Question

Durban Metal Products, Ltd., of the Republic of South Africa makes specialty metal parts used in applications ranging from the cutting edges of bulldozer blades

| Durban Metal Products, Ltd., of the Republic of South Africa makes specialty metal parts used in applications ranging from the cutting edges of bulldozer blades to replacement parts for Land Rovers. The company uses an activity-based costing system for internal decision-making purposes. The company has four activity cost pools as listed below: |

| Activity Cost pool | Activity Measure | Activity Rate | ||

| Order size | Number of direct labor-hours | $ | 16.70 | per direct labor-hour* |

| Customer orders | Number of customer orders | $ | 356.00 | per customer order |

| Product testing | Number of testing hours | $ | 75.00 | per testing hour |

| Selling | Number of sales calls | $ | 1,486.00 | per sales call |

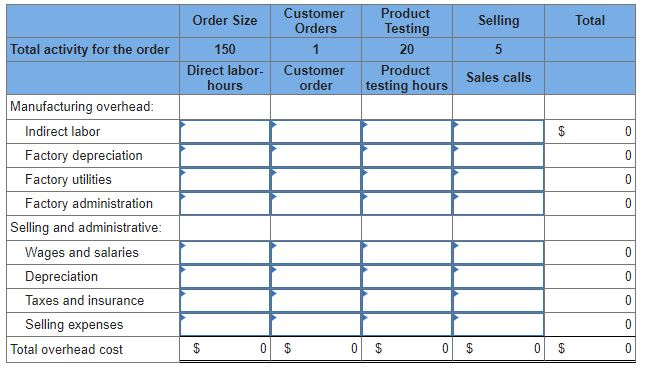

| The managing director of the company would like information concerning the cost of a recently completed order for heavy-duty trailer axles. The order required 150 direct labor-hours, 20 hours of product testing, and 5 sales calls. |

| The results of the first-stage allocation of the activity-based costing system at Durban Metal Products, Ltd., in which the activity rates were computed, appear below: |

| Order Size | Customer Orders | Product Testing | Selling | |||||

| Manufacturing overhead: | ||||||||

| Indirect labor | $ | 9.00 | $ | 230.00 | $ | 30.00 | $ | 0.00 |

| Factory depreciation | 6.80 | 0.00 | 17.00 | 0.00 | ||||

| Factory utilities | .60 | 0.00 | 2.00 | 0.00 | ||||

| Factory administration | 0.00 | 36.00 | 26.00 | 15.00 | ||||

| Selling and administrative: | ||||||||

| Wages and salaries | .30 | 78.00 | 0.00 | 937.00 | ||||

| Depreciation | 0.00 | 12.00 | 0.00 | 43.00 | ||||

| Taxes and insurance | 0.00 | 0.00 | 0.00 | 54.00 | ||||

| Selling expenses | 0.00 | 0.00 | 0.00 | 437.00 | ||||

| Total overhead cost | $ | 16.70 | $ | 356.00 | $ | 75.00 | $ | 1,486.00 |

| Required: | |

| 1. | Prepare a report showing the overhead cost of the order for heavy-duty trailer axles. What is the total overhead cost of the order? |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started