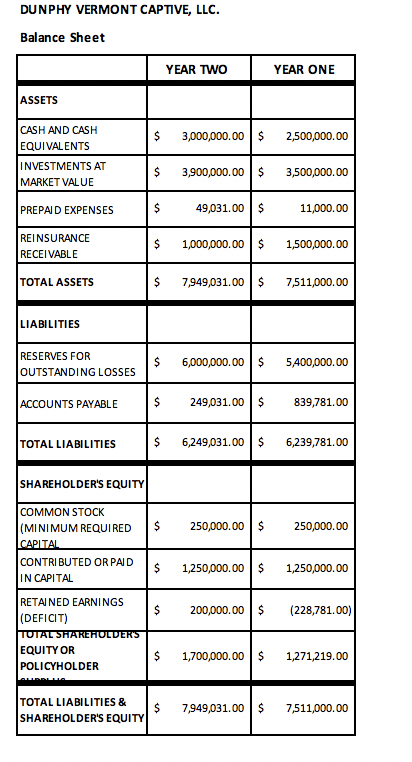

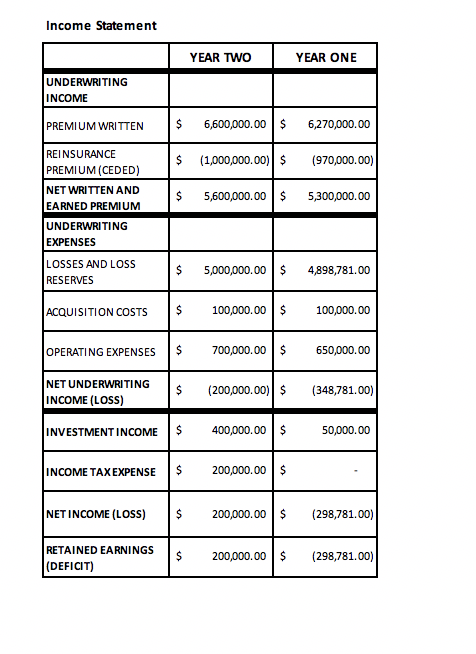

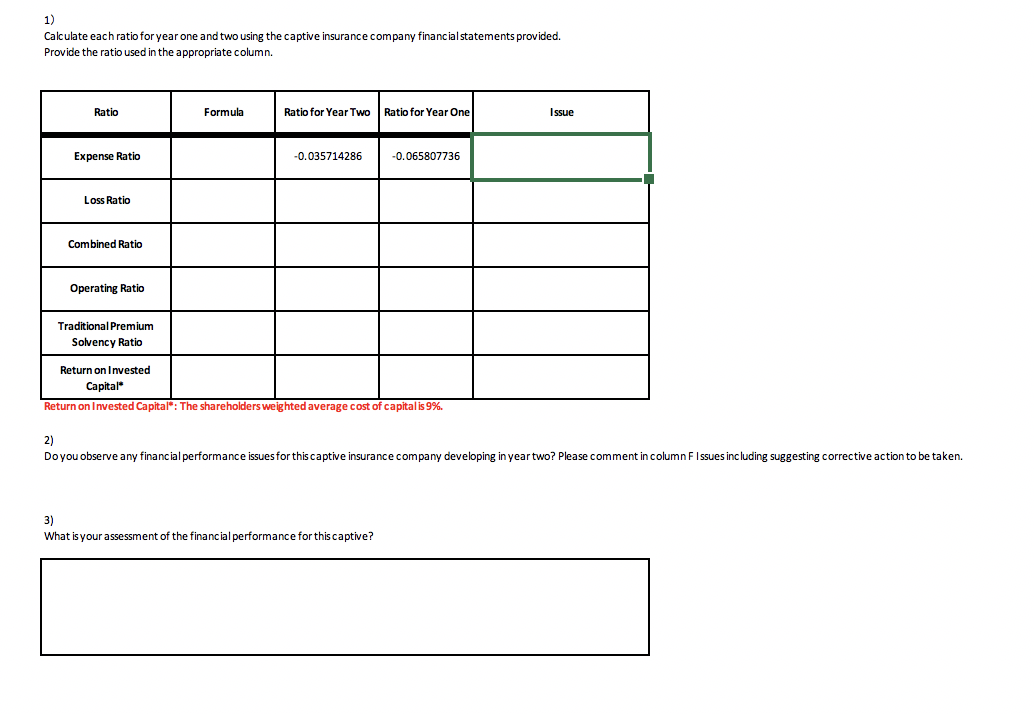

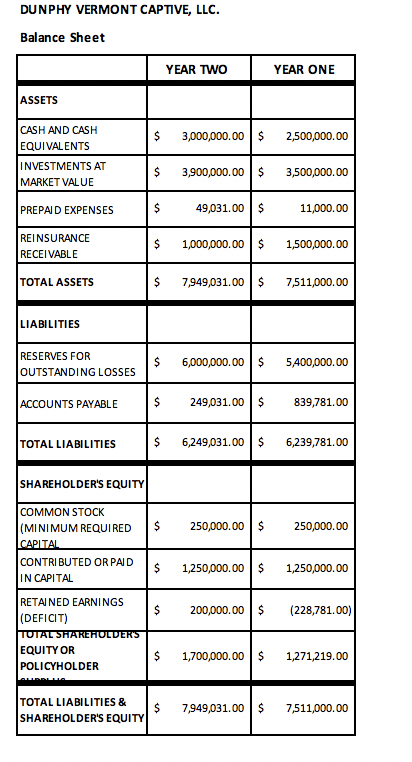

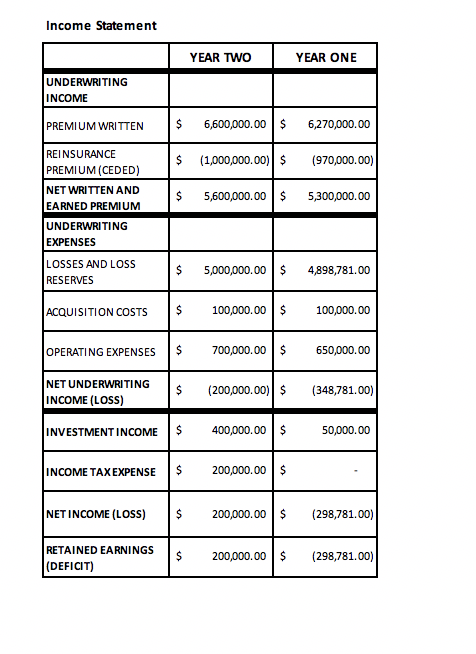

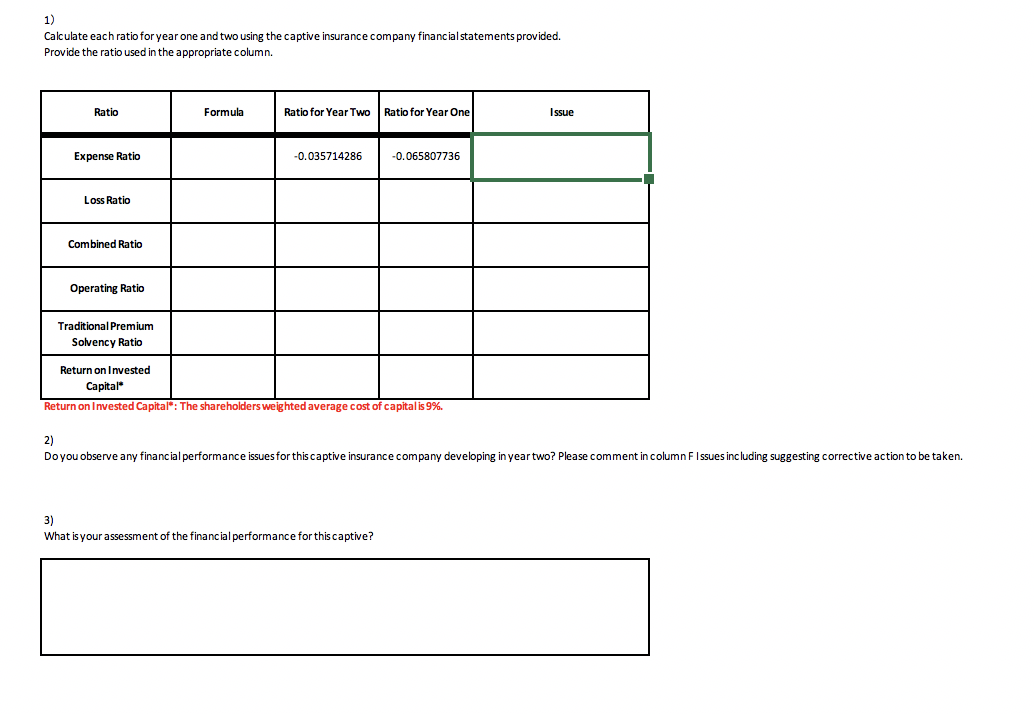

DUNPHY VERMONT CAPTIVE, LLC. Balance Sheet YEAR TWO YEAR ONE ASSETS $ 3,000,000.00 $ 2,500,000.00 CASH AND CASH EQUIVALENTS INVESTMENTS AT MARKET VALUE $ 3,900,000.00 $ 3,500,000.00 PREPAID EXPENSES $ 49,031.00 $ 11,000.00 REINSURANCE RECEIVABLE $ 1,000,000.00 $ 1,500,000.00 TOTAL ASSETS $ 7,949,031.00 $ 7,511,000.00 LIABILITIES RESERVES FOR OUTSTANDING LOSSES 6,000,000.00 $ 5,400,000.00 ACCOUNTS PAYABLE 249,031.00 $ 839,781.00 TOTAL LIABILITIES $ 6,249,031.00 $ 6,239,781.00 SHAREHOLDER'S EQUITY $ 250,000.00 $ 250,000.00 COMMON STOCK (MINIMUM REQUIRED CAPITAL CONTRIBUTED OR PAID IN CAPITAL $ 1,250,000.00 $ 1,250,000.00 $ 200,000.00 $ (228,781.00) RETAINED EARNINGS (DEFICIT) TOTAL SHAREHOLDER'S EQUITY OR POLICYHOLDER $ 1,700,000.00 $ 1,271,219.00 TOTAL LIABILITIES & SHAREHOLDER'S EQUITY $ 7,949,031.00 $ 7,511,000.00 Income Statement YEAR TWO YEAR ONE UNDERWRITING INCOME PREMIUM WRITTEN 6,600,000.00 $ 6,270,000.00 $ (1,000,000.00) $ (970,000.00) REINSURANCE PREMIUM (CEDED) NET WRITTEN AND EARNED PREMIUM UNDERWRITING EXPENSES $ 5,600,000.00 $ 5,300,000.00 LOSSES AND LOSS RESERVES $ 5,000,000.00 $ 4,898,781.00 ACQUISITION COSTS $ 100,000.00 $ 100,000.00 OPERATING EXPENSES 700,000.00 $ 650,000.00 NET UNDERWRITING INCOME (LOSS) $ (200,000.00) $ (348,781.00) INVESTMENT