Question

DSL Company manufactures and sells specialized tools and dies for other manufacturers. The company has two manufacturing operations, machining and assembly. When an order for

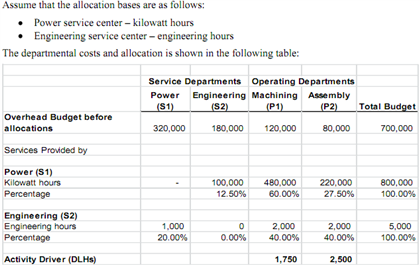

DSL Company manufactures and sells specialized tools and dies for other manufacturers. The company has two manufacturing operations, machining and assembly. When an order for tools and dies is received, the Machining Department makes the parts through a CAD/CAM system. The completed parts are then sent to the Assembly Department where the components are assembled and tested.To support the manufacturing activity, the company has a building that houses the two manufacturing departments as well as the Power Service Center and the Engineering Service Center. To aid in cost control, the company accumulates the costs of these support functions in separate service departments: (S1) Power and (S2) Engineering.  Assume the company has two service departments and their costs are recorded in these departments and are allocated to two production departments. All four departments share the same building. Each service department is an intermediate cost center whose costs are recorded as incurred and then distributed to other cost centers. Prepare an analysis of allocating the overhead costs and determining the total departmental costs and their respective overhead rates based upon the Reciprocal method.

Assume the company has two service departments and their costs are recorded in these departments and are allocated to two production departments. All four departments share the same building. Each service department is an intermediate cost center whose costs are recorded as incurred and then distributed to other cost centers. Prepare an analysis of allocating the overhead costs and determining the total departmental costs and their respective overhead rates based upon the Reciprocal method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started