Answered step by step

Verified Expert Solution

Question

1 Approved Answer

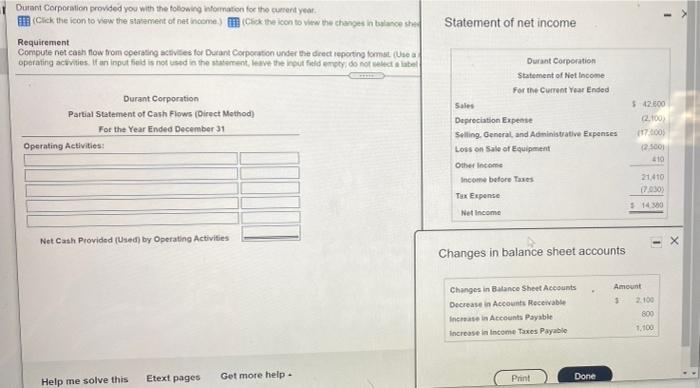

Durant Corporation provided you with the following information for the current year. (Click the icon to view the statement of net income) (Click the

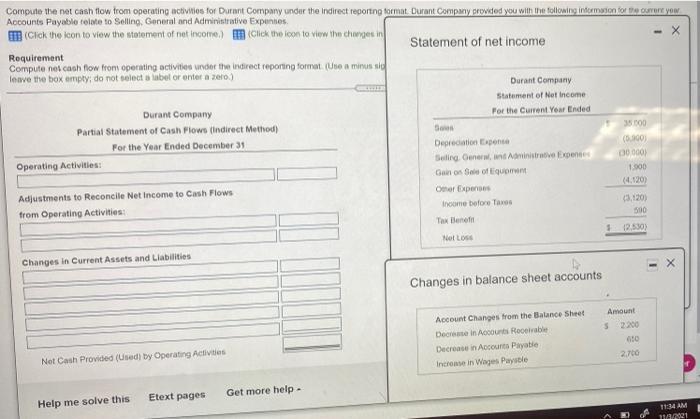

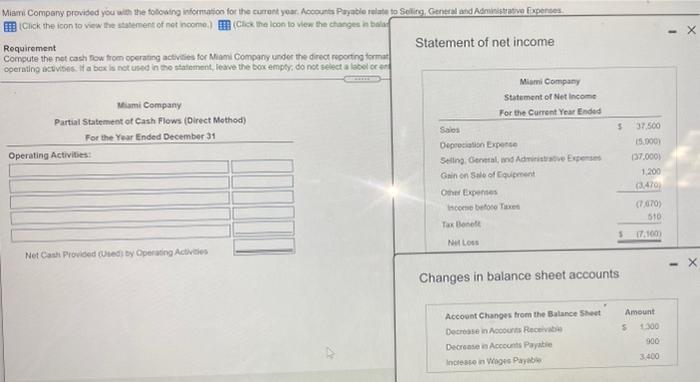

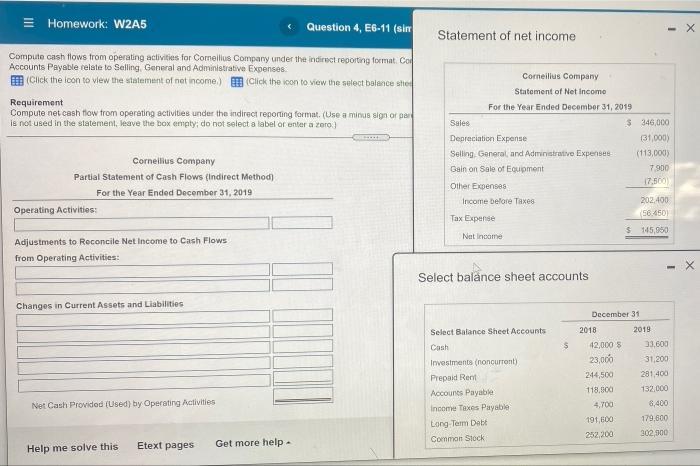

Durant Corporation provided you with the following information for the current year. (Click the icon to view the statement of net income) (Click the icon to view the changes in balance she Requirement Compute net cash flow from operating activities for Durant Corporation under the direct reporting format (Use a operating activities. If an input field is not used in the statement, leave the input field empty; do not select a label Durant Corporation Partial Statement of Cash Flows (Direct Method) For the Year Ended December 31 Operating Activities: Net Cash Provided (Used) by Operating Activities Help me solve this Etext pages Get more help. Statement of net income Sales Durant Corporation Statement of Net Income For the Current Year Ended Depreciation Expense Selling, General, and Administrative Expenses Loss on Sale of Equipment Other Income Income before Taxes Tax Expense Net Income Changes in balance sheet accounts Changes in Balance Sheet Accounts Decrease in Accounts Receivable Increase in Accounts Payable Increase in Income Taxes Payable Print Done $42.600 (2,100) (17.000) (2,500) 410 21,410 (7,030) $ 14.300 Amount $ 2.100 800 1,100 Compute the net cash flow from operating activities for Durant Company under the Indirect reporting format. Durant Company provided you with the following information for the current your Accounts Payable relate to Selling, General and Administrative Expenses. (Click the icon to view the statement of net income.) (Click the icon to view the changes in Statement of net income Requirement Compute net cash flow from operating activities under the indirect reporting format. (Use a minus sig leave the box empty; do not select a label or enter a zero) Durant Company Partial Statement of Cash Flows (Indirect Method) For the Year Ended December 31 Operating Activities: Adjustments to Reconcile Net Income to Cash Flows from Operating Activities: Changes in Current Assets and Liabilities Net Cash Provided (Used) by Operating Activities Help me solve this Etext pages Get more help. EXTER Soes Durant Company Statement of Net Income For the Current Year Ended Depreciation Expense Seling. General, and Administrative Expenses Gain on Sale of Equipment Omer Expenses Income before Taxes Tax Benef Net Loss Changes in balance sheet accounts Account Changes from the Balance Sheet Decrease in Accounts Receivable Decrease in Accounts Payable Increase in Wages Payable 35.000 (5,900) (30.000) 1.900 (4.120) (3,120) 