Answered step by step

Verified Expert Solution

Question

1 Approved Answer

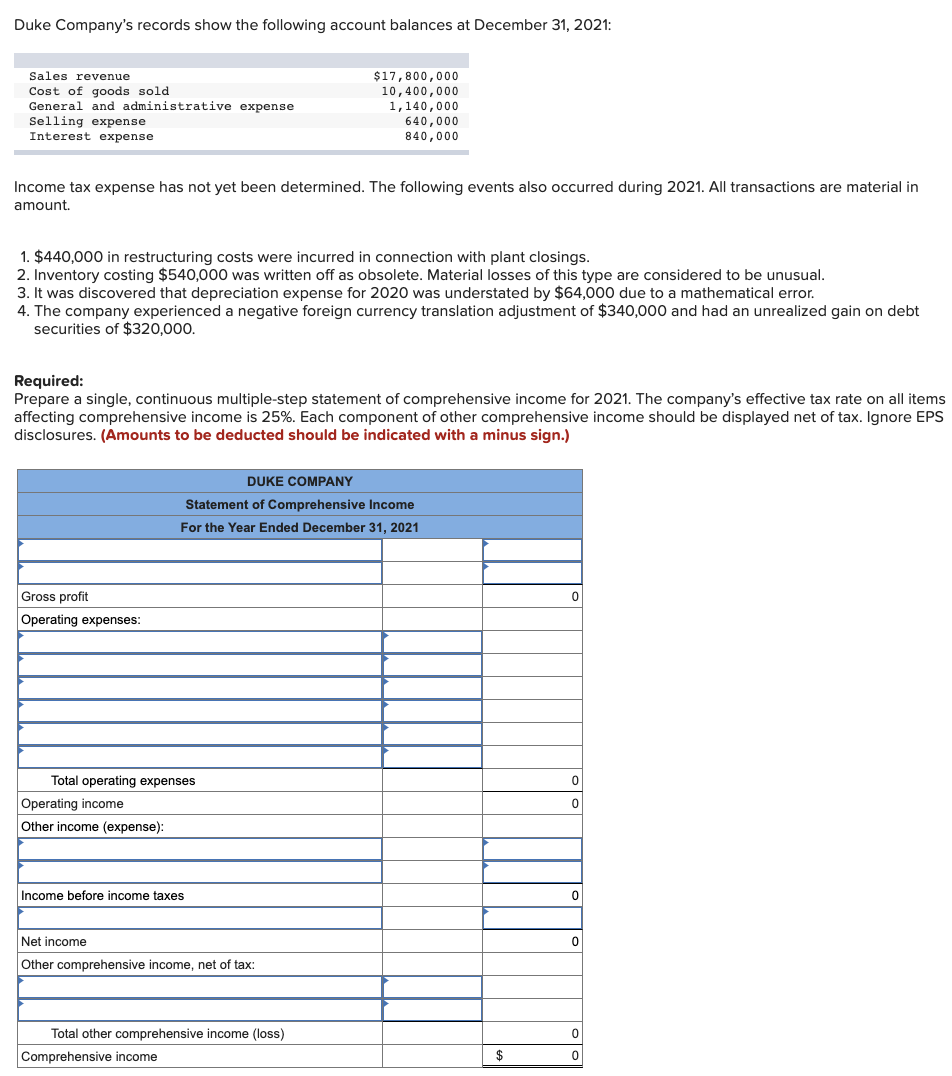

Duke Company's records show the following account balances at December 31, 2021: Sales revenue Cost of goods sold General and administrative expense Selling expense

