Question

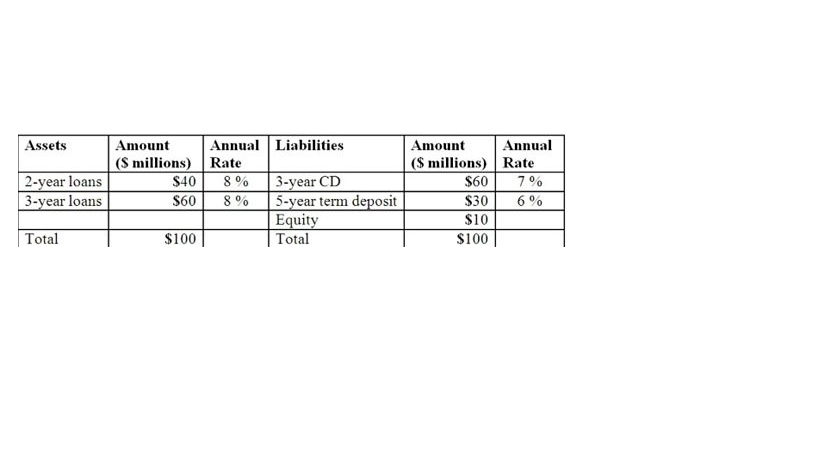

Duration Bank has the following assets and liabilities as of year-end. All assets and liabilities are currently priced at par and pay interest annually. Is

Duration Bank has the following assets and liabilities as of year-end. All assets and liabilities are currently priced at par and pay interest annually.  Is the bank exposed to interest rate increases or decreases and why?

Is the bank exposed to interest rate increases or decreases and why?

Select one:

A.

Interest rate increases because the value of its assets will fall more than its liabilities.

B.

Interest rate decreases because the value of its assets will fall more than its liabilities.

C.

Interest rate increases because the value of its assets will rise more than its liabilities.

D.

Interest rate increases because the value of its assets will fall less than its liabilities.

E.

Interest rate decreases because the value of its assets will rise less than its liabilities.

Assets Amount Annual Liabilities (5 millions) Rate 2-year loans $40 8 % 3-year CD 3-year loans $60 5-year term deposit Equity Total $100 Total Amount Annual ($ millions) Rate $60 7% $30 6% $10 $100 8 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started