| Dunkin Donuts | Starbuks | |

| | 2018 | 2017 | 2018 | 2017 | |

| Current Ratio | 1.51 | 2.69 | 2.20 | 1.25 | |

| Current Assets/Current Liabilties | 813473/539581 | 1304333/484499 | 12494200/5684200 | 5283400/4220700 | |

| | | | | | |

| Acid Test ratio | 1.22 | 2.35 | 1.69 | 0.84 | |

| | (517594+75963+64412+)/539581 | (1018317+69517+52332)/484499 | (8756300+181500+693100)/5684200 | (2462300+228600+870400)/4220700 |

| | | | | | |

| Inventory Turnover ratio | | | | | |

| COGS/Avg Inventory | Neglible inventory in prepaid expenses | so cant calculate it | 7.36 | 6.59 | |

| | | | 10174500/((1400500+1364000)/2) | 9034300/((1364000+1378500)/2) |

| Ratio day sales in invesntory | | | | | |

| Inv Turnover/365 | Neglible inventory in prepaid expenses | so cant calculate it | | | |

| | | | | | |

| Ratio days in receivables | 36.21 | 29.62 | 11.54 | 13.36 | |

| Avg rec/Sales*365 | ((140375+121849)/2)/1321617*365 | ((121849+85184)/1275551*365 | ((693100+870400)/2)/24719500*365 | ((870400+768800)/2)/22386800*365 |

| | | | | | |

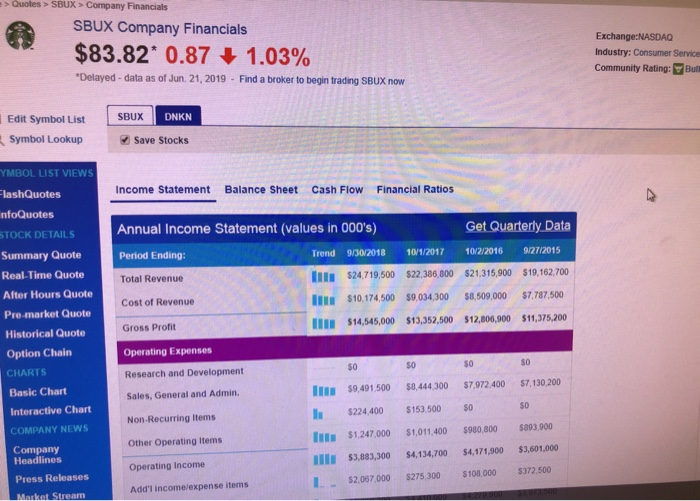

| Gross profit Margin | 89.7 | 89.2 | 29.7 | 30.6 | % |

| Gross profit/revenue*100 | 1186103/1321617*100 | 1138238/1275551*100 | 7351800/24719500*100 | 6859200/22386800*100 | |

| | | | as per nasdaq data | | |

| | | | 58.8 | 59.6 | % |

| | | | 14545000/24719500*100 | 13352500/22386800*100 |

provide one page of discussion of what the financial data revealed compare the two companies make recommendation discus any events that may impact the financial state of the company.