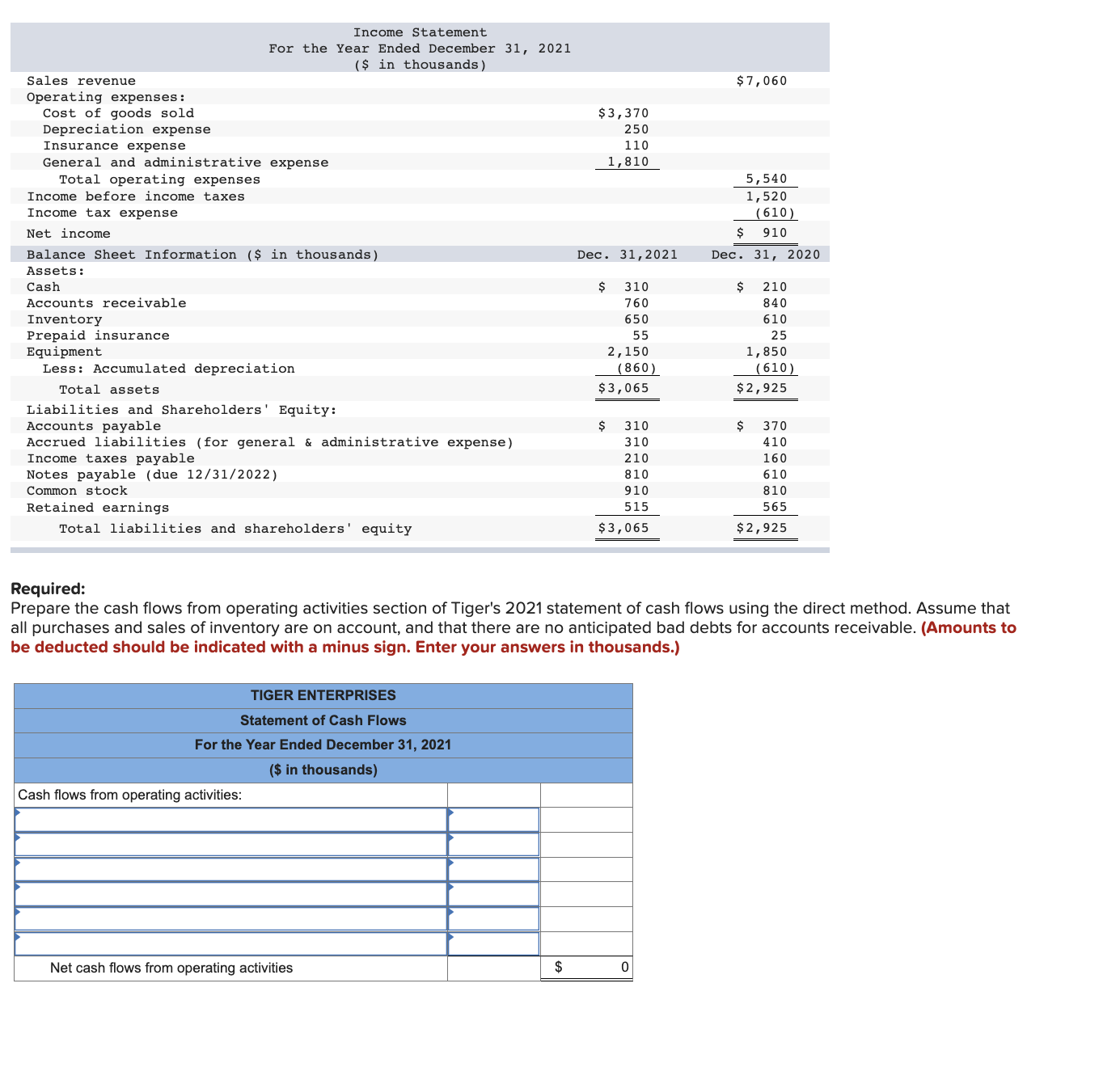

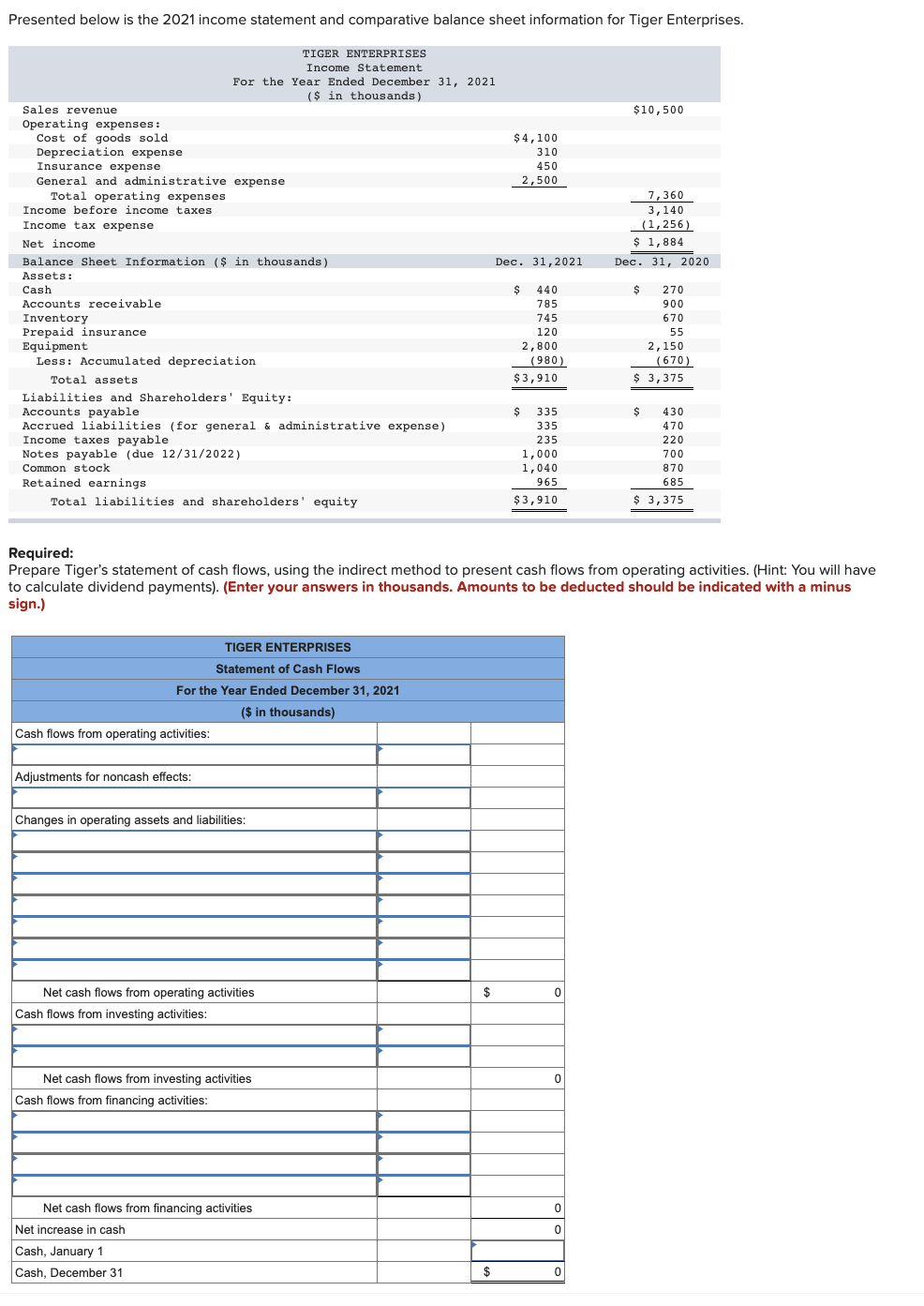

Duke Company's records show the following account balances at December 31, 2021: Sales revenue Cost of goods sold General and administrative expense Selling expense Interest expense $17,800,000 10,400,000 1,140,000 640,000 840,000 Income tax expense has not yet been determined. The following events also occurred during 2021. All transactions are material in amount. 1. $440,000 in restructuring costs were incurred in connection with plant closings. 2. Inventory costing $540,000 was written off as obsolete. Material losses of this type are considered to be unusual. 3. It was discovered that depreciation expense for 2020 was understated by $64,000 due to a mathematical error. 4. The company experienced a negative foreign currency translation adjustment of $340,000 and had an unrealized gain on debt securities of $320,000. Required: Prepare a single, continuous multiple-step statement of comprehensive income for 2021. The company's effective tax rate on all items affecting comprehensive income is 25%. Each component of other comprehensive income should be displayed net of tax. Ignore EPS disclosures. (Amounts to be deducted should be indicated with a minus sign.) Gross profit Operating expenses: DUKE COMPANY Statement of Comprehensive Income For the Year Ended December 31, 2021 Total operating expenses Operating income Other income (expense): Income before income taxes Net income Other comprehensive income, net of tax: 0 0 0 0 0 Total other comprehensive income (loss) Comprehensive income 0 $ 0 