Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DRT Company is a manufacturer of gasoline-powered go-karts and other power products. DRT is a calendar-year, accrual-basis taxpayer. DRT generally files their tax return

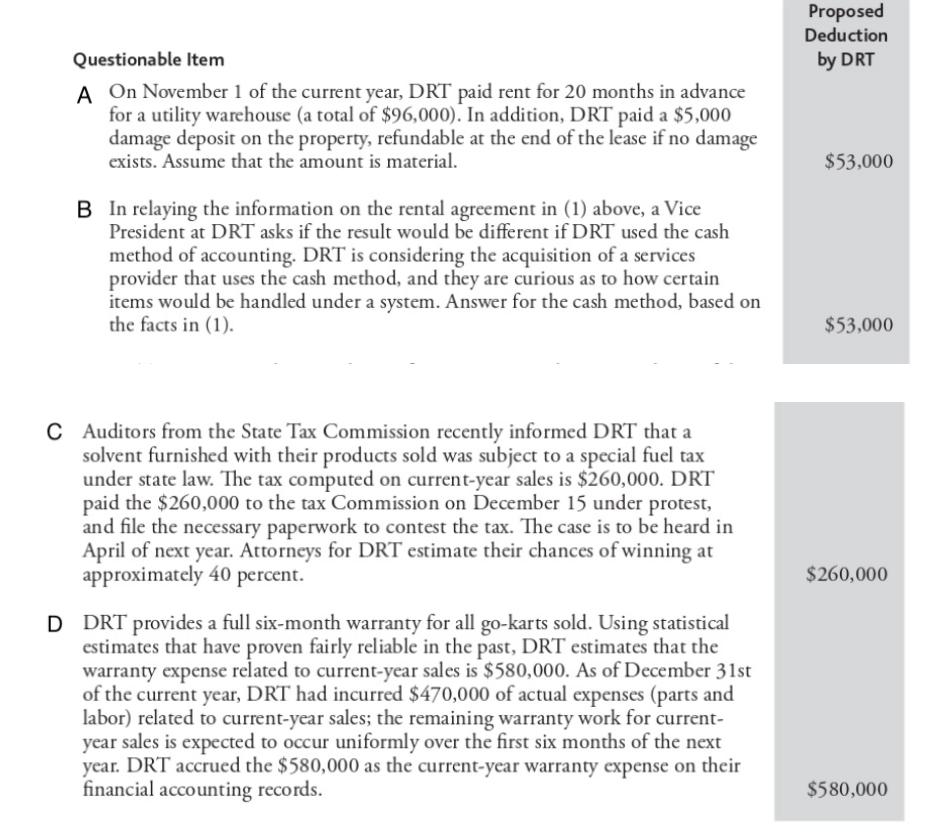

DRT Company is a manufacturer of gasoline-powered go-karts and other power products. DRT is a calendar-year, accrual-basis taxpayer. DRT generally files their tax return by the extended due date (9 months following the close of the tax year). In late December, repre- sentatives of DRT ask for your assistance in determining the appropriate deduction for the current year for 10 different items described in the chart below. DRT is willing to elect the recurring item exception for any item listed, and all amounts are assumed to be material. In addition, DRT also has two specific questions regarding the reporting of intangibles related to (1) the acquisition of a business during the year and (2) the disposition of two intangibles from an acquisition six years ago. Information for these two questions is provided the last two sections of the chart shown below, and may require some research Questionable Item A On November 1 of the current year, DRT paid rent for 20 months in advance for a utility warehouse (a total of $96,000). In addition, DRT paid a $5,000 damage deposit on the property, refundable at the end of the lease if no damage exists. Assume that the amount is material. B In relaying the information on the rental agreement in (1) above, a Vice President at DRT asks if the result would be different if DRT used the cash method of accounting. DRT is considering the acquisition of a services provider that uses the cash method, and they are curious as to how certain items would be handled under a system. Answer for the cash method, based on the facts in (1). C Auditors from the State Tax Commission recently informed DRT that a solvent furnished with their products sold was subject to a special fuel tax under state law. The tax computed on current-year sales is $260,000. DRT paid the $260,000 to the tax Commission on December 15 under protest, and file the necessary paperwork to contest the tax. The case is to be heard in April of next year. Attorneys for DRT estimate their chances of winning at approximately 40 percent. D DRT provides a full six-month warranty for all go-karts sold. Using statistical estimates that have proven fairly reliable in the past, DRT estimates that the warranty expense related to current-year sales is $580,000. As of December 31st of the current year, DRT had incurred $470,000 of actual expenses (parts and labor) related to current-year sales; the remaining warranty work for current- year sales is expected to occur uniformly over the first six months of the next year. DRT accrued the $580,000 as the current-year warranty expense on their financial accounting records. Proposed Deduction by DRT $53,000 $53,000 $260,000 $580,000

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

580000 Explanation The deduction for the current year shou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started