Answered step by step

Verified Expert Solution

Question

1 Approved Answer

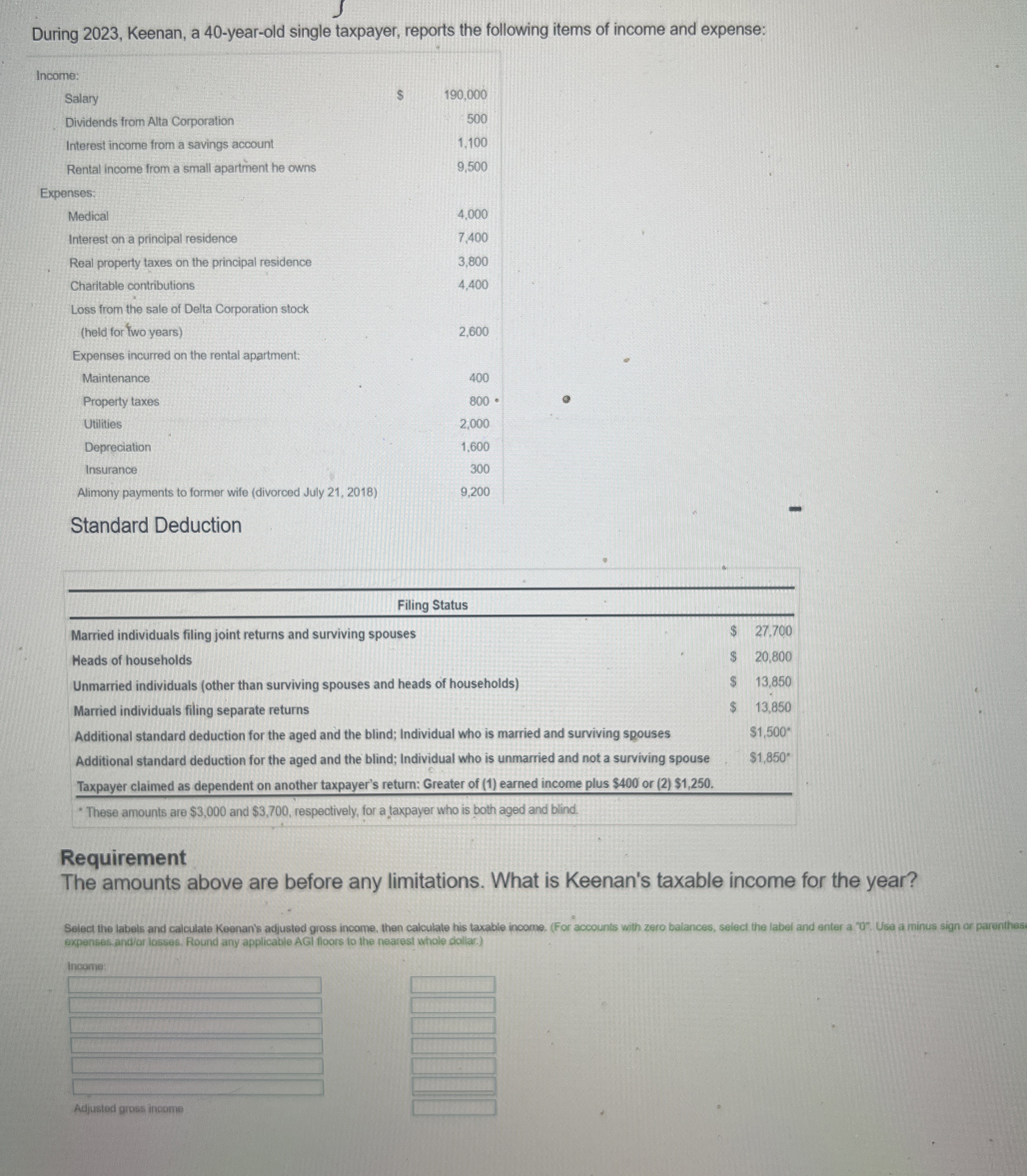

During 2 0 2 3 , Keenan, a 4 0 - year - old single taxpayer, reports the following items of income and expense: Requirement

During Keenan, a yearold single taxpayer, reports the following items of income and expense:

Requirement

The amounts above are before any limitations What is Keenan's taxable income for the year?

Select the labels and calculate Keenan's adjusted gross income, then calculate his taxable income. For accounts with zero balances, select the label and enter a Use a minus sign or parenthesi

expenses andar losses. Round any applicable AGI floors to the nearest whole dollar.

Income:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started