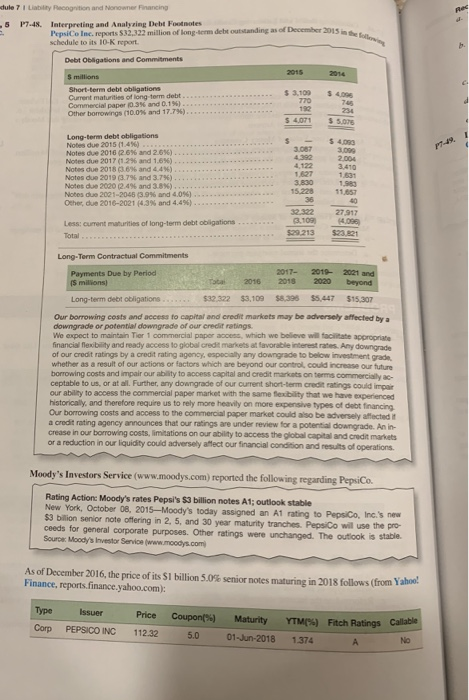

dule 7 I Liability Recognition and Nonowner Financing P7-48. Interpreting and Analyzing Debt Footnotes 5 PepsiCe Inc. reports $32,322 milion of long-derm debt outstanding as of December 2013 in schedule to its 10-K report Debt Obligations and Commitments Short-term debt obligations Current maturities of long-term debt Commercial paper (0.3%and 0.1%) Other borrow ngs (10.0% and i 7.796) . .. .. . 3.100 %4096 770 4071$5.076 Long-term debt obligations Notes due 2015 (1.4%) Notes a" 2016(2.6% and 26%) 3.087 309 2.004 3.410 Notes due 2018(36% and 4.4%) Notes due 2019 a 7% and 37%) Notes due 2020 (2.4% and 3.8%) Notes due 2021-2045(3.9% and 4.0%) Other, due 2016-2021 (43% and 4.4%) 1,627 3.830 983 15.22811,657 40 3232227917 Less: current maturities of long-term debt obiigations Total 29 213$23,821 2017- 2019 2021 Payments Due by Period Tota 2016 2018 2020 beyond $32.322 $3,109 $8,398 $5,447 $15,307 Long-term debt obligations Our borrowing costs and access to capital and credit markets may be adversely affected by a downgrade or potential downgrade of our credit ratings We expect to maintain Tior 1 commercial paper access, which we believe will facilitate appropriane fnancial fhlexibity and ready access to global credit markets at avorable interest rates. Anmy downgrade of our credit ratings by a credit rating agency, especialty any downgrade to below investment grade whether as a result of our actions or factors which are beyond our control, could increase our future borrowing costs and impair our ability to access capital and credit markats on terms commercialy ac- ceptable to us, or at all. Further, any downgrade of our current short-term credit ratings could impair our ability to access the commercial paper market with the same flexibility that we have experienced historically, and therefore require us to rely more heavily on more expensive types of debt financing Our borrowing costs and access to the commercial paper market could also be adversely affected t a credit rating agency announces that our ratings are under review for a potential downgrade. An in- crease in our borrowing costs, limitations on our ability to access the global capital and credt markets or a reduction in our liquidity could adversely affect our financial condition and results of operations. foody's Investors Service (www.moodys.com) reported the following regarding PepsiCo. Rating Action: Moody's rates Pepsi's $3 billion notes A1; outlook stable New York, October 08, 2015-Moody's today assigned an A1 rating to PepsiCo, Inc.s new $3 bilion senior note offering in 2, 5, and 30 year maturity tranches PepsiCo will use the pro- ceeds for general corporate purposes. Other ratings were unchanged. The outlook is Souroe: Moody's Investor Service(www.moodys.com) I stable. As of December 2016, the price of its S1 billion 5.0% senior notes maturing in 2018 follows (from y Finance, reports.finance.yahoo.com): TypeIssuer Price Coupon(%) Maturity YTM(%) Fitch Ratings Corp PEPSICO INC 112.32 5.0 01-Jun-2018 1374 dule 7 I Liability Recognition and Nonowner Financing P7-48. Interpreting and Analyzing Debt Footnotes 5 PepsiCe Inc. reports $32,322 milion of long-derm debt outstanding as of December 2013 in schedule to its 10-K report Debt Obligations and Commitments Short-term debt obligations Current maturities of long-term debt Commercial paper (0.3%and 0.1%) Other borrow ngs (10.0% and i 7.796) . .. .. . 3.100 %4096 770 4071$5.076 Long-term debt obligations Notes due 2015 (1.4%) Notes a" 2016(2.6% and 26%) 3.087 309 2.004 3.410 Notes due 2018(36% and 4.4%) Notes due 2019 a 7% and 37%) Notes due 2020 (2.4% and 3.8%) Notes due 2021-2045(3.9% and 4.0%) Other, due 2016-2021 (43% and 4.4%) 1,627 3.830 983 15.22811,657 40 3232227917 Less: current maturities of long-term debt obiigations Total 29 213$23,821 2017- 2019 2021 Payments Due by Period Tota 2016 2018 2020 beyond $32.322 $3,109 $8,398 $5,447 $15,307 Long-term debt obligations Our borrowing costs and access to capital and credit markets may be adversely affected by a downgrade or potential downgrade of our credit ratings We expect to maintain Tior 1 commercial paper access, which we believe will facilitate appropriane fnancial fhlexibity and ready access to global credit markets at avorable interest rates. Anmy downgrade of our credit ratings by a credit rating agency, especialty any downgrade to below investment grade whether as a result of our actions or factors which are beyond our control, could increase our future borrowing costs and impair our ability to access capital and credit markats on terms commercialy ac- ceptable to us, or at all. Further, any downgrade of our current short-term credit ratings could impair our ability to access the commercial paper market with the same flexibility that we have experienced historically, and therefore require us to rely more heavily on more expensive types of debt financing Our borrowing costs and access to the commercial paper market could also be adversely affected t a credit rating agency announces that our ratings are under review for a potential downgrade. An in- crease in our borrowing costs, limitations on our ability to access the global capital and credt markets or a reduction in our liquidity could adversely affect our financial condition and results of operations. foody's Investors Service (www.moodys.com) reported the following regarding PepsiCo. Rating Action: Moody's rates Pepsi's $3 billion notes A1; outlook stable New York, October 08, 2015-Moody's today assigned an A1 rating to PepsiCo, Inc.s new $3 bilion senior note offering in 2, 5, and 30 year maturity tranches PepsiCo will use the pro- ceeds for general corporate purposes. Other ratings were unchanged. The outlook is Souroe: Moody's Investor Service(www.moodys.com) I stable. As of December 2016, the price of its S1 billion 5.0% senior notes maturing in 2018 follows (from y Finance, reports.finance.yahoo.com): TypeIssuer Price Coupon(%) Maturity YTM(%) Fitch Ratings Corp PEPSICO INC 112.32 5.0 01-Jun-2018 1374