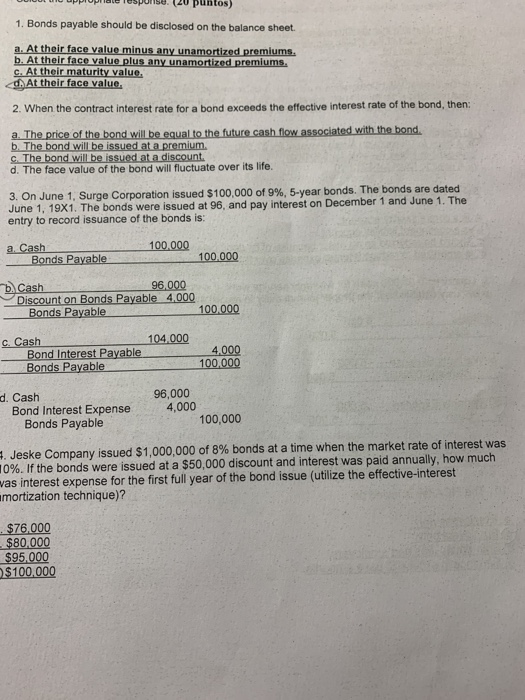

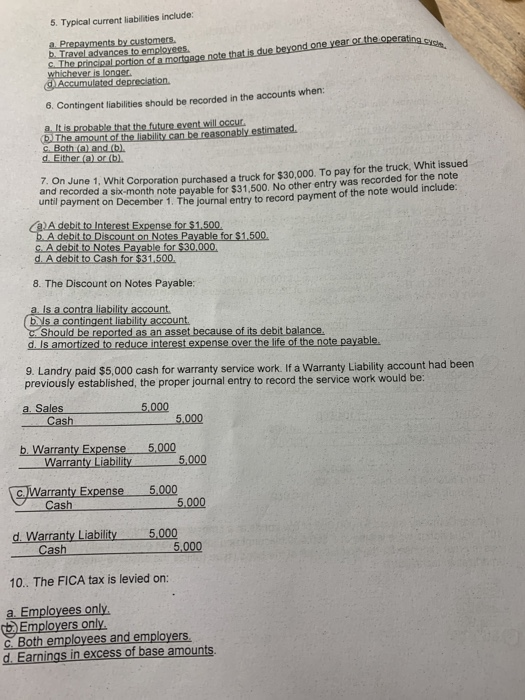

DUDUL upprupid Spurs (20 puntos) 1. Bonds payable should be disclosed on the balance sheet. a. At their face value minus any unamortized premiums. b. At their face value plus any unamortized premiums. c. At their maturity value. At their face value. 2. When the contract interest rate for a bond exceeds the effective interest rate of the bond, then a. The price of the bond will be equal to the future cash flow associated with the bond. b. The bond will be issued at a premium c. The bond will be issued at a discount. d. The face value of the bond will fluctuate over its life. 3. On June 1, Surge Corporation issued $100,000 of 9%. 5-year bonds. The bonds are dated June 1. 19X1. The bonds were issued at 96, and pay interest on December 1 and June 1. The entry to record issuance of the bonds is: 100.000 a Cash Bonds Pavable 100.000 b. Cash 96,000 Discount on Bonds Payable 4.000 Bonds Payable 100.000 104.000 c. Cash Bond Interest Payable Bonds Payable 4.000 100,000 d. Cash Bond Interest Expense Bonds Payable 96,000 4,000 100,000 Jeske Company issued $1,000,000 of 8% bonds at a time when the market rate of interest was 10%. If the bonds were issued at a $50,000 discount and interest was paid annually, how much was interest expense for the first full year of the bond issue (utilize the effective-interest amortization technique)? . $76.000 - $80,000 $95.000 $100,000 5. Typical current liabilities include: the operating Sy a Prepayments by customers b. Travel advances to employees ne principal portion of a mortgage note that is due beyond one year or the operating whichever is longer Accumulated depreciation 6. Contingent liabilities should be recorded in the accounts when: a. It is probable that the future event will occur. (b The amount of the liability can be reasonably estimated c. Both (a) and (b). d. Either (a) or (b) on June 1, Whit Corporation purchased a truck for $30.000. To pay for the truck, Whit issued and recorded a six-month note pavable for $31 500. No other entry was recorded for the note payment on December 1. The lournal entry to record payment of the note would include. a A debit to Interest Expense for $1.500. b. A debit to Discount on Notes Payable for $1.500. c. A debitato Notes Payable for $30,000. d. A debit to Cash for $31.500. 8. The Discount on Notes Payable: als a contra liability account. bls a contingent liability account. c. Should be reported as an asset because of its debit balance. d. Is amortized to reduce interest expense over the life of the note payable 9. Landry paid $5,000 cash for warranty service work. If a Warranty Liability account had been previously established, the proper journal entry to record the service work would be: 5.000 a. Sales Cash 5.000 b. Warranty Expense Warranty Liability 5,000 5 ,000 C Warranty Expense Cash 5.000 5.000 d. Warranty Liability Cash 5.000 5.000 10.. The FICA tax is levied on: a. Employees only. . Employers only. c. Both employees and employers. d. Earnings in excess of base amounts. DUDUL upprupid Spurs (20 puntos) 1. Bonds payable should be disclosed on the balance sheet. a. At their face value minus any unamortized premiums. b. At their face value plus any unamortized premiums. c. At their maturity value. At their face value. 