Income Statement For the Year Ended December 31, 2021 ($ in thousands) Sales revenue Operating expenses: Cost of goods sold Depreciation expense Insurance expense General and administrative expense Total operating expenses Income before income taxes Income tax expense Net income $7,060 $3,370 250 110 1,810 5,540 1,520 (610) $ 910 Balance Sheet Information ($ in thousands) Dec. 31,2021 Dec. 31, 2020 Assets: Cash $ 310 $ 210 Accounts receivable 760 840 Inventory 650 610 Prepaid insurance 55 25 Equipment 2,150 1,850 Less: Accumulated depreciation (860) (610) Total assets Accounts payable $3,065 $2,925 Liabilities and Shareholders' Equity: $ 310 $ 370 Accrued liabilities (for general & administrative expense) 310 410 Income taxes payable 210 160 Notes payable (due 12/31/2022) 810 610 Common stock Retained earnings 910 810 Total liabilities and shareholders' equity 515 $3,065 565 $2,925 Required: Prepare the cash flows from operating activities section of Tiger's 2021 statement of cash flows using the direct method. Assume that all purchases and sales of inventory are on account, and that there are no anticipated bad debts for accounts receivable. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands.) TIGER ENTERPRISES Statement of Cash Flows For the Year Ended December 31, 2021 ($ in thousands) Cash flows from operating activities: Net cash flows from operating activities $ 0 Presented below is the 2021 income statement and comparative balance sheet information for Tiger Enterprises. TIGER ENTERPRISES Income Statement For the Year Ended December 31, 2021 ($ in thousands) Sales