Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Drop Words 1. a. 1,850 b. 360 c.3250 d.450 2. a. does b. does not 3. a. 25% b.10% c.15% d.20% 4. a. Safe- maximum

Drop Words

1.

a. 1,850

b. 360

c.3250

d.450

2.

a. does

b. does not

3.

a. 25%

b.10%

c.15%

d.20%

4.

a. Safe- maximum debt

b. Safe- manageable debt

c. unsafe debt

d. safe - low debt

5.

a. increase

b. decrease

6.

a. more

b. less

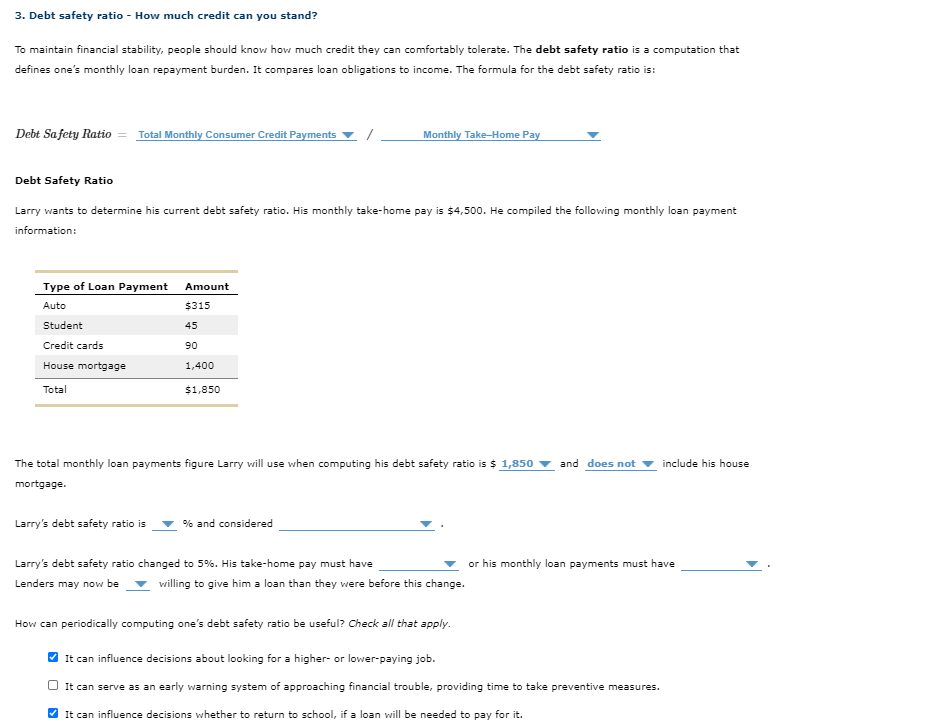

3. Debt safety ratio - How much credit can you stand? To maintain financial stability, people should know how much credit they can comfortably tolerate. The debt safety ratio is a computation that defines one's monthly loan repayment burden. It compares loan obligations to income. The formula for the debt safety ratio is: Debt Safety Ratio = Total Monthly Consumer Credit Payments Monthly Take-Home Pay Debt Safety Ratio Larry wants to determine his current debt safety ratio. His monthly take-home pay is $4,500. He compiled the following monthly loan payment information: Amount $315 Type of Loan Payment Auto Student Credit cards House mortgage 45 90 1,400 Total $1,850 and does not include his house The total monthly loan payments figure Larry will use when computing his debt safety ratio is $ 1,850 mortgage. Larry's debt safety ratio is % and considered Larry's debt safety ratio changed to 5%. His take-home pay must have or his monthly loan payments must have Lenders may now be willing to give him a loan than they were before this change. How can periodically computing one's debt safety ratio be useful? Check all that apply. It can influence decisions about looking for a higher- or lower-paying job. It can serve as an early warning system of approaching financial trouble, providing time to take preventive measures. It can influence decisions whether to return to school, if a loan will be needed to pay for it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started