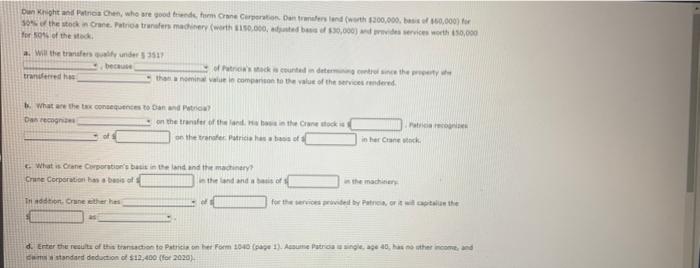

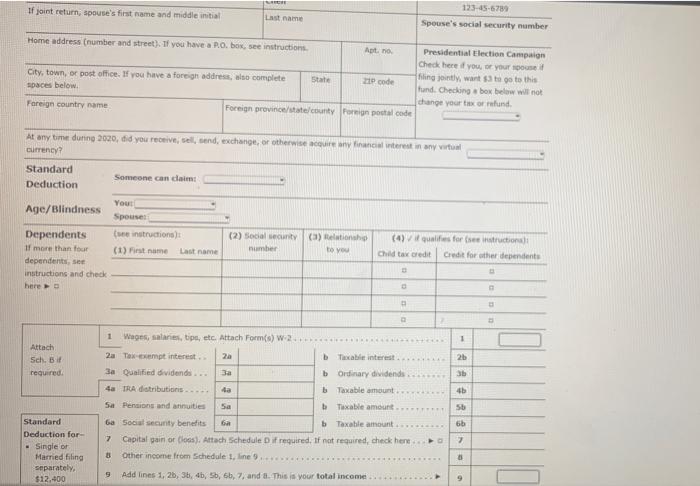

Dunght and to Chen, who are good tradem Cane Curtis anders and worth $300,000.00.000) for So the stock n Crane. Pri tre medier (worth 180.000 had bee530,000) und deservices with 50,000 for of the a. Will the transfer 3511 because of tracks under control in the pret transferred thaminan companion to the value of the videre What are the one to Dan and Petrica? Dane on the transfer of the the cock on the treater Patricia hasa basa o in her neck What is Crane Corporation's best in the land and the machinery Cane Corporation has a basso the land of the machinery Tron Cunether hes for the services wide by Patna, or wit citation the di Enter the results of this transaction to Patricia on her Form 1000 (page 1). Asume Petrosae has the comme cm standard deduction of $12,400 (for 2020) SRCE If joint return, spouse's first name and middle initial Last name 123-456789 Spouse's social security number Home address (number and street). If you have a RO box, see instructions Apt.no Presidential Election Campaign Check here you, or your City, town, or post office. If you have a foreign address, also complete State code filing jointly want to go to this tund. Checking a box below will not spaces below. change your tax or refund Foreign country name Foreign province/statcounty Foreign postal code At any time during 2020, did you receive, sell, and exchange, or otherwise in financial interest in any wal Currency? Standard Someone can dat Deduction Yout Age/Blindness Spouses Dependents Ce instructions): (2) Social security (3) Relations (4) qualifies for struction If more than four (1) First name Last name number to you Child tax credit Credit for other dependents dependents instructions and check . here 1 Attach Sch. B required 2b 4b 1 Wages, salas, tips, etc. Attach Form() W-2 2a Txempt interest. 2 Thxable interest 3a Qualified dividends.. b Ordinary dividende 4a TRA distributions ..... 4a Taxable amount 5a Pensions and annuities 5a Taxable amount 6a Social security benefits b Taxable amount 7 Capital gain or loss). Attach Schedule Dif required. If not required, check here 3 Other income from Schedule 1. line Sb 6b 7 Standard Deduction for - Single or Married filing separately, $12.400 9 Add lines 1, 2, 3, 4, 5, 6, 7, and . This is your total income 9 Dunght and to Chen, who are good tradem Cane Curtis anders and worth $300,000.00.000) for So the stock n Crane. Pri tre medier (worth 180.000 had bee530,000) und deservices with 50,000 for of the a. Will the transfer 3511 because of tracks under control in the pret transferred thaminan companion to the value of the videre What are the one to Dan and Petrica? Dane on the transfer of the the cock on the treater Patricia hasa basa o in her neck What is Crane Corporation's best in the land and the machinery Cane Corporation has a basso the land of the machinery Tron Cunether hes for the services wide by Patna, or wit citation the di Enter the results of this transaction to Patricia on her Form 1000 (page 1). Asume Petrosae has the comme cm standard deduction of $12,400 (for 2020) SRCE If joint return, spouse's first name and middle initial Last name 123-456789 Spouse's social security number Home address (number and street). If you have a RO box, see instructions Apt.no Presidential Election Campaign Check here you, or your City, town, or post office. If you have a foreign address, also complete State code filing jointly want to go to this tund. Checking a box below will not spaces below. change your tax or refund Foreign country name Foreign province/statcounty Foreign postal code At any time during 2020, did you receive, sell, and exchange, or otherwise in financial interest in any wal Currency? Standard Someone can dat Deduction Yout Age/Blindness Spouses Dependents Ce instructions): (2) Social security (3) Relations (4) qualifies for struction If more than four (1) First name Last name number to you Child tax credit Credit for other dependents dependents instructions and check . here 1 Attach Sch. B required 2b 4b 1 Wages, salas, tips, etc. Attach Form() W-2 2a Txempt interest. 2 Thxable interest 3a Qualified dividends.. b Ordinary dividende 4a TRA distributions ..... 4a Taxable amount 5a Pensions and annuities 5a Taxable amount 6a Social security benefits b Taxable amount 7 Capital gain or loss). Attach Schedule Dif required. If not required, check here 3 Other income from Schedule 1. line Sb 6b 7 Standard Deduction for - Single or Married filing separately, $12.400 9 Add lines 1, 2, 3, 4, 5, 6, 7, and . This is your total income 9