2. When the contract interest rate for a bond exceeds the effective interest rate of the bond, then a. The price of the bond will be equal to the future cash flow associated with the bond. b. The bond will be issued at a premium c. The bond will be issued at a discount. d. The face value of the bond will fluctuate over its life. 3. On June 1, Surge Corporation issued $100,000 of 9%. 5-year bonds. The bonds are dated June 1. 19X1. The bonds were issued at 96, and pay interest on December 1 and June 1. The entry to record issuance of the bonds is: 100.000 a Cash Bonds Pavable 100.000 b. Cash 96,000 Discount on Bonds Payable 4.000 Bonds Payable 100.000 104.000 c. Cash Bond Interest Payable Bonds Payable 4.000 100,000 d. Cash Bond Interest Expense Bonds Payable 96,000 4,000 100,000 Jeske Company issued $1,000,000 of 8% bonds at a time when the market rate of interest was 10%. If the bonds were issued at a $50,000 discount and interest was paid annually, how much was interest expense for the first full year of the bond issue (utilize the effective-interest amortization technique)? . $76.000 - $80,000 $95.000 $100,000 5. Typical current liabilities include: the operating Sy a Prepayments by customers b. Travel advances to employees ne principal portion of a mortgage note that is due beyond one year or the operating whichever is longer Accumulated depreciation 6. Contingent liabilities should be recorded in the accounts when: a. It is probable that the future event will occur. (b The amount of the liability can be reasonably estimated c. Both (a) and (b). d. Either (a) or (b) on June 1, Whit Corporation purchased a truck for $30.000. To pay for the truck, Whit issued and recorded a six-month note pavable for $31 500. No other entry was recorded for the note payment on December 1. The lournal entry to record payment of the note would include. a A debit to Interest Expense for $1.500. b. A debit to Discount on Notes Payable for $1.500. c. A debitato Notes Payable for $30,000. d. A debit to Cash for $31.500. 8. The Discount on Notes Payable: als a contra liability account. bls a contingent liability account. c. Should be reported as an asset because of its debit balance. d. Is amortized to reduce interest expense over the life of the note payable 9. Landry paid $5,000 cash for warranty service work. If a Warranty Liability account had been previously established, the proper journal entry to record the service work would be: 5.000 a. Sales Cash 5.000 b. Warranty Expense Warranty Liability 5,000 5 ,000 C Warranty Expense Cash 5.000 5.000 d. Warranty Liability Cash 5.000 5.000 10.. The FICA tax is levied on: a. Employees only. . Employers only. c. Both employees and employers. d. Earnings in excess of base amounts