Answered step by step

Verified Expert Solution

Question

1 Approved Answer

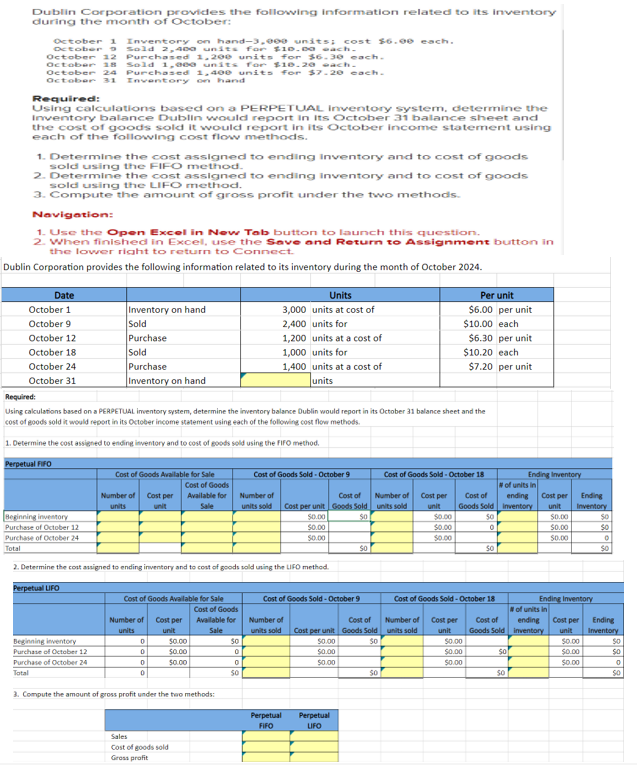

Dublin Corporation provides the following information related to its inventory during the month of October: October 1 October October 12 October 18 October 24

Dublin Corporation provides the following information related to its inventory during the month of October: October 1 October October 12 October 18 October 24 October 31 Required: Inventory on hand-3,000 units; cost $6.00 each. Sold 2,400 units for $10.00 each. Purchased 1,200 units for $6.30 each. Sold 1,000 units for $10.20 each. Purchased 1,400 units for $7.20 each. Inventory on hand Using calculations based on a PERPETUAL Inventory system, determine the Inventory balance Dublin would report In Its October 31 balance sheet and the cost of goods sold it would report in its October income statement using each of the following cost flow methods. 1. Determine the cost assigned to ending inventory and to cost of goods sold using the FIFO method. 2. Determine the cost assigned to ending inventory and to cost of goods sold using the LIFO method. 3. Compute the amount of gross profit under the two methods. Navigation: 1. Use the Open Excel in New Tab button to launch this question. 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect. Dublin Corporation provides the following information related to its inventory during the month of October 2024. Purchase Date October 1 October 9 Inventory on hand Sold October 12 October 18 Sold October 24 Purchase October 31 Inventory on hand Required: Units 3,000 units at cost of 2,400 units for 1,200 units at a cost of 1,000 units for 1,400 units at a cost of units Per unit $6.00 per unit $10.00 each $6.30 per unit $10.20 each $7.20 per unit Using calculations based on a PERPETUAL inventory system, determine the inventory balance Dublin would report in its October 31 balance sheet and the cost of goods sold it would report in its October income statement using each of the following cost flow methods. 1. Determine the cost assigned to ending inventory and to cost of goods sold using the FIFO method. Perpetual FIFO Cost of Goods Available for Sale Cost of Goods Sold - October 9 Cost of Goods Sold-October 18 Ending Inventory Cost of Goods # of units in Number of Cost per units unit Available for Sale Number of units sold Beginning inventory Purchase of October 12 Cost of Cost per unit Goods Sold $0.00 50 $0.00 Number of units sold Cost per unit Cost of Goods Sold ending Inventory Cost per unit Ending Inventory $0.00 50 $0.00 $0.00 0 $0.00 Purchase of October 24 50.00 $0.00 50.00 50 Total 50 50 2. Determine the cost assigned to ending inventory and to cost of goods sold using the LIFO method. Perpetual UFO Cost of Goods Available for Sale Cost of Goods Sold - October 9 Cost of Goods Sold-October 18 Ending Inventory Cost of Goods Number of Cost per units unit Available for Sale Number of units sold Beginning inventory 0 50.00 50 Cost per unit $0.00 Cost of Goods Sold 50 Number of units sold Cost per unit Cost of Goods Sold # of units in ending Inventory Cost per Ending unit Inventory $0.00 $0.00 Purchase of October 12 0 $0.00 0 $0.00 $0.00 so $0.00 Purchase of October 24 0 $0.00 0 $0.00 $0.00 $0.00 Total 0 50 50 50 8808 3. Compute the amount of gross profit under the two methods: Sales Cost of goods sold Gross profit Perpetual FIFO Perpetual LIFO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Using FIFO Method 1 Determine the cost assigned to ending inventory and cost of goods sold a Cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started