Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Duncan Construction Company has won the bid to be the contractor of the Fil-Air, Inc. Shopping Complex project in Canlubang. The construction project is

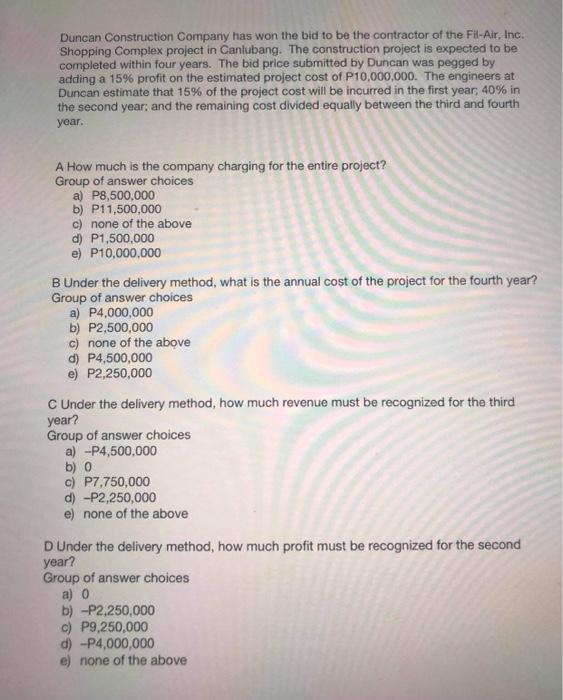

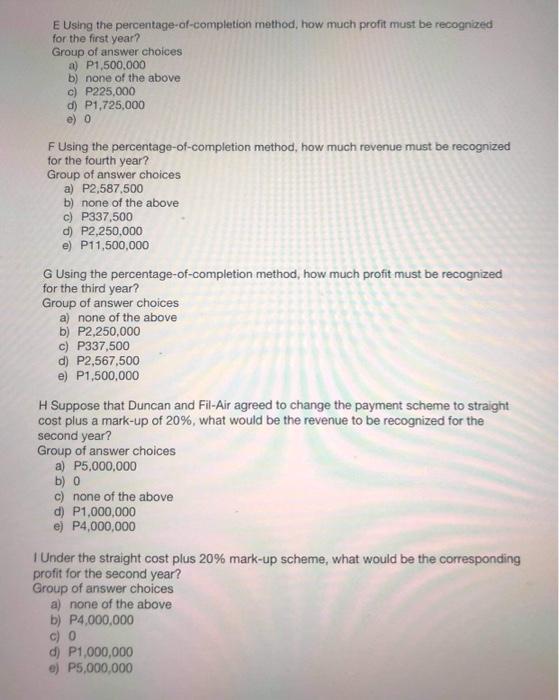

Duncan Construction Company has won the bid to be the contractor of the Fil-Air, Inc. Shopping Complex project in Canlubang. The construction project is expected to be completed within four years. The bid price submitted by Duncan was pegged by adding a 15% profit on the estimated project cost of P10,000,000. The engineers at Duncan estimate that 15% of the project cost will be incurred in the first year, 40% in the second year; and the remaining cost divided equally between the third and fourth year. A How much is the company charging for the entire project? Group of answer choices a) P8,500,000 b) P11,500,000 c) none of the above d) P1,500,000 e) P10,000,000 B Under the delivery method, what is the annual cost of the project for the fourth year? Group of answer choices a) P4,000,000 b) P2,500,000 c) none of the above d) P4,500,000 e) P2,250,000 C Under the delivery method, how much revenue must be recognized for the third year? Group of answer choices a) -P4,500,000 b) 0 c) P7,750,000 d) -P2,250,000 e) none of the above D Under the delivery method, how much profit must be recognized for the second year? Group of answer choices a) 0 b) -P2,250,000 c) P9,250,000 d) -P4,000,000 e) none of the above E Using the for the first year? Group of answer choices a) P1,500,000 b) none of the above c) P225,000 d) P1,725,000 e) 0 percentage-of-completion method, how much profit must be recognized F Using the percentage-of-completion method, how much revenue must be recognized for the fourth year? Group of answer choices a) P2,587,500 b) none of the above c) P337,500 d) P2,250,000 e) P11,500,000 G Using the percentage-of-completion method, how much profit must be recognized for the third year? Group of answer choices a) none of the above b) P2,250,000 c) P337,500 d) P2,567,500 e) P1,500,000 H Suppose that Duncan and Fil-Air agreed to change the payment scheme to straight cost plus a mark-up of 20%, what would be the revenue to be recognized for the second year? Group of answer choices a) P5,000,000 b) 0 c) none of the above d) P1,000,000 e) P4,000,000 I Under the straight cost plus 20% mark-up scheme, what would be the corresponding profit for the second year? Group of answer choices a) none of the above b) P4,000,000 (C) d) P1,000,000 e) P5,000,000

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answers A The company is charging bP11500000 for the entire project B Under the delivery method the annual cost of the project for the fourth year is d P4500000 C Under the delivery method the revenue ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started