INCOME $ 400,000.00 $ 50,000.00 INCOME TAX EXPENSE $ 200,000.00 $ NET INCOME (LOSS) $ 200,000.00 $ (298,781.00) RETAINED EARNINGS (DEFICIT) $ 200,000.00 $ (298,781.00) 1) Calculate each ratio for year one and two using the captive insurance company financial statements provided. Provide the ratio used in the appropriate column. Ratio Formula Ratio for Year Two Ratio for Year One Issue Expense Ratio -0.035714286 -0.065807736 Loss Ratio Combined Ratio Operating Ratio Traditional Premium Solvency Ratio Return on Invested Capital Return on invested Capital": The shareholders weighted average cost of capitalis 9%. 2) Do you observe any financial performance issues for this captive insurance company developing in year two? Please comment in column F Issues including suggesting corrective action to be taken. 3) What is your assessment of the financial performance for this captive? DUNPHY VERMONT CAPTIVE, LLC. Balance Sheet YEAR TWO YEAR ONE ASSETS $ 3,000,000.00 $ 2,500,000.00 CASH AND CASH EQUIVALENTS INVESTMENTS AT MARKET VALUE $ 3,900,000.00 $ 3,500,000.00 PREPAID EXPENSES $ 49,031.00 $ 11,000.00 REINSURANCE RECEIVABLE $ 1,000,000.00 $ 1,500,000.00 TOTAL ASSETS $ 7,949,031.00 $ 7,511,000.00 LIABILITIES RESERVES FOR OUTSTANDING LOSSES 6,000,000.00 $ 5,400,000.00 ACCOUNTS PAYABLE 249,031.00 $ 839,781.00 TOTAL LIABILITIES $ 6,249,031.00 $ 6,239,781.00 SHAREHOLDER'S EQUITY $ 250,000.00 $ 250,000.00 COMMON STOCK (MINIMUM REQUIRED CAPITAL CONTRIBUTED OR PAID IN CAPITAL $ 1,250,000.00 $ 1,250,000.00 $ 200,000.00 $ (228,781.00) RETAINED EARNINGS (DEFICIT) TOTAL SHAREHOLDER'S EQUITY OR POLICYHOLDER $ 1,700,000.00 $ 1,271,219.00 TOTAL LIABILITIES & SHAREHOLDER'S EQUITY $ 7,949,031.00 $ 7,511,000.00 Income Statement YEAR TWO YEAR ONE UNDERWRITING INCOME PREMIUM WRITTEN 6,600,000.00 $ 6,270,000.00 $ (1,000,000.00) $ (970,000.00) REINSURANCE PREMIUM (CEDED) NET WRITTEN AND EARNED PREMIUM UNDERWRITING EXPENSES $ 5,600,000.00 $ 5,300,000.00 LOSSES AND LOSS RESERVES $ 5,000,000.00 $ 4,898,781.00 ACQUISITION COSTS $ 100,000.00 $ 100,000.00 OPERATING EXPENSES 700,000.00 $ 650,000.00 NET UNDERWRITING INCOME (LOSS) $ (200,000.00) $ (348,781.00) INVESTMENT INCOME $ 400,000.00 $ 50,000.00 INCOME TAX EXPENSE $ 200,000.00 $ NET INCOME (LOSS) $ 200,000.00 $ (298,781.00) RETAINED EARNINGS (DEFICIT) $ 200,000.00 $ (298,781.00) 1) Calculate each ratio for year one and two using the captive insurance company financial statements provided. Provide the ratio used in the appropriate column. Ratio Formula Ratio for Year Two Ratio for Year One Issue Expense Ratio -0.035714286 -0.065807736 Loss Ratio Combined Ratio Operating Ratio Traditional Premium Solvency Ratio Return on Invested Capital Return on invested Capital": The shareholders weighted average cost of capitalis 9%. 2) Do you observe any financial performance issues for this captive insurance company developing in year two? Please comment in column F Issues including suggesting corrective action to be taken. 3) What is your assessment of the financial performance for this captive