Answered step by step

Verified Expert Solution

Question

1 Approved Answer

due saturday 11.59am QS 3-3Accrual and cash accounting LO3 In its first year of operations, Harris Construction earned $39,000 in revenues and received $33,000 cash

due saturday 11.59am

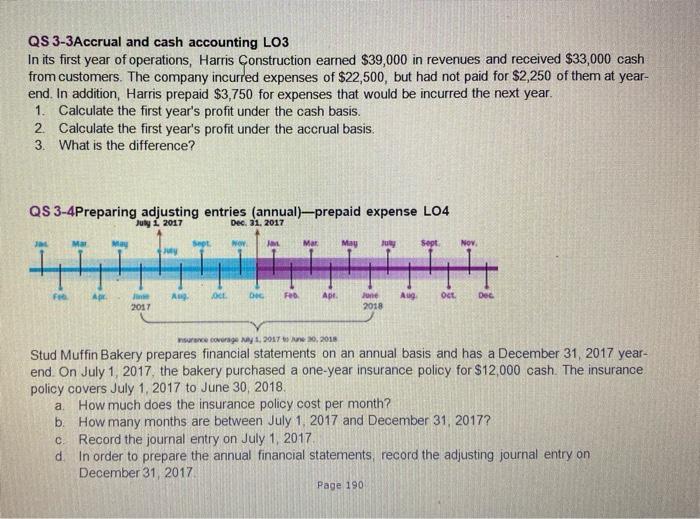

QS 3-3Accrual and cash accounting LO3 In its first year of operations, Harris Construction earned $39,000 in revenues and received $33,000 cash from customers. The company incurred expenses of $22,500, but had not paid for $2,250 of them at year- end. In addition, Harris prepaid $3,750 for expenses that would be incurred the next year. 1. Calculate the first year's profit under the cash basis. 2 Calculate the first year's profit under the accrual basis. 3. What is the difference? QS 3-4Preparing adjusting entries (annual)-prepaid expense L04 July 1 2017 Dec. 31. 2017 May WOW JE Mar May Sept Nov My F Apr A OCE Feb Ape Aug Oct. Dec June 2018 2017 We coverage Ny 1, 2017 2018 . Stud Muffin Bakery prepares financial statements on an annual basis and has a December 31, 2017 year- end On July 1, 2017, the bakery purchased a one-year insurance policy for $12,000 cash. The insurance policy covers July 1, 2017 to June 30, 2018 How much does the insurance policy cost per month? b. How many months are between July 1, 2017 and December 31, 2017? c. Record the journal entry on July 1, 2017 d In order to prepare the annual financial statements, record the adjusting journal entry on December 31, 2017 Page 190

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started