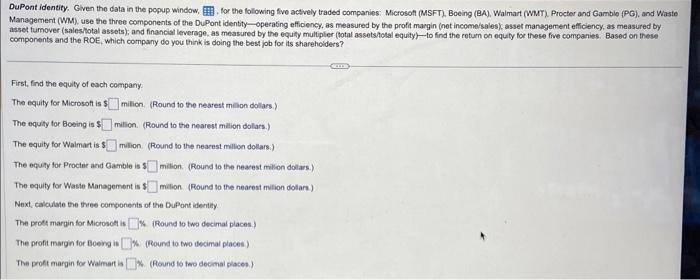

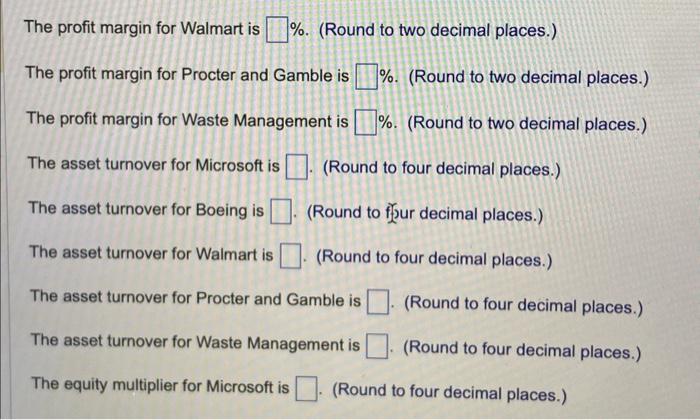

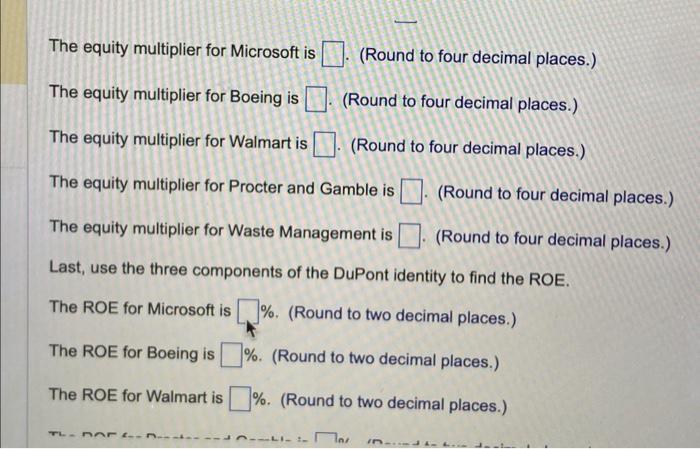

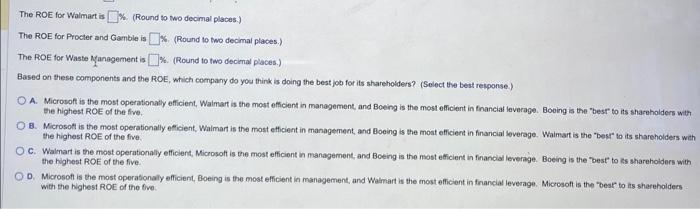

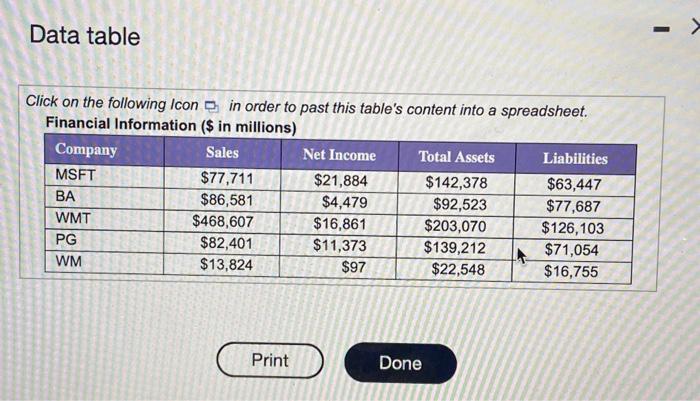

DuPont identity, Given the data in the popup window, , for the following five actively traded companies: Microsof (MSFT), Boeing (BA), Walmart (WMT) Procter and Gamble (PG), and Waste Management (WM), use the three components of the Dupont identity-operating efficency, as measured by the profit margin (net incomeisales), asset managerrent efficiency, as measured by asset tumover (salesitotal assets); and financial leverage, as measured by the equity multipler (total assetshotal equity)- to find the roturn on equaty for these five companies. Based on these components and the ROE, Which company do you think is doing the best job for its sharehoiders? First, find the equity of each compary. The equity for Microsoft is 5 milion. (Round to the nearest mision dollars.) The equity for boeing is $ milion. (Round to the nearest malion dolars.) The equity for Waimart is $ milion. (Round to the nearest milion dollars.) The equity for Procter and Gamble is 1 milion. (Round to the nearest milion dolars.) The equity for Wasie Management is 5 milion. (Round to the nearest mition dollars) Next, calculate the tree components of the Dupont identity. The prots marpin for Mictosot is \%. (Round to twa decimal places.) The profit margin for Boeng is is (Round to two tecimal places ) The poft margin for Walmart is of (Round to teo decomal placen.) The profit margin for Walmart is %. (Round to two decimal places.) The profit margin for Procter and Gamble is \%. (Round to two decimal places.) The profit margin for Waste Management is \%. (Round to two decimal places.) The asset turnover for Microsoft is (Round to four decimal places.) The asset turnover for Boeing is (Round to ff'ur decimal places.) The asset turnover for Walmart is . (Round to four decimal places.) The asset turnover for Procter and Gamble is _ (Round to four decimal places.) The asset turnover for Waste Management is _ (Round to four decimal places.) The equity multiplier for Microsoft is (Round to four decimal places.) The equity multiplier for Microsoft is (Round to four decimal places.) The equity multiplier for Boeing is (Round to four decimal places.) The equity multiplier for Walmart is (Round to four decimal places.) The equity multiplier for Procter and Gamble is (Round to four decimal places.) The equity multiplier for Waste Management is (Round to four decimal places.) Last, use the three components of the DuPont identity to find the ROE. The ROE for Microsoft is \%. (Round to two decimal places.) The ROE for Boeing is %. (Round to two decimal places.) The ROE for Walmart is \%. (Round to two decimal places.) The ROE for Walmart is K. (Round to two decimal places.) The ROE for Procter and Gamble is \%. (Round to two decimal places.) The ROE for Waste Nanegement is is. (Round to two decimal places.) Based on these components and the ROE, which company do you think is doing the best job for its sharehoiders? (Select the best repponse) A. Microsof is the most operationally efficient, Walmart is the most efficient in manegement, and Boeing is the most efficient in finaneial leverage. Booing is the "bese to its shareholders with Bie highest ROE of the five. 8. Microsoft is the most operationally eficient, Waimart is the most etticient in management, and Boeing is the moat efficient in financial loverage. Waimart is the "best" to its shareholders with the highest ROE of the five. c. Walnart is the most operationally efficient, Microsoft is the most efficiont in management, and Boeing is the most efficient in financial levernge. Boeing is the best to as sharehoiders with the highest ROE of the five. D. Microsoft is the most operasonaly efficient, Boeing is the most efficient in management, and Wamart is the most efficient in financial levernge. Microsoft is the best to its shereholders : with the highest ROE of the tive. Data table Click on the following Icon in order to past this table's content into a spreadsheet. Financial Information ( $ in millions)