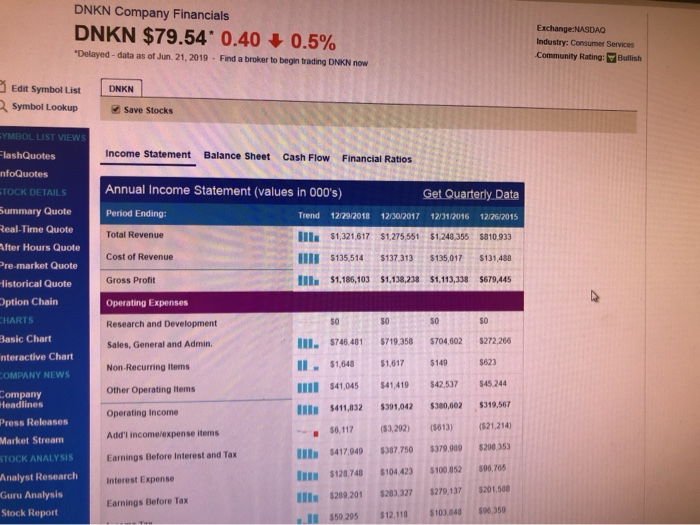

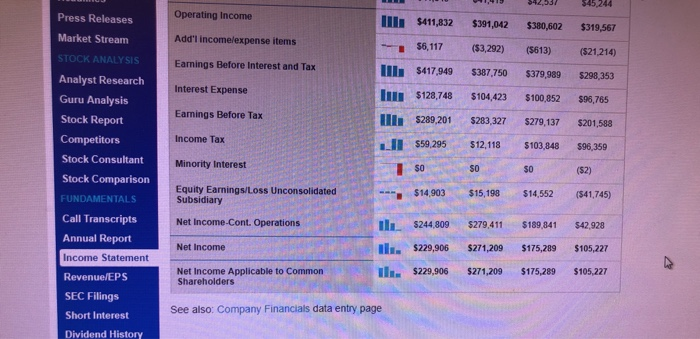

DNKN Company Financials DNKN $79.54 0.40 0.5% Exchange:NASDAQ Industry: Consumer Services Delayed- data as of Jun, 21, 2019- Find a broker to begin trading DNKN now Community Rating:Bullish Edit Symbol List DNKN Symbol Lookup Save Stocks YMBOL LIST VIEWS lashQuotes Income Statement Balance Sheet Cash Flow Financial Ratios nfoQuotes Annual Income Statement (values in 000's) TOCK DETAILS Get Quarterly Data Summary Quote Period Ending: Trend 12/29/2018 12/30/2017 12/31/2016 12/26/2015 Real-Time Quote Total Revenue ll$1,321,617 $1,275,5511 $1,248,355 $810,933 After Hours Quote Cost of Revenue $135,514 $137.313 $135,017 $131,488 Pre-market Quote l $1.186,103 $1,138,238 $1,113,338 $679,445 Gross Profit Historical Quote Option Chain Operating Expenses CHARTS 50 S0 Research and Development 50 S0 Basic Chart $272,266 Jll $746 481 $719.358 $704.602 Sales, General and Admin. nteractive Chart $149 $623 II. $1,617 $1,648 Non-Recurring Items COMPANY NEWS $45.244 I$41,045 $41,419 $42,537 Other Operating Items Company Headlines $319,567 $391,042 $380,602 ll $411,832 Operating Income Press Releases ($21,214) ($3,202) ($613) 56,117 Add'l incomelexpense items Market Stream $379 989 $208 353 $387 750 $417.949 lla STOCK ANALYSIS Earnings Before Interest and Tax S96 765 $100 852 $104 423 Analyst Research I $128.748 Interest Expense $201.508 $279 137 $283.327 Guru Analysis lls $209,201 Earnings Before Tax $96.359 $103.648 Stock Report $12.110 JI$50.295 Tau $45,244 Operating Income Press Releases l$411,832 $391,042 $380,602 $319,567 Market Stream Add'l incomelexpense items $6,117 ($3,292) ($613) ($21,214) STOCK ANALYSIS Earnings Before Interest and Tax l$417,949 $387,750 $379,989 $298,353 Analyst Research Interest Expense I $128,748 $104,423 Guru Analysis $100,852 $96,765 Earmings Before Tax l$289,201 Stock Report $283,327 $279,137 $201,588 Competitors Income Tax $59,295 $12,118 $96.359 $103,848 Stock Consultant Minority Interest S0 SC (S2) Stock Comparison Equity Earnings/Loss Unconsolidated Subsidiary $14,903 $15,198 $14,552 ($41,745) FUNDAMENTALS Call Transcripts Net Income-Cont. Operations $279.411 S244,809 $189,841 $42,928 Annual Report l $229,906 Net Income $271,209 $175,289 $105,227 Income Statement i $229,906 Net Income Applicable to Common Shareholders $271,209 $175,289 $105.227 Revenue/EPS SEC Filings See also: Company Financials data entry page Short Interest Dividend History > Quotes> SBUX> Company Financials SBUX Company Financials $83.82 0.87 Exchange:NASDAQ 1.03% Industry: Consumer Service Community Rating: Bull Delayed- data as of Jun. 21, 2019 Find a broker to begin trading SBUX now Edit Symbol List Symbol Lookup SBUX DNKN Save Stocks YMBOL LIST VIEWS Income Statement Balance Sheet lashQuotes Cash Flow Financial Ratios nfoQuotes Annual Income Statement (values in 000's) Get Quarterly Data STOCK DETAILS Summary Quote Period Ending: Trend 9/30/2018 10/1/2017 9/27/2015 10/2/2016 Real-Time Quote Ill$24,719.500 Total Revenue $22.386.000 $21.315,900 $19,162.700 After Hours Quote I $10.174,500 $8.509,000 Cost of Revenue $9,034,300 $7,787,500 Pre-market Quote l$14,545,000 Gross Profit $13,352,500 $12,806,900 $11,375,200 Historical Quote Option Chain Operating Expenses CHARTS S0 $0 S0 Research and Development Basic Chart $7,130.200 $7.972 400 $8,444,300 Iu $9,491.500 Sales, General and Admin. Interactive