Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Duration: 2.8334 Duration and Price Changes As a measure of interest rate risk, duration allows for a quick estimation of the percentage change in value

Duration: 2.8334

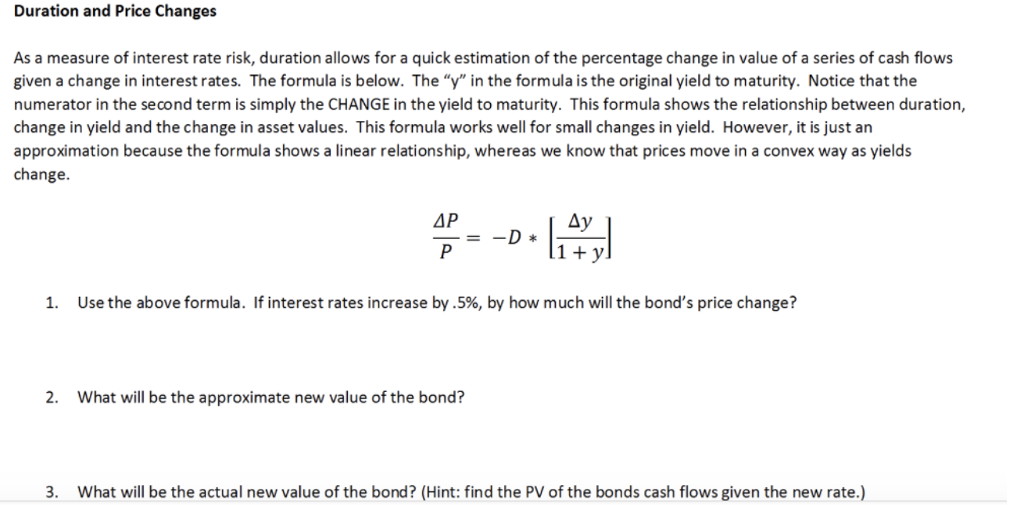

Duration and Price Changes As a measure of interest rate risk, duration allows for a quick estimation of the percentage change in value of a series of cash flows given a change in interest rates. The formula is below. The "y" in the formula is the original yield to maturity. Notice that the numerator in the second term is simply the CHANGE in the yield to maturity. This formula shows the relationship between duration, change in yield and the change in asset values. This formula works well for small changes in yield. However, it is just an approximation because the formula shows a linear relationship, whereas we know that prices move in a convex way as yields change. ?? 1 + y 1. Use the above formula. If interest rates increase by .5%, by how much will the bond's price change? 2. What will be the approximate new value of the bond? 3. What will be the actual new value of the bond? (Hint:find the PV of the bonds cash flows given the new rate.) Duration and Price Changes As a measure of interest rate risk, duration allows for a quick estimation of the percentage change in value of a series of cash flows given a change in interest rates. The formula is below. The "y" in the formula is the original yield to maturity. Notice that the numerator in the second term is simply the CHANGE in the yield to maturity. This formula shows the relationship between duration, change in yield and the change in asset values. This formula works well for small changes in yield. However, it is just an approximation because the formula shows a linear relationship, whereas we know that prices move in a convex way as yields change. ?? 1 + y 1. Use the above formula. If interest rates increase by .5%, by how much will the bond's price change? 2. What will be the approximate new value of the bond? 3. What will be the actual new value of the bond? (Hint:find the PV of the bonds cash flows given the new rate.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started