Answered step by step

Verified Expert Solution

Question

1 Approved Answer

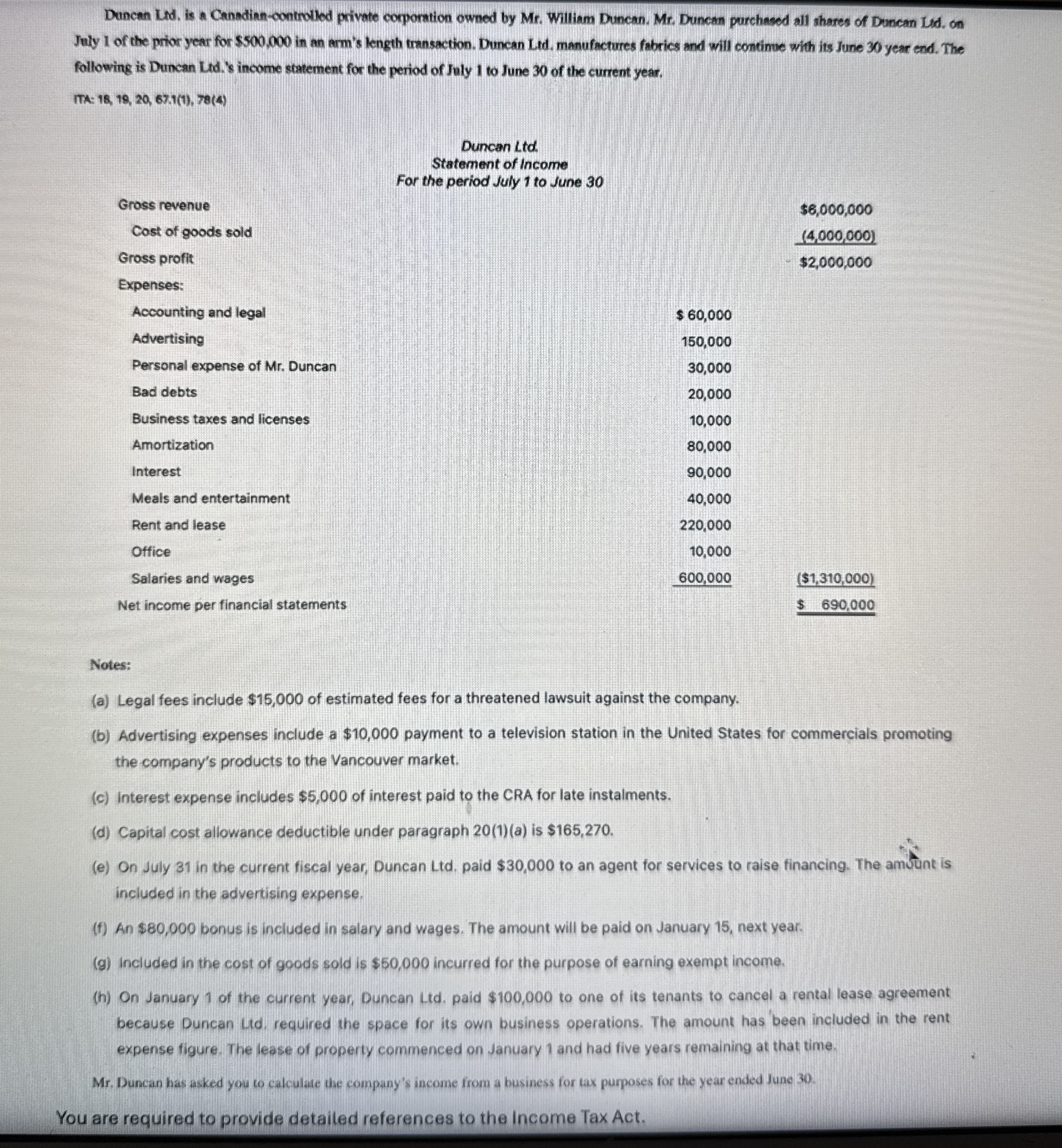

Duncen Ltd , is a Cenadian - controlled private corporation owned by Mr . William Duncan. Mr . Duncan purchased all shares of Duncan Ltd

Duncen Ltd is a Cenadiancontrolled private corporation owned by Mr William Duncan. Mr Duncan purchased all shares of Duncan Ltd on

July of the prior year for $ in an arm's length transaction. Duncan Ltd manufactures fabrics and will continue with its June year end. The following is Duncan Lid,s income statement for the period of July to June of the current year. CHECK PICTURE OF JNCOMEINCOME STATMENT!!!

ITA:

Notes:

a Legal fees include $ of estimated fees for a threatened lawsuit against the company.

b Advertising expenses include a $ payment to a television station in the United States for commercials promoting

the company's products to the Vancouver market.

c Interest expense includes $ of interest paid to the CRA for late instalments.

d Capital cost allowance deductible under paragraph a is $

e On July in the current fiscal year, Duncan Ltd paid $ to an agent for services to raise financing. The amount is included in the advertising expense.

f An $ bonus is included in salary and wages. The amount will be paid on January next year.

g Included in the cost of goods sold is $ incurred for the purpose of earning exempt income.

h On January of the current year, Duncan Ltd paid $ to one of its tenants to cancel a rental lease agreement

because Duncan Lid, required the space for its own business operations. The amount has been included in the rent

expense figure. The lease of property commenced on January and had five years remaining at that time.

Mr Duncan has asked you to calculate the company's income from a business for tax purposes for the year ended June

You are required to provide detailed references to the Canadian Income Tax Act.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started