Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Durian Ltd. owns an office building which it uses for administrative purposes with a depreciated historical cost of $2 million on 1 July 20x5,

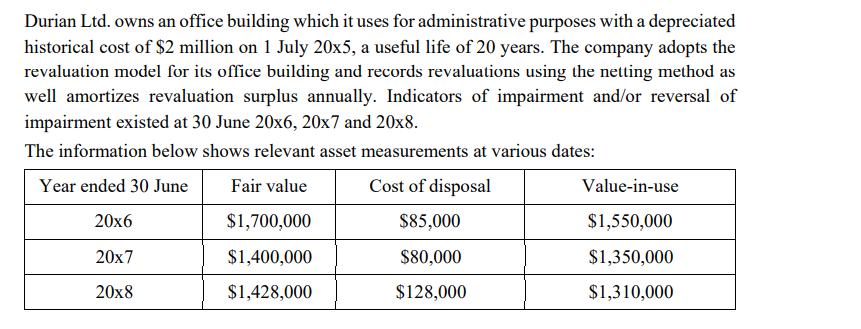

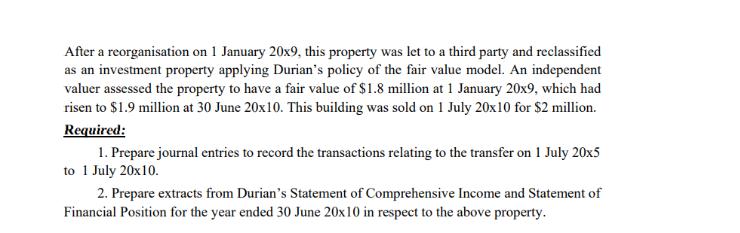

Durian Ltd. owns an office building which it uses for administrative purposes with a depreciated historical cost of $2 million on 1 July 20x5, a useful life of 20 years. The company adopts the revaluation model for its office building and records revaluations using the netting method as well amortizes revaluation surplus annually. Indicators of impairment and/or reversal of impairment existed at 30 June 20x6, 20x7 and 20x8. The information below shows relevant asset measurements at various dates: Year ended 30 June Fair value Cost of disposal Value-in-use 20x6 $1,700,000 $85,000 $1,550,000 20x7 $1,400,000 $80,000 $1,350,000 20x8 $1,428,000 $128,000 $1,310,000 After a reorganisation on 1 January 20x9, this property was let to a third party and reclassified as an investment property applying Durian's policy of the fair value model. An independent valuer assessed the property to have a fair value of $1.8 million at 1 January 20x9, which had risen to $1.9 million at 30 June 20x10. This building was sold on 1 July 20x10 for $2 million. Required: 1. Prepare journal entries to record the transactions relating to the transfer on 1 July 20x5 to 1 July 20x10. 2. Prepare extracts from Durian's Statement of Comprehensive Income and Statement of Financial Position for the year ended 30 June 20x10 in respect to the above property.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Historical cost 2 million and useful life 20 Years and Carrying Value on 1 july 2006 Depreciation 200000020 100000 Carrying Value on 1st july 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started