Answered step by step

Verified Expert Solution

Question

1 Approved Answer

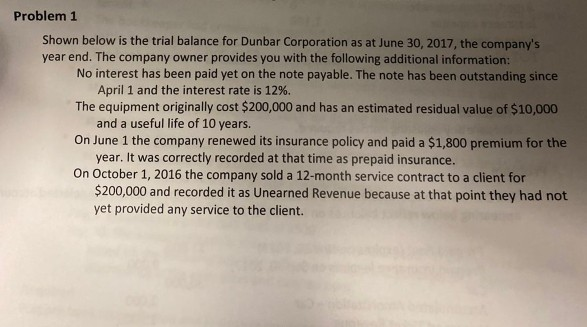

DUNBAR CORPORATION TRIAL BALANCE AS AT JUNE 30, 2017 Credit Debit 8,900 28,000 1,200 100,000 Cash Accounts receivable Prepaid insurance Equipment Accumulated amortization Accounts payable

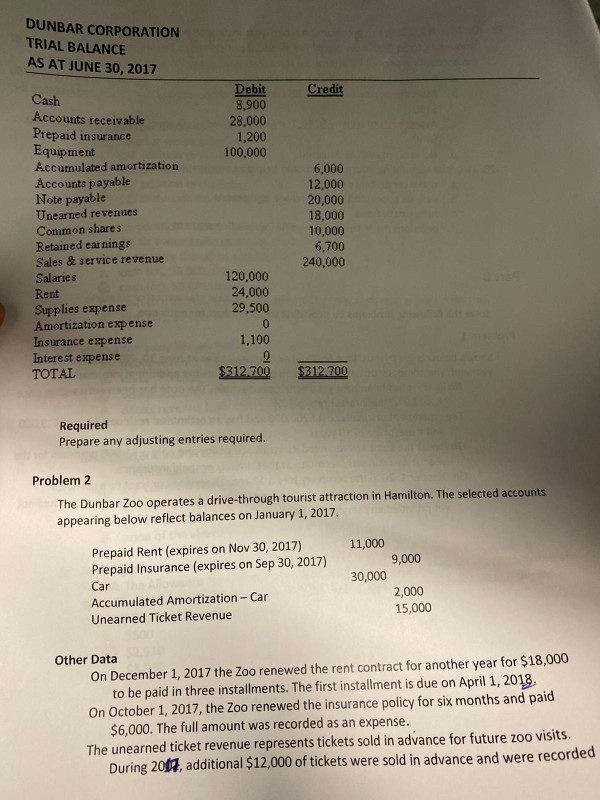

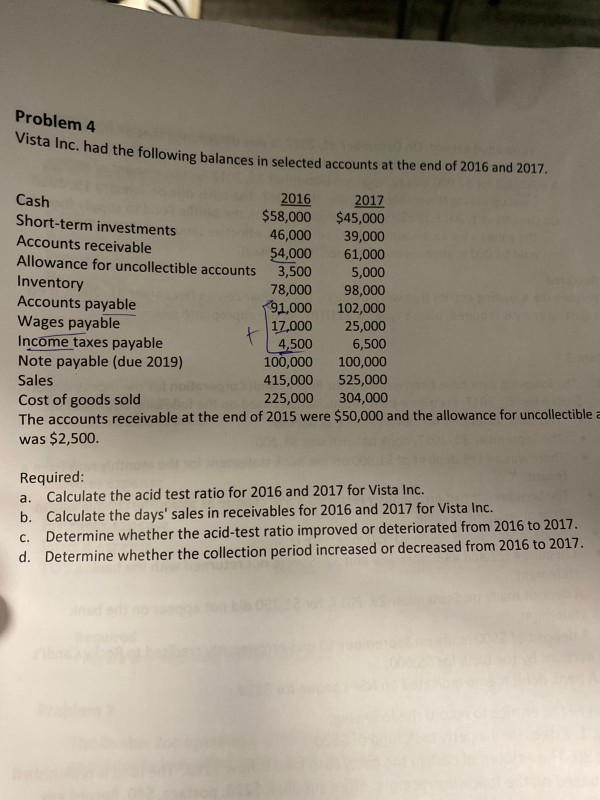

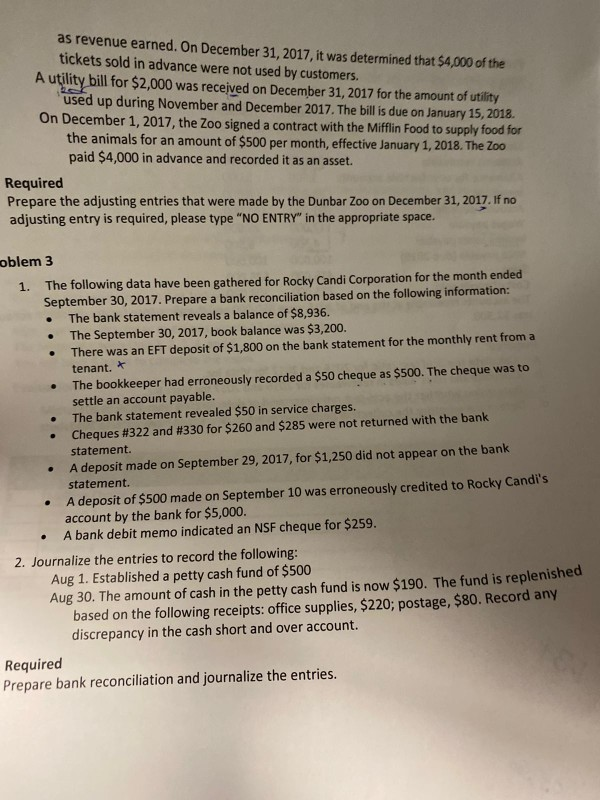

DUNBAR CORPORATION TRIAL BALANCE AS AT JUNE 30, 2017 Credit Debit 8,900 28,000 1,200 100,000 Cash Accounts receivable Prepaid insurance Equipment Accumulated amortization Accounts payable Note payable Unearned revenues Common shares Retained earnings Sales & service revenue Salaries Rent Supplies expense Amortization expense Insurance expense Interest expense TOTAL 6,000 12,000 20,000 18.000 10,000 6.700 240,000 120,000 24,000 29,500 1,100 $312.700 $312.700 Required Prepare any adjusting entries required. Problem 2 The Dunbar Zoo operates a drive-through tourist attraction in Hamilton. The selected accounts appearing below reflect balances on January 1, 2017. Prepaid Rent (expires on Nov 30, 2017) Prepaid Insurance (expires on Sep 30, 2017) Car Accumulated Amortization - Car Unearned Ticket Revenue 11,000 9,000 30,000 2,000 15,000 Other Data On December 1, 2017 the Zoo renewed the rent contract for another year for $18,000 to be paid in three installments. The first installment is due on April 1, 2018. On October 1, 2017, the Zoo renewed the insurance policy for six months and paid $6,000. The full amount was recorded as an expense. The unearned ticket revenue represents tickets sold in advance for future zoo visits. During 2007, additional $12,000 of tickets were sold in advance and were recorded Problem 4 Vista Inc. had the following balances in e following balances in selected accounts at the end of 2016 and 2017, Cash 2016 2017 Short-term investments $58,000 $45,000 46,000 39,000 Accounts receivable 54,000 61,000 Allowance for uncollectible accounts 3,500 5,000 Inventory 78,000 98,000 Accounts payable 91,000 Wages payable 17,000 25,000 Income taxes payable 4,500 Note payable (due 2019) 100,000 100,000 Sales 415,000 525,000 Cost of goods sold 225,000 304,000 The accounts receivable at the end of 2015 were $50,000 and the allowance for uncollectible a was $2,500. 