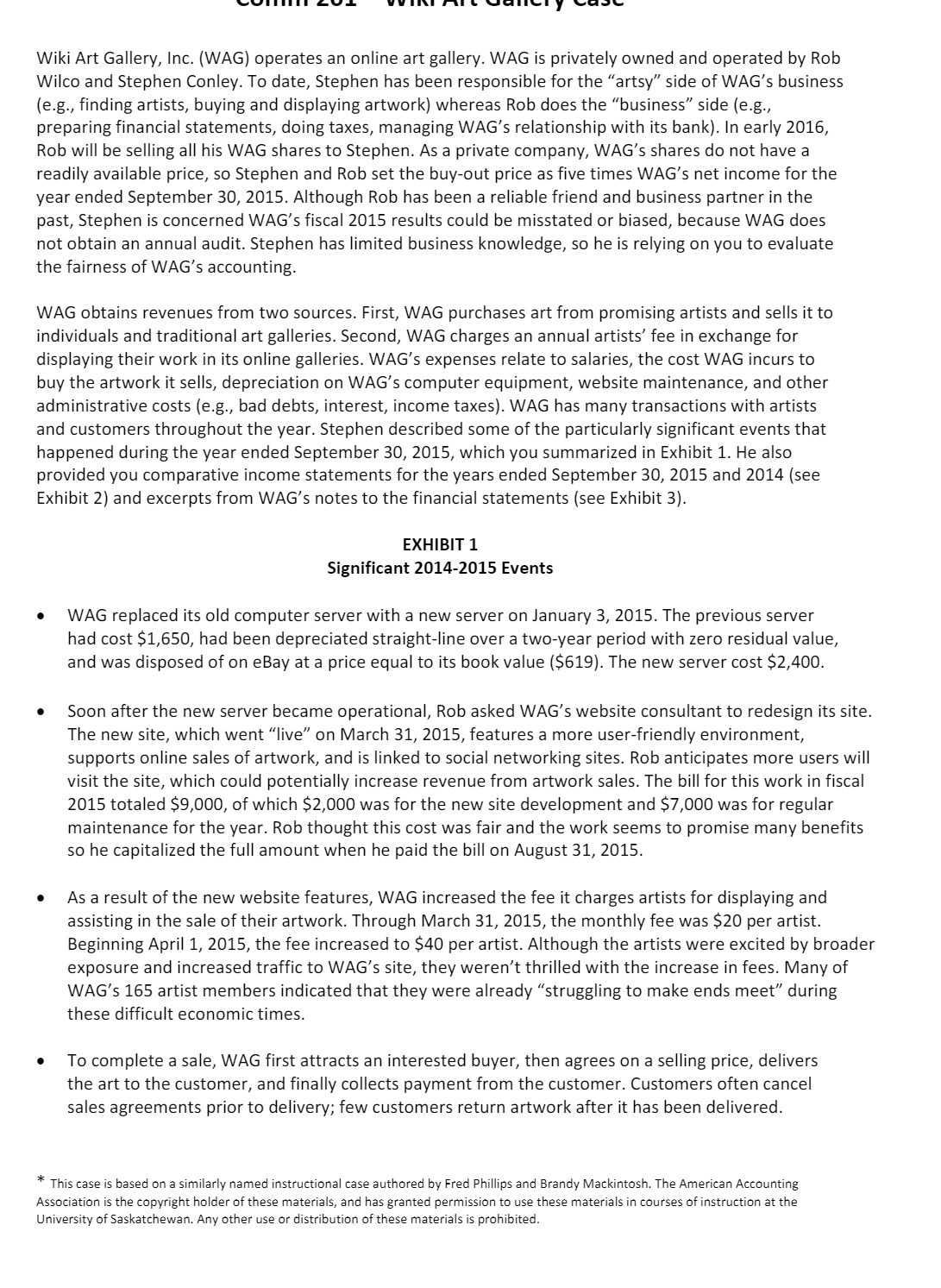

DUIIIIII LUI- I'I'II\\I I'll I. Halli-II , unan Wiki Art Gallery, Inc. (WAG) operates an online art gallery. WAG is privately owned and operated by Rob Wilco and Stephen Conley. To date, Stephen has been responsible for the \"artsy\" side of WAG's business (e.g., finding artists, buying and displaying artwork) whereas Rob does the "business\" side (e.g., preparing financial statements, doing taxes, managing WAG's relationship with its bank). In early 2016, Rob will be selling all his WAG shares to Stephen. As a private company, WAG's shares do not have a readily available price, so Stephen and Rob set the buyout price as five times WAG's net income for the year ended September 30, 2015. Although Rob has been a reliable friend and business partner in the past, Stephen is concerned WAG's fiscal 2015 results could be misstated or biased, because WAG does not obtain an annual audit. Stephen has limited business knowledge, so he is relying on you to evaluate the fairness of WAG's accounting. WAG obtains revenues from two sources. First, WAG purchases art from promising artists and sells it to individuals and traditional art galleries. Second, WAG charges an annual artists' fee in exchange for displaying their work in its online galleries. WAG's expenses relate to salaries, the cost WAG incurs to buy the artwork it sells, depreciation on WAG's computer equipment, website maintenance, and other administrative costs (e.g., bad debts, interest, income taxes). WAG has many transactions with artists and customers throughout the year. Stephen described some of the particularly significant events that happened during the year ended September 30, 2015, which you summarized in Exhibit 1. He also provided you comparative income statements for the years ended September 30, 2015 and 2014 (see Exhibit 2) and excerpts from WAG's notes to the financial statements (see Exhibit 3). EXHIBIT 1 Signicant 2014-2015 Events 0 WAG replaced its old computer server with a new server on January 3, 2015. The previous server had cost $1,650, had been depreciated straight~line over a two~year period with zero residual value, and was disposed of on eBay at a price equal to its book value (5619). The new server cost $2,400. 0 Soon after the new server became operational, Rob asked WAG's website consultant to redesign its site. The new site, which went \"live" on March 31, 2015, features a more userfriendly environment, supports online sales of artwork, and is linked to social networking sites. Rob anticipates more users will visit the site, which could potentially increase revenue from artwork sales. The bill for this work in fiscal 2015 totaled $9,000, of which $2,000 was for the new site development and $7,000 was for regular maintenance for the year. Rob thought this cost was fair and the work seems to promise many benefits so he capitalized the full amount when he paid the bill on August 31, 2015. 0 As a result of the new website features, WAG increased the fee it charges artists for displaying and assisting in the sale of their artwork. Through March 31, 2015, the monthly fee was $20 per artist. Beginning April 1, 2015, the fee increased to 540 per artist. Although the artists were excited by broader exposure and increased traffic to WAG's site, they weren't thrilled with the increase in fees. Many of WAG's 165 artist members indicated that they were already \"struggling to make ends meet" during these difficult economic times. 0 To complete a sale, WAG first attracts an interested buyer, then agrees on a selling price, delivers the art to the customer, and finally collects payment from the customer. Customers often cancel sales agreements prior to delivery; few customers return artwork after it has been delivered. * This case is based on a similarly named instructional case authored by Fred Phillips and Brandy Mackintosh. The American Accounting Association is the copyright holder ofthese materials, and has granted permission to use these materials in courses of instruction at the University ofSaskatchewan. Any other use or distribution of these materials is prohibited