Answered step by step

Verified Expert Solution

Question

1 Approved Answer

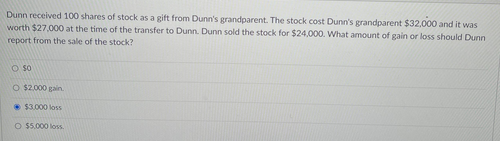

Dunn received 100 shares of stock as a gift from Dunn's grandparent. The stock cost Dunn's grandparent $32,000 and it was worth $27,000 at

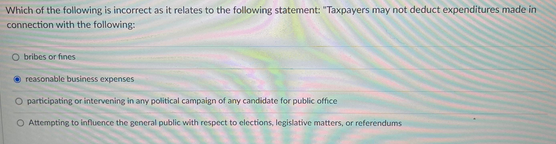

Dunn received 100 shares of stock as a gift from Dunn's grandparent. The stock cost Dunn's grandparent $32,000 and it was worth $27,000 at the time of the transfer to Dunn. Dunn sold the stock for $24,000. What amount of gain or loss should Dunn report from the sale of the stock? O so O $2.000 gain. $3.000 loss O 55.000 loss. Which of the following is incorrect as it relates to the following statement: "Taxpayers may not deduct expenditures made in connection with the following: O bribes or fines reasonable business expenses O participating or intervening in any political campaign of any candidate for public office O Attempting to influence the general public with respect to elections, legislative matters, or referendums

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

C 3000 LOSS Here since the price of the stock declined from t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started