Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dropdown Options: 1.)An individual, A Group 3. Private health insurance - Comparison of plans and providers In the United States, private health insurance plans can

Dropdown Options:

1.)An individual, A Group

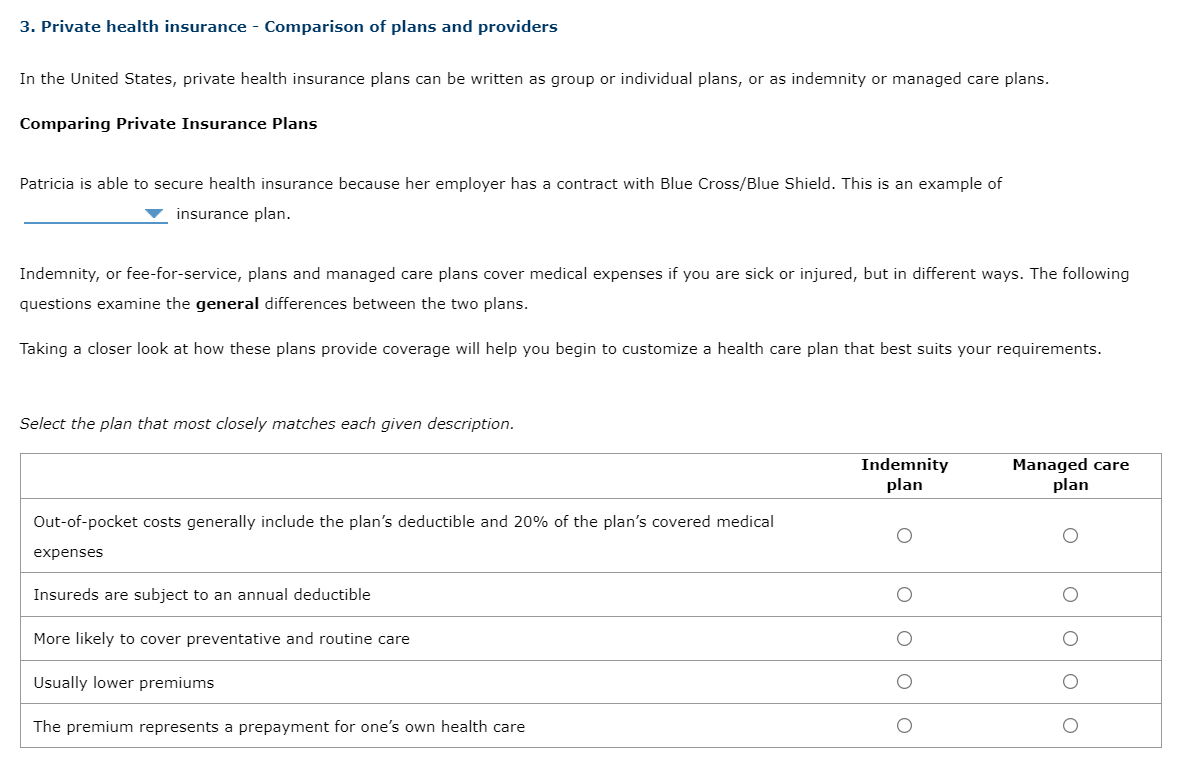

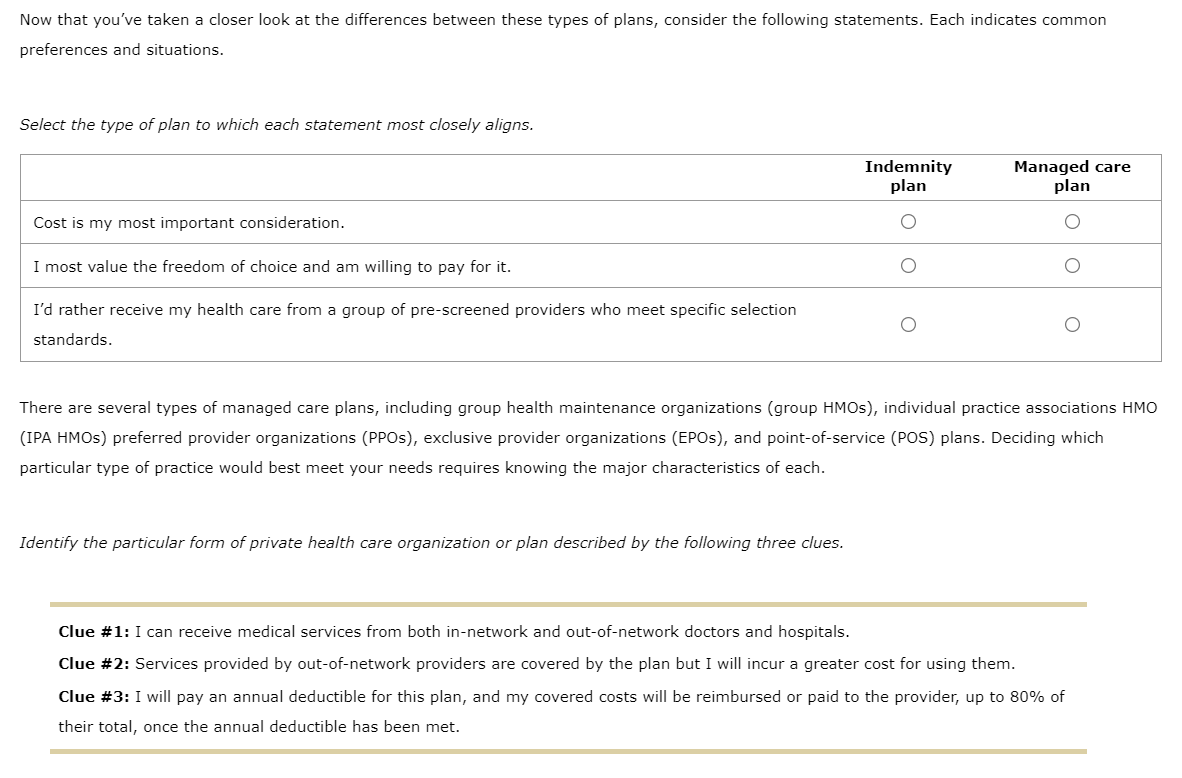

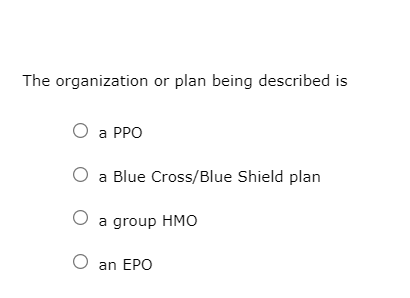

3. Private health insurance - Comparison of plans and providers In the United States, private health insurance plans can be written as group or individual plans, or as indemnity or managed care plans. Comparing Private Insurance Plans Patricia is able to secure health insurance because her employer has a contract with Blue Cross/Blue Shield. This is an example of insurance plan. Indemnity, or fee-for-service, plans and managed care plans cover medical expenses if you are sick or injured, but in different ways. The following questions examine the general differences between the two plans. Taking a closer look at how these plans provide coverage will help you begin to customize a health care plan that best suits your requirements. Select the plan that most closely matches each given description. Indemnity plan Managed care plan Out-of-pocket costs generally include the plan's deductible and 20% of the plan's covered medical expenses Insureds are subject to an annual deductible More likely to cover preventative and routine care Usually lower premiums The premium represents a prepayment for one's own health care O OOO Now that you've taken a closer look at the differences between these types of plans, consider the following statements. Each indicates common preferences and situations. Select the type of plan to which each statement most closely aligns. Indemnity plan Managed care plan Cost is my most important consideration. I most value the freedom of choice and am willing to pay for it. I'd rather receive my health care from a group of pre-screened providers who meet specific selection standards. There are several types of managed care plans, including group health maintenance organizations (group HMOs), individual practice associations HMO (IPA HMOs) preferred provider organizations (PPOS), exclusive provider organizations (EPOS), and point-of-service (POS) plans. Deciding which particular type of practice would best meet your needs requires knowing the major characteristics of each. Identify the particular form of private health care organization or plan described by the following three clues. Clue #1: I can receive medical services from both in-network and out-of-network doctors and hospitals. Clue #2: Services provided by out-of-network providers are covered by the plan but I will incur a greater cost for using them. Clue #3: I will pay an annual deductible for this plan, and my covered costs will be reimbursed or paid to the provider, up to 