Answered step by step

Verified Expert Solution

Question

1 Approved Answer

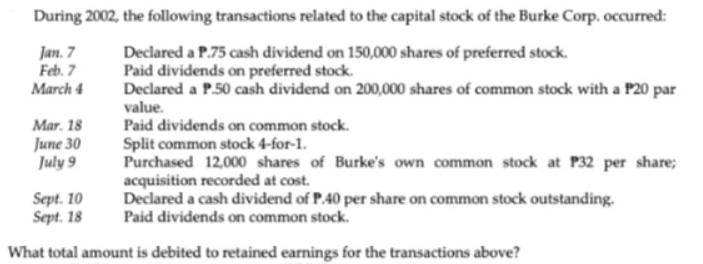

During 2002, the following transactions related to the capital stock of the Burke Corp. occurred: Declared a P.75 cash dividend on 150,000 shares of

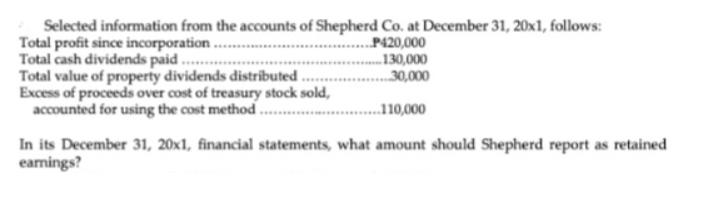

During 2002, the following transactions related to the capital stock of the Burke Corp. occurred: Declared a P.75 cash dividend on 150,000 shares of preferred stock. Paid dividends on preferred stock. Declared a P.50 cash dividend on 200,000 shares of common stock with a P20 par value. Paid dividends on common stock. Split common stock 4-for-1. Jan. 7 Feb. 7 March 4 Mar. 18 June 30 July 9 Purchased 12,000 shares of Burke's own common stock at P32 per share; acquisition recorded at cost. Declared a cash dividend of P.40 per share on common stock outstanding. Paid dividends on common stock. Sept. 10 Sept. 18 What total amount is debited to retained earnings for the transactions above? Selected information from the accounts of Shepherd Co. at December 31, 20x1, follows: Total profit since incorporation. ...P420,000 Total cash dividends paid. Total value of property dividends distributed Excess of proceeds over cost of treasury stock sold, accounted for using the cost method. 130,000 30,000 ...110,000 In its December 31, 20x1, financial statements, what amount should Shepherd report as retained earnings?

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of the total amount debited to retained earnings for the transactions involving the capi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started