Answered step by step

Verified Expert Solution

Question

1 Approved Answer

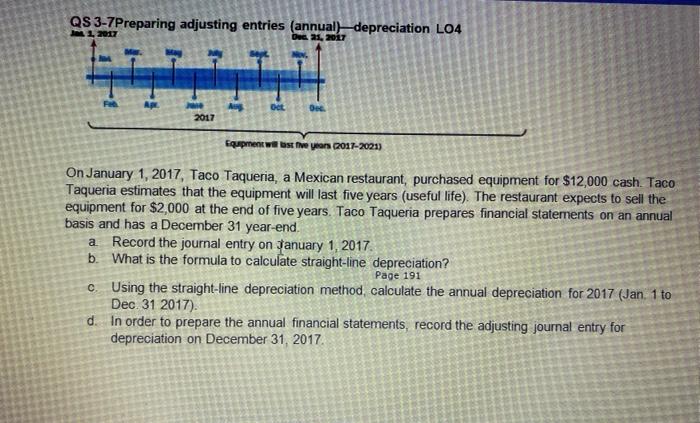

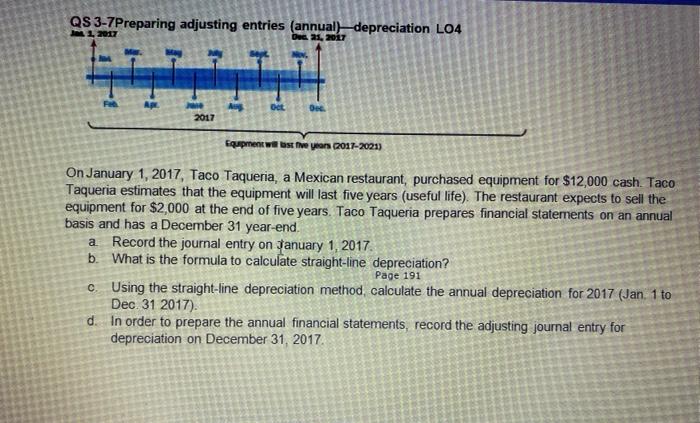

due saturday 11:59 am QS 3-7Preparing adjusting entries (annual) depreciation LO4 Jet 1 2017 Dec 21, 2017 Oct ON 2017 Equipment we best five years

due saturday 11:59 am

QS 3-7Preparing adjusting entries (annual) depreciation LO4 Jet 1 2017 Dec 21, 2017 Oct ON 2017 Equipment we best five years 2017-2021) On January 1, 2017, Taco Taqueria, a Mexican restaurant, purchased equipment for $12,000 cash Taco Taqueria estimates that the equipment will last five years (useful life). The restaurant expects to sell the equipment for $2,000 at the end of five years. Taco Taqueria prepares financial statements on an annual basis and has a December 31 year-end. a Record the journal entry on January 1, 2017 b. What is the formula to calculate straight-line depreciation? Page 191 c. Using the straight-line depreciation method, calculate the annual depreciation for 2017 (Jan 1 to Dec 31 2017) d In order to prepare the annual financial statements, record the adjusting journal entry for depreciation on December 31, 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started