500 (2,530) Amount $ 2200 600 2,700 X 11:34 AM 11/3/2021 Miami Company provided you with the following information for the current year. Accounts Payable relate to Selling, General and Administrative Expenses. (Click the icon to view the statement of not income.) (Click the icon to view the changes in bala Statement of net income Requirement Compute the net cash flow from operating activities for Miami Company under the direct reporting format operating activities. If a box is not used in the statement, leave the box empty, do not select a label or en Miami Company Partial Statement of Cash Flows (Direct Method) For the Year Ended December 31 Operating Activities: Net Cash Provided (Used) by Operating Activities Miami Company Statement of Net Income For the Current Year Ended Sales Depreciation Expense Selling, General, and Administrative Expenses Gain on Sale of Equipment Other Expenses Income before Taxes Tax Benett Net Loss $ Changes in balance sheet accounts Account Changes from the Balance Sheet Decrease in Accounts Receivable Decrease in Accounts Payable Increase in Wages Payable 37,500 15.900) (37,000) 1,200 (3,470) (7 670) 510 17,100) Amount 1.300 900 3.400 = Homework: W2A5 Question 4, E6-11 (sim Compute cash flows from operating activities for Corneillus Company under the indirect reporting format. Com Accounts Payable relate to Selling, General and Administrative Expenses. (Click the icon to view the statement of net income.)(Click the icon to view the select balance shee Requirement Compute net cash flow from operating activities under the indirect reporting format. (Use a minus sign or par is not used in the statement, leave the box empty; do not select a label or enter a zero) Cornellius Company Partial Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2019 Operating Activities: Adjustments to Reconcile Net Income to Cash Flows from Operating Activities: Changes in Current Assets and Liabilities Net Cash Provided (Used) by Operating Activities Help me solve this Etext pages Get more help. **** Statement of net income Sales For the Year Ended December 31, 2019 Cornelius Company Statement of Net Income Depreciation Expense Selling General, and Administrative Expenses Gain on Sale of Equipment Other Expenses Income before Taxes Tax Expense Net Income Select balance sheet accounts Select Balance Sheet Accounts Cash Investments (noncurrent) Prepaid Rent Accounts Payable Income Taxes Payable Long-Term Debt Common Stock: $ 2018 42,000 $ 23,000 $ 346,000 December 31 244,500 118.900 4,700 191,600 252,200 (31,000) (113,000) 7,900 (7,500) 202,400 (56.450) $ 145,950 2019 33,600 31,200 281,400 132,000 6,400 179,600 302,900

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Durant Corporation Partial Statement of Cash Flows Direct Meth...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started