exhibits cash flows. Jamison's desired rate of return is 8.00%. Given the cash flows expected from the company's new project, compute the project's anticipated modified internal rate of return (MIRR). Hint: Round all dollar amounts to the nearest whole dollar, and your final MIRR value to two decimal places.) o 6.98% 7.85% o 8.72% 10.46% Jamison's managers are generally conservative, and select projects based solely on the project's modified internal rate of return (MIRR). Should the company's managers accept this independent project? O No O Yes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started