Chart So S0 $224.400 $153.500 Non-Recurring Items COMPANY NEWS $893.900 $980,800 $1.011.400 Ill$1.247.000 Other Operating Items Company Headlines $3,601,000 $4.171,900 $4,134,700 ll$3,883,300 Operating Income Press Releases $372 500 $275 300 $108 000 $2.067 000 Add'l income/expense items Market Stream vestm Felsonlal Pre-market Quote I$14,545,000 $13,352,500 Gross Profit $12,806,900 $11,375,200 Historical Quote Option Chain Operating Expenses CHARTS Research and Development S0 $0 $0 $0 Basic Chart l $9,491,500 Sales, General and Admin. $8,444,300 $7,972,400 $7,130,200 Interactive Chart Non-Recurring Items S0 $224,400 $153,500 S0 COMPANY NEWS Other Operating Items I $1,247,000 $1,011,400 $980,800 $893,900 Company Headlines Operating Income Jll$3,883,300 $4,134,700 $4,171,900 $3,601,000 Press Releases L$2,067,000 $275,300 Add'l incomelexpense items $108,000 $372,500 Market Stream STOCK ANALYSIS Ju $5,950,30 Earnings Before Interest and Tax $4,410,000 $4,279,900 $3,973,500 Analyst Research Interest Expense I $170.300 $92,500 $81,300 $70,500 Guru Analysis Earnings Before Tax $4.198.600 $5.780,000 $4,317,500 $3,903,000 Stock Report l $1,262,000 Income Tax $1.432.600 $1,379,700 $1,143,700 Competitors Stock Consultant $300 ($200) ($1,200) ($1,900) Minority Interest Stock Comparison Equity Earnings/Loss Unconsolidated Subsidiary l$301.200 $249,900 $391,400 $318,200 FUNDAMENTALS Call Transcripts $3,135,900 $2,946,200 Net Income-Cont. Operations $4,819,500 $3,276,100 Annual Report $2,757,400 $4,518,300 $2,817,700 $2,884,700 Net Income Income Statement I $4,518,300 $2,817,700 $2,757,400 $2,884,700 Net Income Applicable to Common Shareholders Revenuel/EPS SEC Fillings See also: Company Financials data entry page Short Interest Dividend History DNKN Company Financials DNKN $79.54 0.40 0.5% Exchange:NASDAQ Industry: Consumer Services Delayed- data as of Jun, 21, 2019- Find a broker to begin trading DNKN now Community Rating:Bullish Edit Symbol List DNKN Symbol Lookup Save Stocks YMBOL LIST VIEWS lashQuotes Income Statement Balance Sheet Cash Flow Financial Ratios nfoQuotes Annual Income Statement (values in 000's) TOCK DETAILS Get Quarterly Data Summary Quote Period Ending: Trend 12/29/2018 12/30/2017 12/31/2016 12/26/2015 Real-Time Quote Total Revenue ll$1,321,617 $1,275,5511 $1,248,355 $810,933 After Hours Quote Cost of Revenue $135,514 $137.313 $135,017 $131,488 Pre-market Quote l $1.186,103 $1,138,238 $1,113,338 $679,445 Gross Profit Historical Quote Option Chain Operating Expenses CHARTS 50 S0 Research and Development 50 S0 Basic Chart $272,266 Jll $746 481 $719.358 $704.602 Sales, General and Admin. nteractive Chart $149 $623 II. $1,617 $1,648 Non-Recurring Items COMPANY NEWS $45.244 I$41,045 $41,419 $42,537 Other Operating Items Company Headlines $319,567 $391,042 $380,602 ll $411,832 Operating Income Press Releases ($21,214) ($3,202) ($613) 56,117 Add'l incomelexpense items Market Stream $379 989 $208 353 $387 750 $417.949 lla STOCK ANALYSIS Earnings Before Interest and Tax S96 765 $100 852 $104 423 Analyst Research I $128.748 Interest Expense $201.508 $279 137 $283.327 Guru Analysis lls $209,201 Earnings Before Tax $96.359 $103.648 Stock Report $12.110 JI$50.295 Tau $45,244 Operating Income Press Releases l$411,832 $391,042 $380,602 $319,567 Market Stream Add'l incomelexpense items $6,117 ($3,292) ($613) ($21,214) STOCK ANALYSIS Earnings Before Interest and Tax l$417,949 $387,750 $379,989 $298,353 Analyst Research Interest Expense I $128,748 $104,423 Guru Analysis $100,852 $96,765 Earmings Before Tax l$289,201 Stock Report $283,327 $279,137 $201,588 Competitors Income Tax $59,295 $12,118 $96.359 $103,848 Stock Consultant Minority Interest S0 SC (S2) Stock Comparison Equity Earnings/Loss Unconsolidated Subsidiary $14,903 $15,198 $14,552 ($41,745) FUNDAMENTALS Call Transcripts Net Income-Cont. Operations $279.411 S244,809 $189,841 $42,928 Annual Report l $229,906 Net Income $271,209 $175,289 $105,227 Income Statement i $229,906 Net Income Applicable to Common Shareholders $271,209 $175,289 $105.227 Revenue/EPS SEC Filings See also: Company Financials data entry page Short Interest Dividend History > Quotes> SBUX> Company Financials SBUX Company Financials $83.82 0.87 Exchange:NASDAQ 1.03% Industry: Consumer Service Community Rating: Bull Delayed- data as of Jun. 21, 2019 Find a broker to begin trading SBUX now Edit Symbol List Symbol Lookup SBUX DNKN Save Stocks YMBOL LIST VIEWS Income Statement Balance Sheet lashQuotes Cash Flow Financial Ratios nfoQuotes Annual Income Statement (values in 000's) Get Quarterly Data STOCK DETAILS Summary Quote Period Ending: Trend 9/30/2018 10/1/2017 9/27/2015 10/2/2016 Real-Time Quote Ill$24,719.500 Total Revenue $22.386.000 $21.315,900 $19,162.700 After Hours Quote I $10.174,500 $8.509,000 Cost of Revenue $9,034,300 $7,787,500 Pre-market Quote l$14,545,000 Gross Profit $13,352,500 $12,806,900 $11,375,200 Historical Quote Option Chain Operating Expenses CHARTS S0 $0 S0 Research and Development Basic Chart $7,130.200 $7.972 400 $8,444,300 Iu $9,491.500 Sales, General and Admin. Interactive Chart So S0 $224.400 $153.500 Non-Recurring Items COMPANY NEWS $893.900 $980,800 $1.011.400 Ill$1.247.000 Other Operating Items Company Headlines $3,601,000 $4.171,900 $4,134,700 ll$3,883,300 Operating Income Press Releases $372 500 $275 300 $108 000 $2.067 000 Add'l income/expense items Market Stream vestm Felsonlal Pre-market Quote I$14,545,000 $13,352,500 Gross Profit $12,806,900 $11,375,200 Historical Quote Option Chain Operating Expenses CHARTS Research and Development S0 $0 $0 $0 Basic Chart l $9,491,500 Sales, General and Admin. $8,444,300 $7,972,400 $7,130,200 Interactive Chart Non-Recurring Items S0 $224,400 $153,500 S0 COMPANY NEWS Other Operating Items I $1,247,000 $1,011,400 $980,800 $893,900 Company Headlines Operating Income Jll$3,883,300 $4,134,700 $4,171,900 $3,601,000 Press Releases L$2,067,000 $275,300 Add'l incomelexpense items $108,000 $372,500 Market Stream STOCK ANALYSIS Ju $5,950,30 Earnings Before Interest and Tax $4,410,000 $4,279,900 $3,973,500 Analyst Research Interest Expense I $170.300 $92,500 $81,300 $70,500 Guru Analysis Earnings Before Tax $4.198.600 $5.780,000 $4,317,500 $3,903,000 Stock Report l $1,262,000 Income Tax $1.432.600 $1,379,700 $1,143,700 Competitors Stock Consultant $300 ($200) ($1,200) ($1,900) Minority Interest Stock Comparison Equity Earnings/Loss Unconsolidated Subsidiary l$301.200 $249,900 $391,400 $318,200 FUNDAMENTALS Call Transcripts $3,135,900 $2,946,200 Net Income-Cont. Operations $4,819,500 $3,276,100 Annual Report $2,757,400 $4,518,300 $2,817,700 $2,884,700 Net Income Income Statement I $4,518,300 $2,817,700 $2,757,400 $2,884,700 Net Income Applicable to Common Shareholders Revenuel/EPS SEC Fillings See also: Company Financials data entry page Short Interest Dividend History