6,500 Required: a. Calculate the acid test ratio for 2016 and 2017 for Vista Inc. b. Calculate the days' sales in receivables for 2016 and 2017 for Vista Inc. C. Determine whether the acid-test ratio improved or deteriorated from 2016 to 2017. d. Determine whether the collection period increased or decreased from 2016 to 2017. as revenue earned. On December 31, 2017, it was determined that $4,000 of the tickets sold in advance were not used by customers. A utility bill for $2,000 was received on December 31, 2017 for the amount of utility used up during November and December 2017. The bill is due on January 15, 2018 On December 1, 2017, the Zoo signed a contract with the Mifflin Food to supply food for the animals for an amount of $500 per month, effective January 1, 2018. The Zoo paid $4,000 in advance and recorded it as an asset. Required Prepare the adjusting entries that were made by the Dunbar Zoo on December 31, 2017. If no adjusting entry is required, please type "NO ENTRY" in the appropriate space. oblem 3 1. The following data have been gathered for Rocky Candi Corporation for the month ended September 30, 2017. Prepare a bank reconciliation based on the following information: The bank statement reveals a balance of $8,936. The September 30, 2017, book balance was $3,200. There was an EFT deposit of $1,800 on the bank statement for the monthly rent from a tenant.* The bookkeeper had erroneously recorded a $50 cheque as $500. The cheque was to settle an account payable. The bank statement revealed $50 in service charges. Cheques #322 and #330 for $260 and $285 were not returned with the bank statement. A deposit made on September 29, 2017, for $1,250 did not appear on the bank statement. A deposit of $500 made on September 10 was erroneously credited to Rocky Candi's account by the bank for $5,000. A bank debit memo indicated an NSF cheque for $259. 2. Journalize the entries to record the following: Aug 1. Established a petty cash fund of $500 Aug 30. The amount of cash in the petty cash fund is now $190. The fund is replenished based on the following receipts: office supplies, $220;postage, $80. Record any discrepancy in the cash short and over account. Required Prepare bank reconciliation and journalize the entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started