revenue Operating expenses: Cost of goods sold Depreciation expense Insurance expense General and administrative expense Total operating expenses Income before income taxes Income tax expense Net income $4,100 310 450 2,500 $10,500 7,360 3,140 (1,256) $ 1,884 Balance Sheet Information ($ in thousands) Dec. 31,2021 Dec. 31, 2020 Assets: Cash $ 440 $ 270 Accounts receivable 785 900 Inventory 745 670 Prepaid insurance 120 55 Equipment 2,800 2,150 Less: Accumulated depreciation (980) (670) Total assets Liabilities and Shareholders' Equity: Accounts payable Income taxes payable $3,910 $ 3,375 $ 335 $ 430 Accrued liabilities (for general & administrative expense) 335 470 235 220 Notes payable (due 12/31/2022) 1,000 700 Common stock Retained earnings 1,040 870 Total liabilities and shareholders' equity 965 $3,910 685 $ 3,375 Required: Prepare Tiger's statement of cash flows, using the indirect method to present cash flows from operating activities. (Hint: You will have to calculate dividend payments). (Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign.) TIGER ENTERPRISES Statement of Cash Flows For the Year Ended December 31, 2021 Cash flows from operating activities: Adjustments for noncash effects: Changes in operating assets and liabilities: ($ in thousands) Net cash flows from operating activities Cash flows from investing activities: Net cash flows from investing activities Cash flows from financing activities: Net cash flows from financing activities Net increase in cash Cash, January 1 Cash, December 31 0 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started