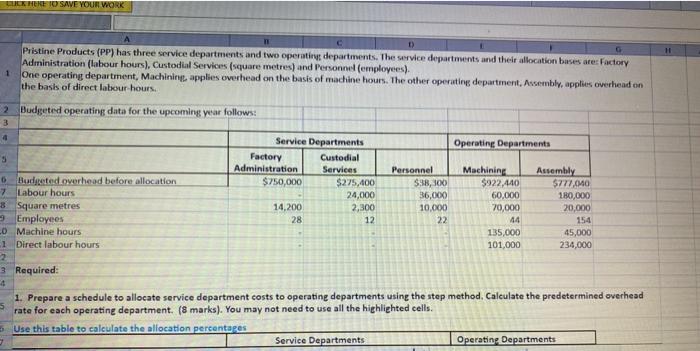

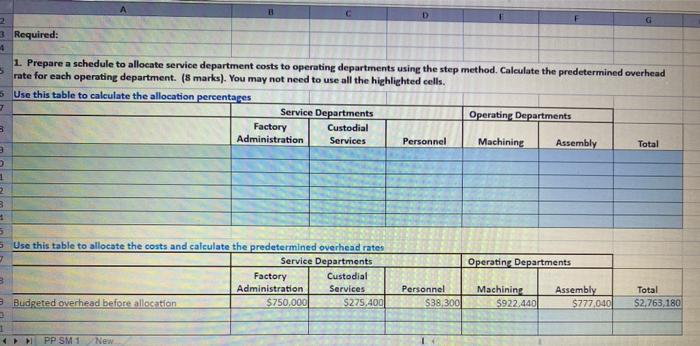

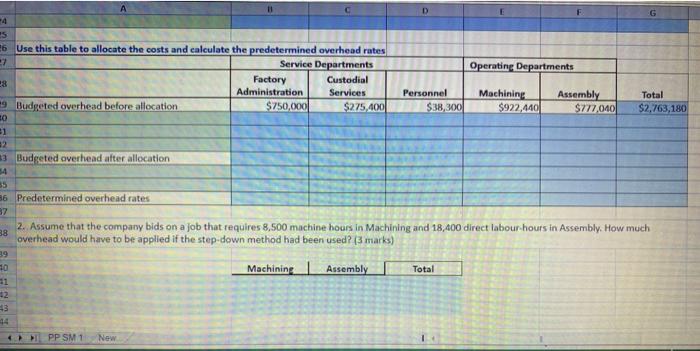

DU HERE TO SAVE YOUR WORK 11 Pristine Products (PP) has three service departments and two operative departments. The service departments and their allocation bases are: Factory Administration (labour hours), Custodial Services (square metres) and Personnel employees). One operating department, Machining applies overhead on the basis of machine hours. The other operating department, Assembly, applies overhead on the basis of direct labour hours 1 2 Budgeted operating data for the upcoming year follows: 4 Operating Departments Service Departments Factory Custodial Administration Services $750,000 $275,400 24,000 14,200 2,300 28 12 Personnel $38,100 36,000 10.000 22 Machining $922.440 60,000 70,000 44 135,000 101,000 Assembly $777,040 180,000 20,000 6 Budgeted overhead before allocation 7 Labour hours 3 Square metres 3 Employees C0 Machine hours 1 Direct labour hours 2 3 Required: 154 45,000 234,000 1. Prepare a schedule to allocate service department costs to operating departments using the step method. Calculate the predetermined overhead 5 rate for each operating department. (8 marks). You may not need to use all the highlighted cells. 6 Use this table to calculate the allocation percentages Service Departments Operating Departments 2 3 Required: 4 1. Prepare a schedule to allocate service department costs to operating departments using the step method. Calculate the predetermined overhead 5 rate for each operating department. (8 marks). You may not need to use all the highlighted cells. Use this table to calculate the allocation percentares Service Departments Operating Departments 8 Factory Custodial Administration Services Personnel Machining Assembly Total 2 8 5 5 Use this table to allocate the costs and calculate the predetermined overhead rates 3 Service Departments 3 Factory Custodial Administration Services Budgeted overhead before allocation $750.000 $275.400 Operating Departments Personnel $38,300 Machining $922.440 Assembly $777,040 Total $2.763,180 1 PP SM1 New Operating Departments -4 5 6 Use this table to allocate the costs and calculate the predetermined overhead rates 7 Service Departments Factory Custodial Administration Services 9 Budgeted overhead before allocation $750,000 $275,400 30 31 32 3 Budgeted overhead after allocation Personnel $38,300 Machining $922,440 Assembly $777,040 Total $2,763,180 55 36 Predetermined overhead rates 38 2. Assume that the company bids on a job that requires 8,500 machine hours in Machining and 18,400 direct labour hours in Assembly. How much overhead would have to be applied if the step-down method had been used? [3 marks) Machining Assembly Total 39 40 1 12 43 PP SM 1 New