80% of their total, once the annual deductible has been met. The organization or plan being described is O a PPO a Blue Cross/Blue Shield plan O a group HMO O an EPO 3. Private health insurance - Comparison of plans and providers In the United States, private health insurance plans can be written as group or individual plans, or as indemnity or managed care plans. Comparing Private Insurance Plans Patricia is able to secure health insurance because her employer has a contract with Blue Cross/Blue Shield. This is an example of insurance plan. Indemnity, or fee-for-service, plans and managed care plans cover medical expenses if you are sick or injured, but in different ways. The following questions examine the general differences between the two plans. Taking a closer look at how these plans provide coverage will help you begin to customize a health care plan that best suits your requirements. Select the plan that most closely matches each given description. Indemnity plan Managed care plan Out-of-pocket costs generally include the plan's deductible and 20% of the plan's covered medical expenses Insureds are subject to an annual deductible More likely to cover preventative and routine care Usually lower premiums The premium represents a prepayment for one's own health care O OOO Now that you've taken a closer look at the differences between these types of plans, consider the following statements. Each indicates common preferences and situations. Select the type of plan to which each statement most closely aligns. Indemnity plan Managed care plan Cost is my most important consideration. I most value the freedom of choice and am willing to pay for it. I'd rather receive my health care from a group of pre-screened providers who meet specific selection standards. There are several types of managed care plans, including group health maintenance organizations (group HMOs), individual practice associations HMO (IPA HMOs) preferred provider organizations (PPOS), exclusive provider organizations (EPOS), and point-of-service (POS) plans. Deciding which particular type of practice would best meet your needs requires knowing the major characteristics of each. Identify the particular form of private health care organization or plan described by the following three clues. Clue #1: I can receive medical services from both in-network and out-of-network doctors and hospitals. Clue #2: Services provided by out-of-network providers are covered by the plan but I will incur a greater cost for using them. Clue #3: I will pay an annual deductible for this plan, and my covered costs will be reimbursed or paid to the provider, up to 80% of their total, once the annual deductible has been met. The organization or plan being described is O a PPO a Blue Cross/Blue Shield plan O a group HMO O an EPOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started