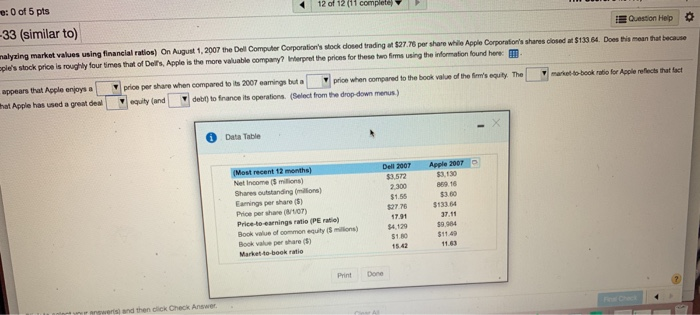

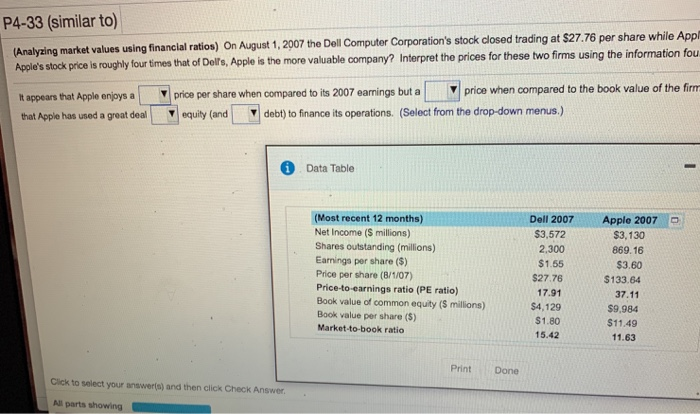

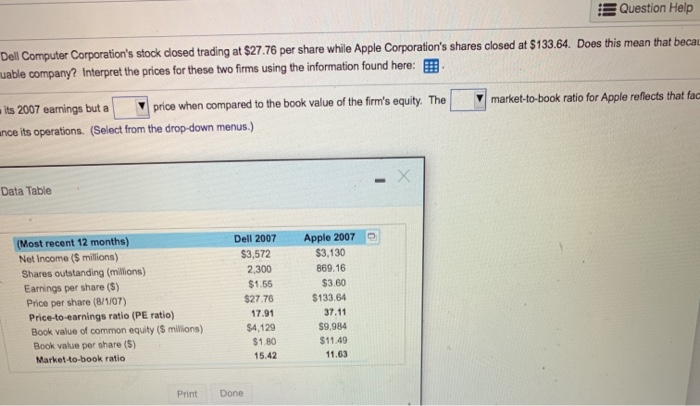

DU05 pes 12012 (17 complete 33 (similar to) Question Help Valyzing market values using financial ration) On August 1, 2007 the Dell Computer Corporation's stock dosed trading at $27.78 per share while ople Corporation's shoes closed 5133 4. Does this mean that because ple's stock price is roughly four times that of Delf's, Apple is the more valuable company? Interpret the prions for these two firms using the information found here: appears that Apple enjoys a price per share when compared to its 2007 earnings but a price when compared to the book value of the firm's equity The market to-book ratio for Apple les that fact hat Apple has used a great e q uity and det) to france its operations (elect from the drop down menus) Data Table Dell 2007 Apple 2007 $ 130 Most recent 12 months) Net Income milions) Share outstanding mons) aming or share Proper who Price-to earnings ratio (PE Book wlue of common equity i $180 ) 1791 $4.120 n s) $9.984 $11.49 Market to book ratio Print Done P4-33 (similar to) (Analyzing market values using financial ratios) On August 1, 2007 the Dell Computer Corporation's stock closed trading at $27.76 per share while App Apple's stock price is roughly four times that of Dells, Apple is the more valuable company? Interpret the prices for these two firms using the information fou It appears that Apple enjoys a that Apple has used a great deal price per share when compared to its 2007 earnings but a price when compared to the book value of the fir equity (and debt) to finance its operations. (Select from the drop-down menus.) Data Table (Most recent 12 months) Net Income ( millions) Shares outstanding (millions) Earnings per share ($) Price per share (B/4/07) Price to earnings ratio (PE ratio) Book value of common equity (5 millions) Book value per share (5) Market-to-book ratio Dell 2007 $3,572 2.300 $1.55 $27.78 17.91 $4,129 $1.80 15.42 Apple 2007 $3,130 869.16 $3.60 $133.64 37.11 $9.984 $11.49 11.63 Click to select your answers and then click Check Answer Print Done All parts showing Question Help Dell Computer Corporation's stock closed trading at $27.76 per share while Apple Corporation's shares closed at $133.64. Does this mean that beca uable company? Interpret the prices for these two firms using the information found here: market-to-book ratio for Apple reflects that fau its 2007 earnings but a price when compared to the book value of the firm's equity. The nce its operations. (Select from the drop-down menus.) Data Table (Most recent 12 months) Net Income ($ millions) Shares outstanding (millions) Earrings per share (S) Price per share (B/1/07) Price-to-earnings ratio (PE ratio) Book value of common equity (5 milions) Book value per share (5) Market-to-book ratio Dell 2007 $3,572 2,300 $1.55 $27.76 17.91 $4,129 $1.80 15.42 Apple 2007 $3,130 869.16 $3.60 $133.64 37.11 59,984 $11.49 11.63 Print Done