Question

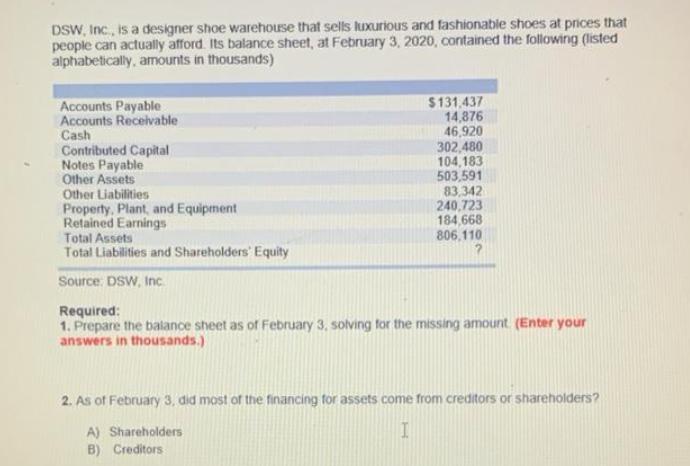

DSW, Inc., is a designer shoe warehouse that sells luxurious and fashionable shoes at prices that people can actually afford. Its balance sheet, at

DSW, Inc., is a designer shoe warehouse that sells luxurious and fashionable shoes at prices that people can actually afford. Its balance sheet, at February 3, 2020, contained the following (listed alphabetically, amounts in thousands) Accounts Payable Accounts Receivable Cash Contributed Capital Notes Payable Other Assets Other Liabilities Property, Plant, and Equipment Retained Earnings Total Assets Total Liabilities and Shareholders' Equity Source: DSW, Inc. $131,437 14,876 46,920 302,480 104,183 503,591 83,342 240,723 184,668 806,110 ? Required: 1. Prepare the balance sheet as of February 3, solving for the missing amount (Enter your answers in thousands.) 2. As of February 3, did most of the financing for assets come from creditors or shareholders? I A) Shareholders B) Creditors

Step by Step Solution

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Accounting

Authors: Fred Phillips, Robert Libby, Patricia Libby

5th edition

78025915, 978-1259115400, 1259115402, 978-0078025914

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App