Answered step by step

Verified Expert Solution

Question

1 Approved Answer

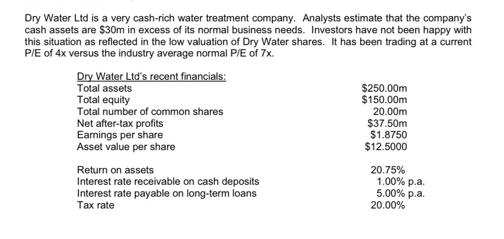

Dry Water Ltd is a very cash-rich water treatment company. Analysts estimate that the company's cash assets are $30m in excess of its normal

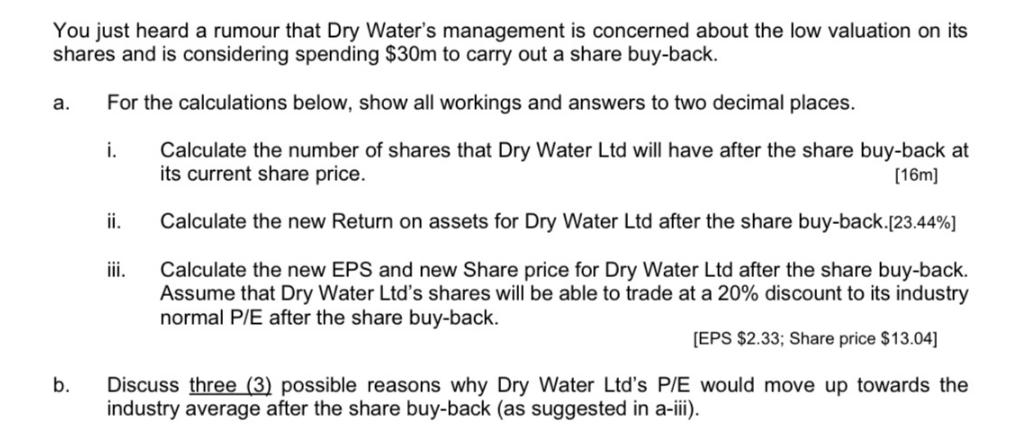

Dry Water Ltd is a very cash-rich water treatment company. Analysts estimate that the company's cash assets are $30m in excess of its normal business needs. Investors have not been happy with this situation as reflected in the low valuation of Dry Water shares. It has been trading at a current P/E of 4x versus the industry average normal P/E of 7x. Dry Water Ltd's recent financials: Total assets Total equity Total number of common shares Net after-tax profits Earnings per share Asset value per share Return on assets Interest rate receivable on cash deposits Interest rate payable on long-term loans Tax rate $250.00m $150.00m 20.00m $37.50m $1.8750 $12.5000 20.75% 1.00% p.a. 5.00% p.a. 20.00% You just heard a rumour that Dry Water's management is concerned about the low valuation on its shares and is considering spending $30m to carry out a share buy-back. a. b. For the calculations below, show all workings and answers to two decimal places. i. Calculate the number of shares that Dry Water Ltd will have after the share buy-back at its current share price. [16m] ii. iii. Calculate the new Return on assets for Dry Water Ltd after the share buy-back.[23.44%] Calculate the new EPS and new Share price for Dry Water Ltd after the share buy-back. Assume that Dry Water Ltd's shares will be able to trade at a 20% discount to its industry normal P/E after the share buy-back. [EPS $2.33; Share price $13.04] Discuss three (3) possible reasons why Dry Water Ltd's P/E would move up towards the industry average after the share buy-back (as suggested in a-iii).

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a i To calculate the number of shares that Dry Water Ltd will have after the share buyback at its current share price you can use the formula New Numb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started